Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW WORK IN EXCEL You have been asked by the president of your company to evaluate the proposed purchase of a $120,000 new Mack

PLEASE SHOW WORK IN EXCEL

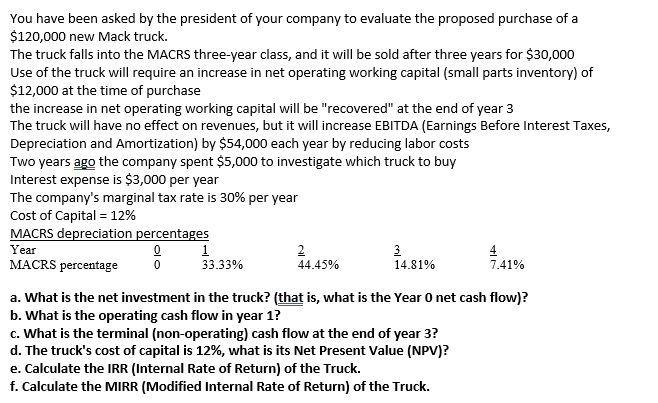

You have been asked by the president of your company to evaluate the proposed purchase of a $120,000 new Mack truck. The truck falls into the MACRS three-year class, and it will be sold after three years for $30,000 Use of the truck will require an increase in net operating working capital (small parts inventory) of $12,000 at the time of purchase the increase in net operating working capital will be "recovered" at the end of year 3 The truck will have no effect on revenues, but it will increase EBITDA (Earnings Before Interest Taxes, Depreciation and Amortization) by $54,000 each year by reducing labor costs Two years ago the company spent $5,000 to investigate which truck to buy Interest expense is $3,000 per year The company's marginal tax rate is 30% per year Cost of Capital = 12% MACRS depreciation percentages Year 0 1 2 2 4 MACRS percentage 0 33.33% 14.81% 44.45% 7.41% a. What is the net investment in the truck? (that is, what is the Year 0 net cash flow)? b. What is the operating cash flow in year 1? c. What is the terminal (non-operating) cash flow at the end of year 3? d. The truck's cost of capital is 12%, what is its Net Present Value (NPV)? e. Calculate the IRR (Internal Rate of Return) of the Truck. f. Calculate the MIRR (Modified Internal Rate of Return) of the TruckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started