Please show work!!

Help ASAP

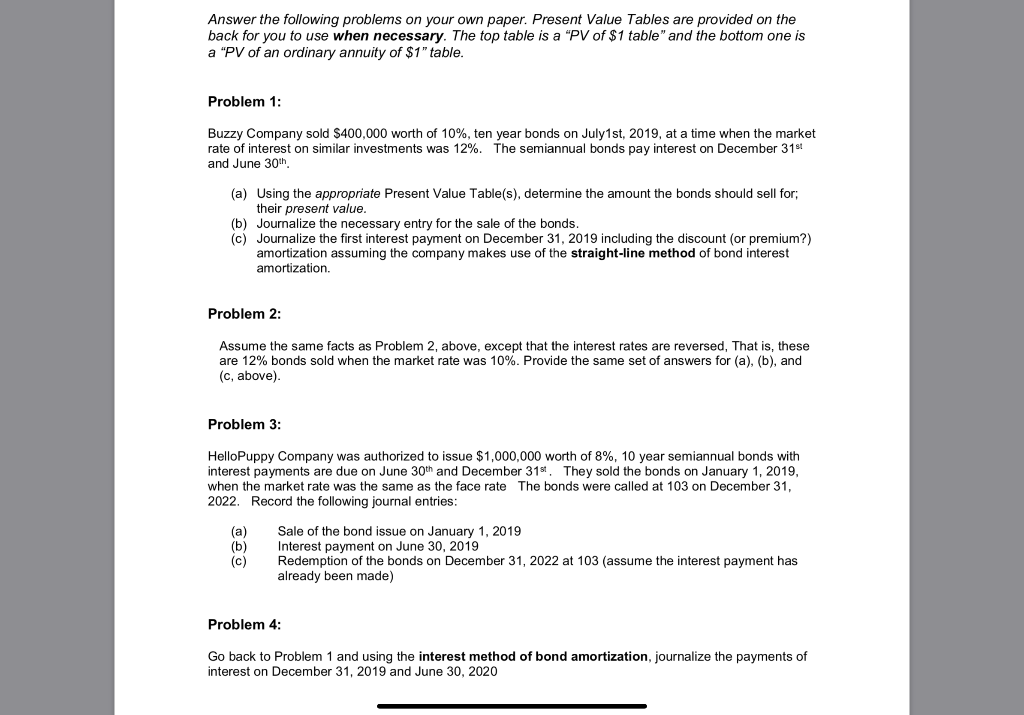

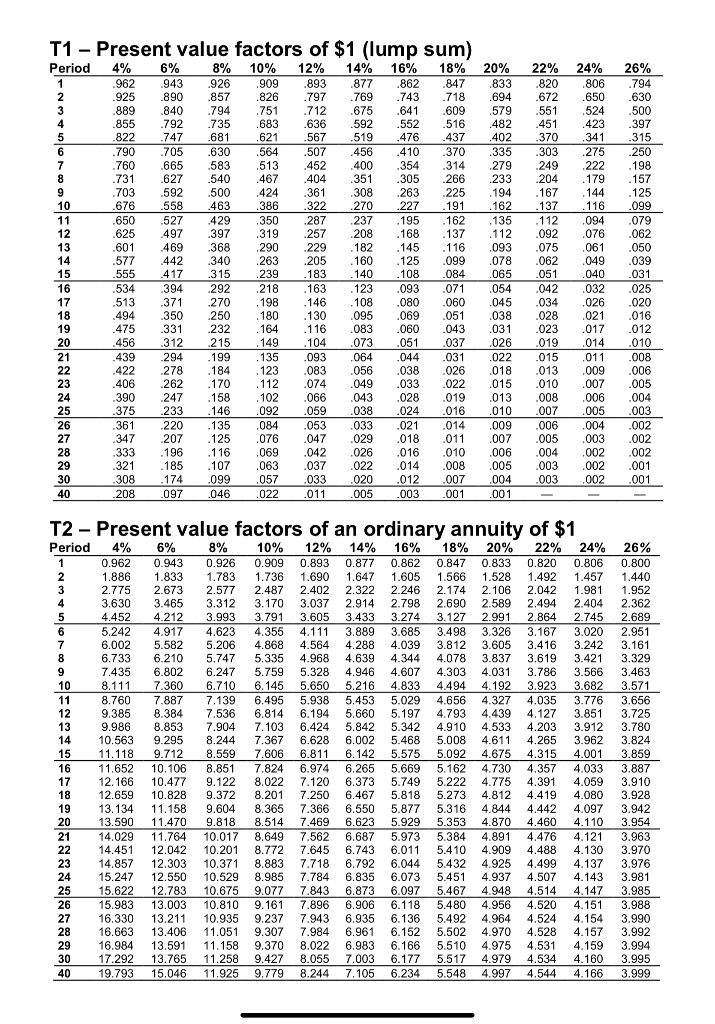

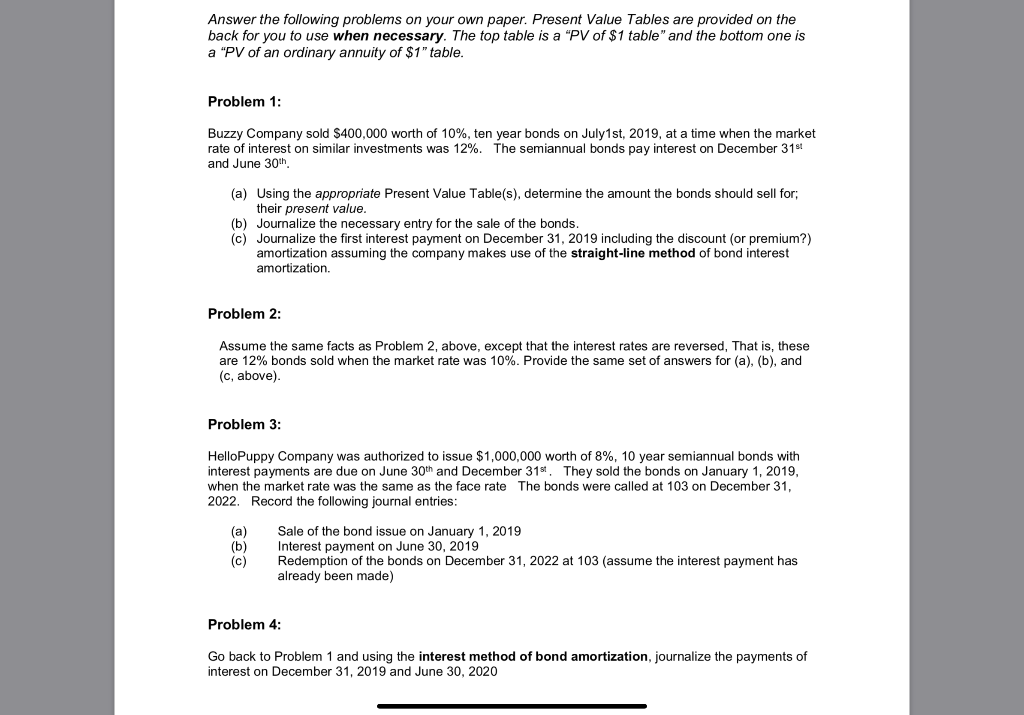

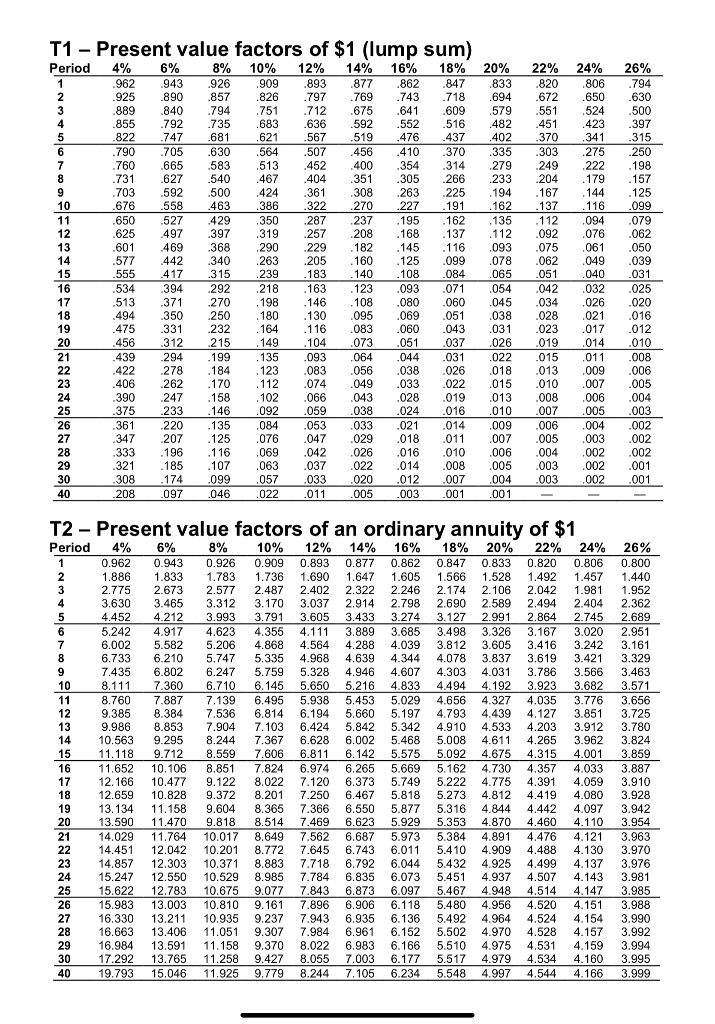

Answer the following problems on your own paper. Present Value Tables are provided on the back for you to use when necessary. The top table is a "PV of $1 table and the bottom one is a "PV of an ordinary annuity of $1" table Problem 1 Buzzy Company sold $400,000 worth of 10%, ten year bonds on July! st, 2019, at a time when the market rate of interest on similar investments was 12%. The semiannual bonds pay interest on December 31st and June 30h (a) Using the appropriate Present Value Table(s), determine the amount the bonds should sell for; their present value (b) Journalize the necessary entry for the sale of the bonds (c) Journalize the first interest payment on December 31, 2019 including the discount (or premium?) amortization assuming the company makes use of the straight-line method of bond interest amortization. Problem 2 Assume the same facts as Problem 2, above, except that the interest rates are reversed, That is, these are 12% bonds sold when the market rate was 10%. Provide the same set of answers for (a), (b), and (c, above) Problem 3: HelloPuppy Company was authorized to issue $1,000,000 worth of 8%, 10 year semiannual bonds with