Please show work how you got the answer and answer both questions !

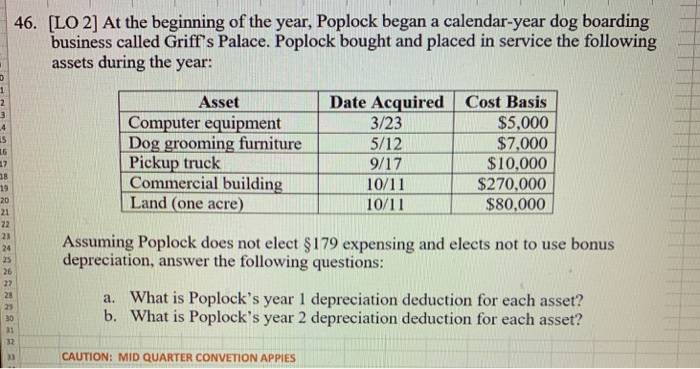

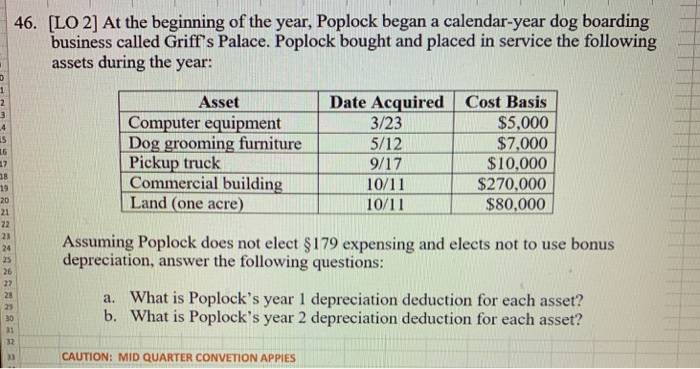

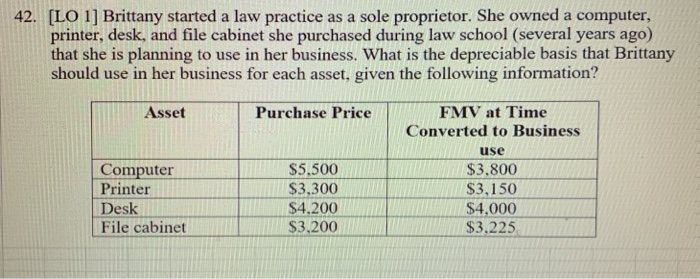

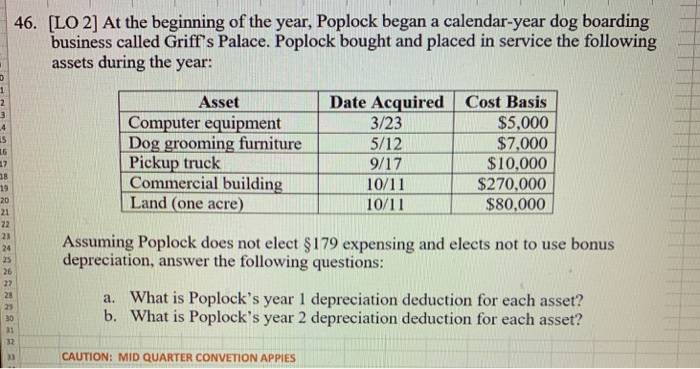

46. LO 2] At the beginning of the year, Poplock began a calendar-year dog boarding business called Griffs Palace. Poplock bought and placed in service the following assets during the year: Asset Computer equipment Dog grooming furniture Pickup truck Commercial building10/11 Land (one acre) Date Acquired Cost Basis $5,000 $7,000 $10,000 $270,000 $80,000 3/23 5/12 6 17 19 20 21 23 Assuming Poplock does not elect 179 expensing and elects not to use bonus depreciation, answer the following questions: 26 27 25 30 31 32 a. b. What is Poplock's year 1 depreciation deduction for each asset? What is Poplock's year 2 depreciation deduction for each asset? CAUTION: MID QUARTER CONVETION APPIES 42. LO 1] Brittany started a law practice as a sole proprietor. She owned a computer printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. What is the depreciable basis that Brittany should use in her business for each asset, given the following information? Asset Purchase Price Computer Printer Desk File cabinet S5,500 $3,300 $4.200 $3.200 FMV at Time Converted to Business use $3.800 $3,150 $4.000 $3.225 46. LO 2] At the beginning of the year, Poplock began a calendar-year dog boarding business called Griffs Palace. Poplock bought and placed in service the following assets during the year: Asset Computer equipment Dog grooming furniture Pickup truck Commercial building10/11 Land (one acre) Date Acquired Cost Basis $5,000 $7,000 $10,000 $270,000 $80,000 3/23 5/12 6 17 19 20 21 23 Assuming Poplock does not elect 179 expensing and elects not to use bonus depreciation, answer the following questions: 26 27 25 30 31 32 a. b. What is Poplock's year 1 depreciation deduction for each asset? What is Poplock's year 2 depreciation deduction for each asset? CAUTION: MID QUARTER CONVETION APPIES 42. LO 1] Brittany started a law practice as a sole proprietor. She owned a computer printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. What is the depreciable basis that Brittany should use in her business for each asset, given the following information? Asset Purchase Price Computer Printer Desk File cabinet S5,500 $3,300 $4.200 $3.200 FMV at Time Converted to Business use $3.800 $3,150 $4.000 $3.225