Answered step by step

Verified Expert Solution

Question

1 Approved Answer

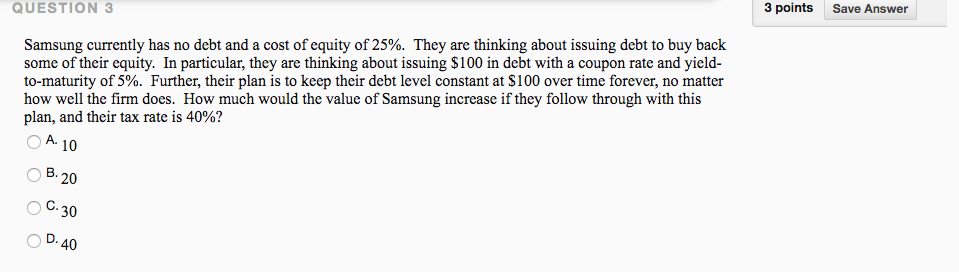

Please show work. It helps a lot! Save Answer 3 points QUESTION 3 Samsung currently has no debt and a cost of equity of 25%.

Please show work. It helps a lot!

Save Answer 3 points QUESTION 3 Samsung currently has no debt and a cost of equity of 25%. They are thinking about issuing debt to buy back some of their equity. In particular, they are thinking about issuing $100 in debt with a coupon rate and yield to-maturity of 5%. Further, their plan is to keep their debt level constant at $100 over time forever, no matter how well the firm does. How much would the value of Samsung increase if they follow through with this plan, and their tax rate is 40%? OA 10 OB. 20 OC.30 O D. 40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started