interest payments are due on June 30th and December 31 They sold the bonds on January 1, 2019 when the market rate was the same as the face rate The bonds were called at 103 on December 31 2022. Record the following journal entries (a) Sale of the bond issue on January 1, 2019 (b) Interest payment on June 30, 2019 (c)Redemption of the bonds on December 31, 2022 at 103 (assume the interest payment has already been made) Problem 4 Go back to Problem 1 and using the interest method of bond amortization, journalize the payments of interest on December 31, 2019 and June 30, 2020 T1 - Present value factors of $1 (lump sum) 10% Period 4% 6% 8% 962 89079468356 12% 14% 16% 18% 20% 22% 24% 26% 806.794 650630 943 857 877862 847 833 820 769 743 718 69467 675 641 592 .552 .516 482 45 , 609.579 .551 655 .840 .9210% , 4 423 .397 621 .567 .519 476 437 402.370 341 .315 456 410370 335 .303 275 250 400 .354314 .279 249 760 665 .583 305 .266 .233 204 86 36 350.287 319.257 208 290 592.500 308 .263 .225 270 .227 558 500 467 452 650527 429 625497397 601469 368 77442340 263205 45137 125 .099 078 062 049 112 .092 116 .093 .075 076 062 108 084 065 051 534.394.292218 513.371 .270 .198 146 108 080 060 045 .034 .026 .020 494 350 .250 475 .331.232 164116 083 .060 .043 031 023 .017012 123 .093 .071 095 069 051 073051 032 .025 038 .028 037 .026 439294 422278 406 262 390247 093 .064 044.031 .022 .015 056 .038 .026 018 013 049 033 .022 015 .010 043 .028 .019 013 008 038 024016 010 007 033 .021 029 .018 .011 026 .016 .010 .006 .004 022 014 008 005 003 020 .012 .007 .004 005 .003 001 009.006 007 005 006 .004 005 .003 014.009 .006 007.005 347 207 003 002 002 .002 29 057 037 T2 - Present value factors of an ordinary annuity of $1 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 0.962 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.800 1.886 1833 1.783 1.736 1.690 1.647 1.605 1.566 .528 1492 1.457 1440 2.775 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106 2.042 1.981 1.952 3.630 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 2.494 2.404 2.362 4.452 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 2.864 2.745 2.689 5.242 4.917 4.623 4.355 4.111 3.889 3.685 3.498 3.326 3.167 3.020 2.951 6.002 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 3.416 3.242 3.161 6.733 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 3.619 3.421 3.329 7.435 6.802 6.247 5.759 5.328 4.946 4.607 4.303 4.031 3.786 3.566 3.463 8.111 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 3.923 3.682 3.571 8.760 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 4.035 3.776 3.656 9.385 8.384 7.536 6.814 6.194 5.660 5.197 4.793 4.439 4.127 3.85 3.725 9.9868.853 .904 7.103 6.424 5.842 5.342 4.910 4.533 4.203 3.912 3.780 14 10.563 9.2958.244 7.367 6.628 6.002 5.468 5.008 4.611 4.265 3.962 3.824 11.118 9.