Answered step by step

Verified Expert Solution

Question

1 Approved Answer

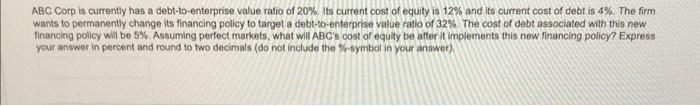

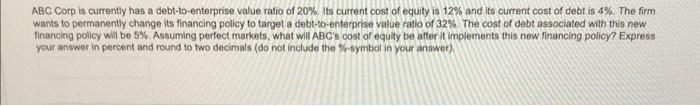

Please show work if possible, Thank you! ABC Corp is currently has a debt-to-enterprise value ratio of 20%. Its current cost of equity is 12%

Please show work if possible, Thank you!

ABC Corp is currently has a debt-to-enterprise value ratio of 20%. Its current cost of equity is 12% and its current cost of debt is 4%. The firm Wants to permanently change its financing policy to target a debt-to-enterprise value ratio of 32%. The cost of debt associated with this new financing policy will be 5%. Assuming perfect markets, what will ABC's oost of equity be after it implements this new rinancing policy? Express your answer in percent and round to two decimals (do not include the %-tymbol in your answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started