Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work for the blank boxes in blue, please keep work in line with how the problem is set up and set up solution

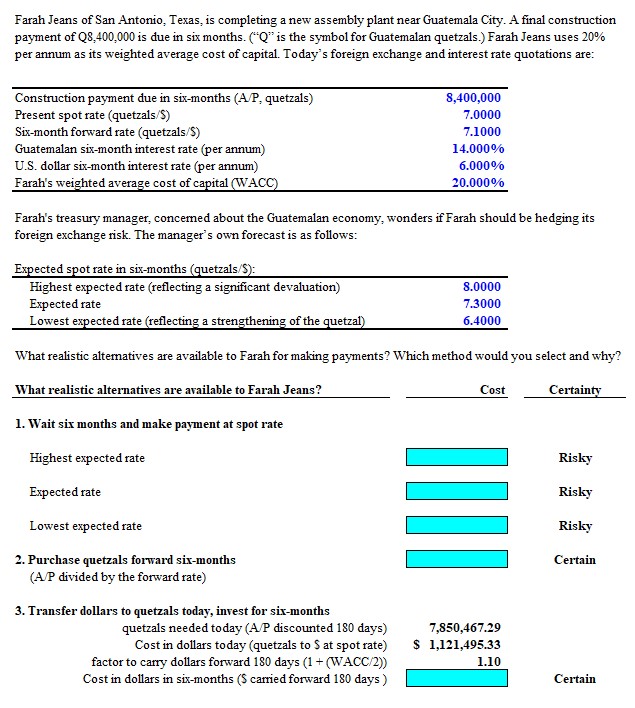

Please show work for the blank boxes in blue, please keep work in line with how the problem is set up and set up solution as such - ie - Highest expected rate =, expected rate =, lowest expect rate =, transfer dollars to questzals today, invest for six moths cost in dollars in six months =

Farah Jeans of San Antonio, Texas, is completing a new assembly plant near Guatemala City. A final construction payment of Q8,400,000 is due in six months. (" Q " is the symbol for Guatemalan quetzals.) Farah Jeans uses 20% per annum as its weighted average cost of capital. Today's foreign exchange and interest rate quotations are: Farah's treasury manager, concerned about the Guatemalan economy, wonders if Farah should be hedging its foreign exchange risk. The manager's own forecast is as follows: What realistic alternatives are available to Farah for making payments? Which method would you select and why? 3. Transfer dollars to quetzals today, invest for six-months quetzals needed today (A/P discounted 180 days) 7,850,467.29 Cost in dollars today (quetzals to S at spot rate) $1,121,495.33 factor to carry dollars forward 180 days (1+(WACC/2)) 1.10 Cost in dollars in six-months ( $ carried forward 180 days ) CertainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started