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 4.315 4.001 3.859 11.652 10.106 8.851 7.824 6.974 6.265 5.669 5.162 4.730 4.357 4.033 3.887 12.166 10.477 9.122 8.022 7.120 6.373 5.749 5.222 4.775 4.391 4.059 3.910 18 12.659 10.828 9.372 8.201 7.250 6.467 5.818 5.273 4.812 4.419 4.080 3.928 13.134 11.158 9.604 8.365 7.366 6.550 5.877 5.316 4.844 4.442 4.097 3.942 13.590 11.470 9.818 8.514 7.469 6.623 5.929 5.353 4.870 4.460 4.110 3.954 14.029 11.764 10.017 8.649 7.562 6.687 5.973 5.384 4.891 4.476 4.121 3.963 22 14.451 12.042 0.201 8.772 7.645 6.743 6.011 5.410 4.909 4.488 4.130 3.970 14.857 2.303 10.371 8.883 7.718 6.792 6.044 5.432 4.925 4.499 4.1373.976 24 15.247 12.550 10.529 8.985 7.784 6.835 6.073 5.451 4.937 4.507 4.143 3.981 15.622 12.783 10.675 9.077 7.843 6.873 6.097 5.4674.948 4.514 4.147 3.985 26 15.983 13.003 10.810 9.161 7.896 6.906 6.118 5.480 4.956 4.520 4.15 3.988 16.330 13.211 10.935 9.237 7.943 6.935 6.136 5.492 4.964 4.524 4.154 3.990 28 16.663 13.406 1.05 9.307 7.984 6.9616.152 5.502 4.970 4.528 4.157 3.992 29 16.984 13.591 .158 9.370 8.022 6.983 6.166 5.510 4.975 4.531 4.159 3.99 17.292 13.765 11.258 9.427 8.055 7.003 6.177 5.5174.979 4.534 4.160 3.995 19.793 5.046 11.925 9.779 8.244 7.105 6.234 5.548 4.997 4.544 4.166 3.999