Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P-3. To review, here is the information for the first problem: One of your first assignments at the world famous Pez Candy Company located

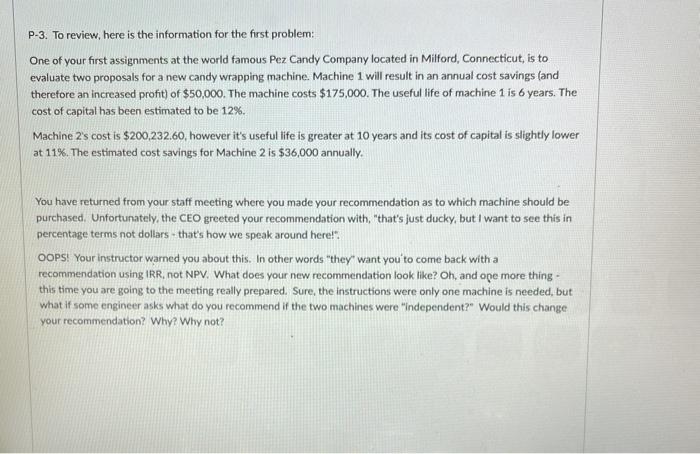

P-3. To review, here is the information for the first problem: One of your first assignments at the world famous Pez Candy Company located in Milford, Connecticut, is to evaluate two proposals for a new candy wrapping machine. Machine 1 will result in an annual cost savings (and therefore an increased profit) of $50,000. The machine costs $175,000. The useful life of machine 1 is 6 years. The cost of capital has been estimated to be 12%. Machine 2's cost is $200,232.60, however it's useful life is greater at 10 years and its cost of capital is slightly lower at 11%. The estimated cost savings for Machine 2 is $36,000 annually. You have returned from your staff meeting where you made your recommendation as to which machine should be purchased. Unfortunately, the CEO greeted your recommendation with, "that's just ducky, but I want to see this in percentage terms not dollars- that's how we speak around here!". OOPS! Your instructor warned you about this. In other words "they" want you to come back with a recommendation using IRR, not NPV. What does your new recommendation look like? Oh, and one more thing- this time you are going to the meeting really prepared. Sure, the instructions were only one machine is needed, but what if some engineer asks what do you recommend if the two machines were "Independent?" Would this change your recommendation? Why? Why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the two machines using the Internal Rate of Return IRR follow these steps Step 1 Underst...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started