Answered step by step

Verified Expert Solution

Question

1 Approved Answer

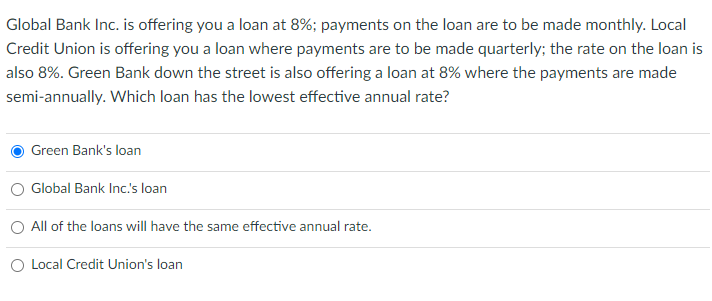

Please show work Global Bank Inc. is offering you a loan at 8%; payments on the loan are to be made monthly. Local Credit Union

Please show work

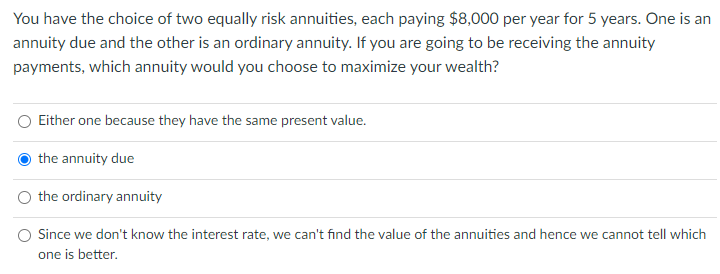

Global Bank Inc. is offering you a loan at 8%; payments on the loan are to be made monthly. Local Credit Union is offering you a loan where payments are to be made quarterly; the rate on the loan is also 8%. Green Bank down the street is also offering a loan at 8% where the payments are made semi-annually. Which loan has the lowest effective annual rate? Green Bank's loan O Global Bank Inc.'s loan All of the loans will have the same effective annual rate. Local Credit Union's loan You have the choice of two equally risk annuities, each paying $8,000 per year for 5 years. One is an annuity due and the other is an ordinary annuity. If you are going to be receiving the annuity payments, which annuity would you choose to maximize your wealth? Either one because they have the same present value. the annuity due the ordinary annuity Since we don't know the interest rate, we can't find the value of the annuities and hence we cannot tell which one is betterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started