PLEASE SHOW WORK IN EXCEL

PLEASE SHOW WORK IN EXCEL

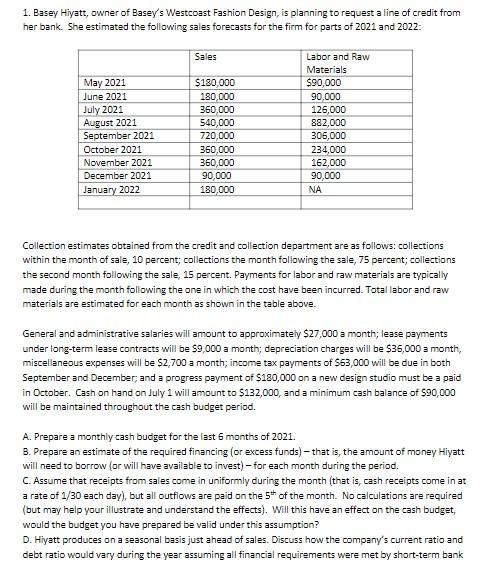

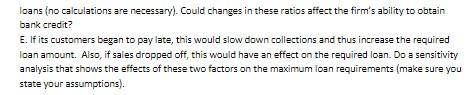

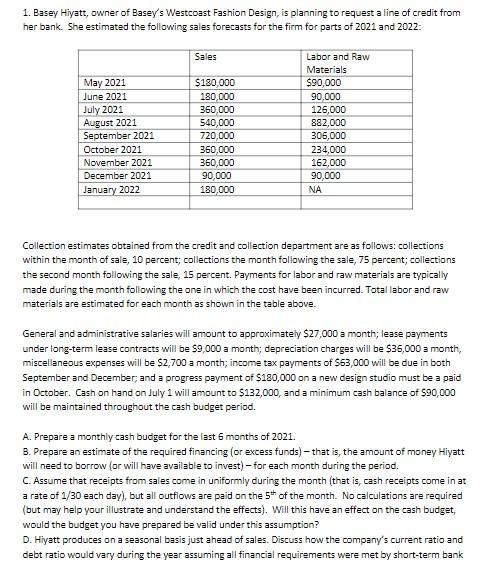

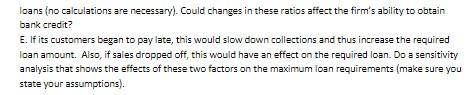

1. Basey Hiyatt, owner of Basey's Westcoast Fashion Design, is planning to request a line of credit from her bank. She estimated the following sales forecasts for the firm for parts of 2021 and 2022 : Collection estimates obtained from the credit and collection department are as follows: collections within the month of sale, 10 percent; collections the month following the sale, 75 percent; collections the second month following the sale, 15 percent. Payments for labor and raw materials are typically made during the month following the one in which the cost have been incurred. Total labor and raw materials are estimated for each month as shown in the table above. General and administrative salaries will amount to approximately $27,000 a month; lease payments under long-term lease contracts will be $9,000 a month; depreciation charges will be $36,000 a month, miscellaneous expenses will be $2,700 a month; income tax payments of $63,000 will be due in both September and December; and a progress payment of $180,000 on a new design studio must be a paid in October. Cash on hand on July 1 will amount to $132,000, and a minimum cash balance of $90,000 will be maintained throughout the cash budget period. A. Prepare a monthly cash budget for the last 6 months of 2021. B. Prepare an estimate of the required financing (or excess funds) - that is, the amount of money Hiyatt will need to borrow (or will have available to invest) - for each month during the period. C. Assume that receipts from sales come in uniformly during the month (that is, cash receipts come in at a rate of 1/30 each day), but all outflows are paid on the 5th of the month. No calculations are required (but may help your illustrate and understand the effects). Will this have an effect on the cash budget, would the budget you have prepared be valid under this assumption? D. Hiyatt produces on a seasonal basis just ahead of sales. Discuss how the company's current ratio and debt ratio would vary during the year assuming all financial requirements were met by short-term bank Ioans (no calculations are necessary). Could changes in these ratios affect the firm's ability to obtain bank credit? E. If its customers began to pay late, this would slow down collections and thus increase the required loan amount. Also, if sales dropped off, this would have an effect on the required loan. Do a sensitivity analysis that shows the effects of these two factors on the maximum loan requirements (make sure you state your assumptions)

PLEASE SHOW WORK IN EXCEL

PLEASE SHOW WORK IN EXCEL