Answered step by step

Verified Expert Solution

Question

1 Approved Answer

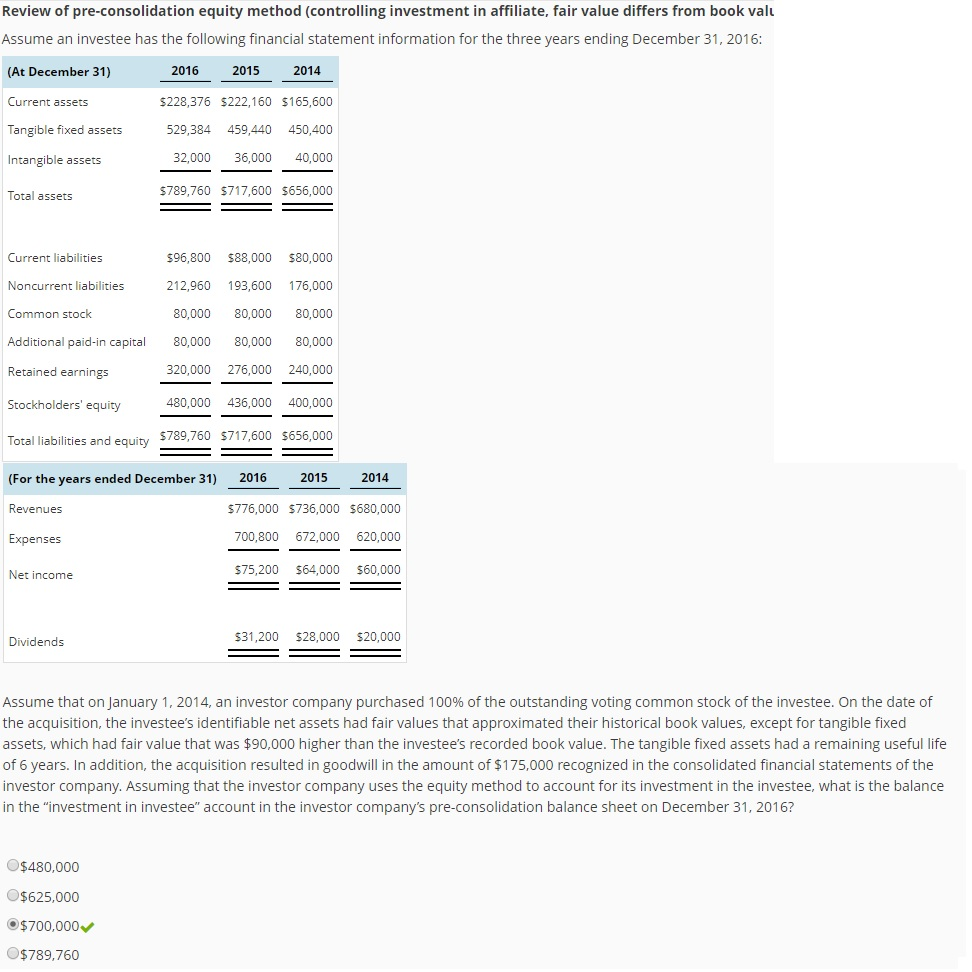

PLease show work how they derive to 700000 Review of pre-consolidation equity method (controlling investment in affiliate, fair value differs from book vall Assume an

PLease show work how they derive to 700000

PLease show work how they derive to 700000

Review of pre-consolidation equity method (controlling investment in affiliate, fair value differs from book vall Assume an investee has the following financial statement information for the three years ending December 31 , 2016: (At December 31) Current assets Tangible fixed assets Intangible assets Total assets Current liabilities Noncurrent liabilities Common stock Additional paid-in capital Retained earnings Stockholders' equity 2016 5228,376 529,384 32,000 989,760 596,800 212,960 80,000 80,000 320,000 480,000 5789,760 Total liabilities and equity 2015 5222, 160 36,000 5717,600 588,000 193,600 80,000 80,000 276,000 436,000 5717,600 2016 (For the years ended December 31) Revenues Expenses Net income Dividends 976,000 700,800 575,200 531 ,200 2014 5165,600 450,400 40,000 5656, ooo 580,000 176,000 80,000 80,000 240,000 400,000 "56,000 2015 5736,ooo 672,000 564, ooo 528,000 2014 "80,000 620,000 560, ooo 520,000 Assume that on January 1, 2014, an investor company purchased 100% of the outstanding voting common stock of the investee. On the date of the acquisition, the investee's identifiable net assets had fair values that approximated their historical book values, except for tangible fixed assets, which had fair value that was $90,000 higher than the investee's recorded book value. The tangible fixed assets had a remaining useful life of 6 years. In addition, the acquisition resulted in goodwill in the amount of $1 75,000 recognized in the consolidated financial statements of the investor company. Assuming that the investor company uses the equity method to account for its investment in the investee, what is the balance in the "investment in investee" account in the investor company's pre-consolidation balance sheet on December 31 , 201 6? 03480,ooo 0$789,760

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started