Answered step by step

Verified Expert Solution

Question

1 Approved Answer

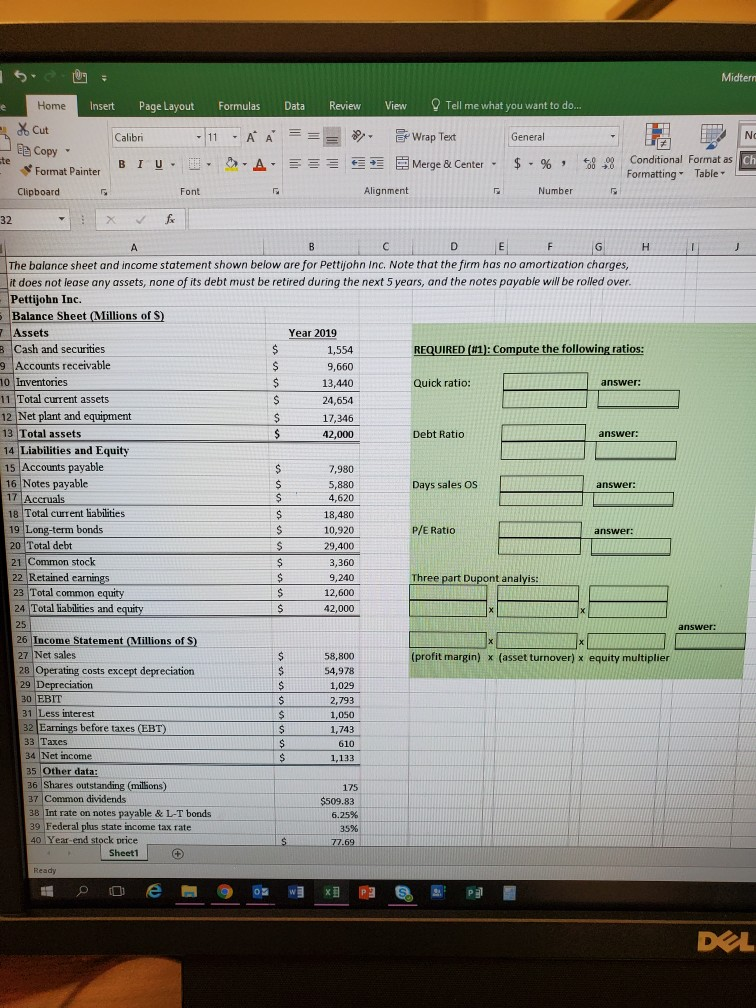

Please show work Midtern Review View Tell me what you want to do... - General E Copy e Home Insert Page Layout Formulas Data 7

Please show work

Midtern Review View Tell me what you want to do... - General E Copy e Home Insert Page Layout Formulas Data 7 of cut Calibri - 11 - AA== Format Painter BIU. 10- >> A Clipboard Font 32 : x for E* Wrap Text Merge & Center - 3 $ - % 48.98 Conditional Format as Formatting Table Ch Alignment Number use E F G The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. - Pettijohn Inc. Balance Sheet (Millions of S) - Assets Year 2019 B Cash and securities 1,554 REQUIRED (6/1): Compute the following ratios: 9 Accounts receivable 9,660 70 Inventories 13,440 Quick ratio: answer: 11 Total current assets 24,654 12 Net plant and equipment 17,346 13 Total assets 42,000 Debt Ratio answer: 14 Liabilities and Equity 15 Accounts payable 7,980 16 Notes payable 5,880 Days sales os answer: 17 Accruals 4.620 18 Total current liabilities 18,480 19 Long-term bonds 10,920 P/E Ratio answer: 20 Total debt 29,400 21 Common stock 3,360 22 Retained earnings 9,240 Three part Dupont analyis: 23 Total common equity $ 12,600 24 Total liabilities and equityS $ 42,000 isuus answer: (profit margin) x (asset turnover) x equity multiplier 26 Income Statement Millions of S) 27 Net sales 28 Operating costs except depreciation 29 Depreciation 30 EBIT 31 Less interest 32 Earnings before taxes (EBT) 33 Taxes 34 Net income 35 Other data: 36 Shares outstanding (millions) 37 Common dividends 38 Intrate on notes payable & L-T bonds 39 Federal plus state income tax rate 40 Year-end stock price Sheet1 58,800 54,978 1,029 2,793 1,050 1,743 610 1,133 $ $ $ $ 175 $509.83 6.25% 35% 77.69 Ready 119 0 e a wi x P DELStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started