Answered step by step

Verified Expert Solution

Question

1 Approved Answer

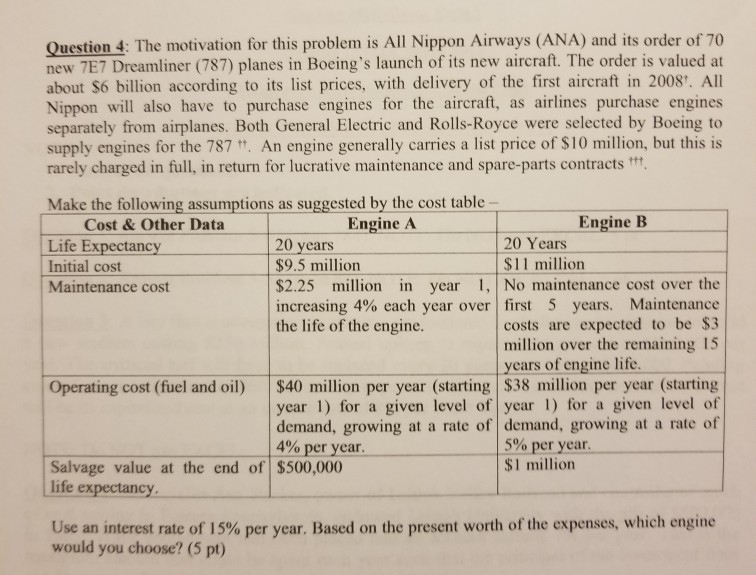

Question 4: The motivation for this problem is All Nippon Airways (ANA) and its order of 70 new 7E7 Dreamliner (787) planes in Boeing's launch

Question 4: The motivation for this problem is All Nippon Airways (ANA) and its order of 70 new 7E7 Dreamliner (787) planes in Boeing's launch of its new aircraft. The order is valued at about S6 billion according to its list prices, with delivery of the first aircraft in 2008'. All Nippon will also have to purchase engines for the aircraft, as airlines purchase engines separately from airplanes. Both General Electric and Rolls-Royce were selected by Boeing to supply engines for the 787 tt. An engine generally carries a list price of $10 million, but this is rarely charged in full, in return for lucrative maintenance and spare-parts contracts ", Make the following assumptions as suggested by the cost table Cost & Other Data Engine A Engine B Life Expectancy Initial cost Maintenance cost 20 years $9.5 million $2.25 million in year 1, No maintenance cost over the increasing 4% each year over! first 5 years. Maintenance the life of the engine. 20 Years $11 million costs are expected to be $3 million over the remaining 15 years of engine life, Operating cost (fuel and oil) $40 million per year (starting $38 million per year (starting year 1) for a given level of year 1) for a given level of demand, growing at a rate of demand, growing at a rate of 400 per year. 5% peryear. $1 million Salvage value at the end of $500,000 life ex Use an interest rate of 15% per year. Based on the present worth of the expenses, which engine would you choose? (5 pt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started