Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work on excel You are considering the purchase of a small multifamily building. In year 1, you expect to earn an NOI of

Please show work on excel

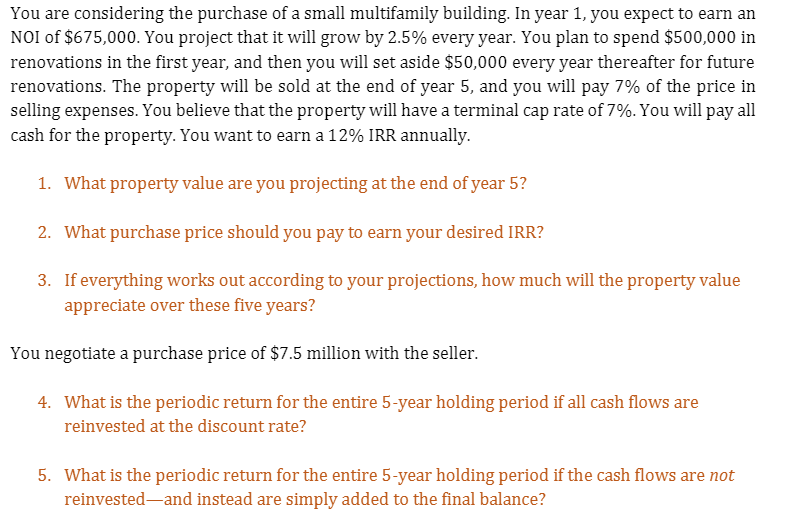

You are considering the purchase of a small multifamily building. In year 1, you expect to earn an NOI of $675,000. You project that it will grow by 2.5% every year. You plan to spend $500,000 in renovations in the first year, and then you will set aside $50,000 every year thereafter for future renovations. The property will be sold at the end of year 5, and you will pay 7% of the price in selling expenses. You believe that the property will have a terminal cap rate of 7%. You will pay all cash for the property. You want to earn a 12% IRR annually. 1. What property value are you projecting at the end of year 5? 2. What purchase price should you pay to earn your desired IRR? 3. If everything works out according to your projections, how much will the property value appreciate over these five years? You negotiate a purchase price of $7.5 million with the seller. 4. What is the periodic return for the entire 5-year holding period if all cash flows are reinvested at the discount rate? 5. What is the periodic return for the entire 5-year holding period if the cash flows are not reinvestedand instead are simply added to the final balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started