Question

Please show work: Peace Corporation acquired 75 percent of the ownership of Symbol Company on January 1, 20X1. The fair value of the noncontrolling interest

Please show work:

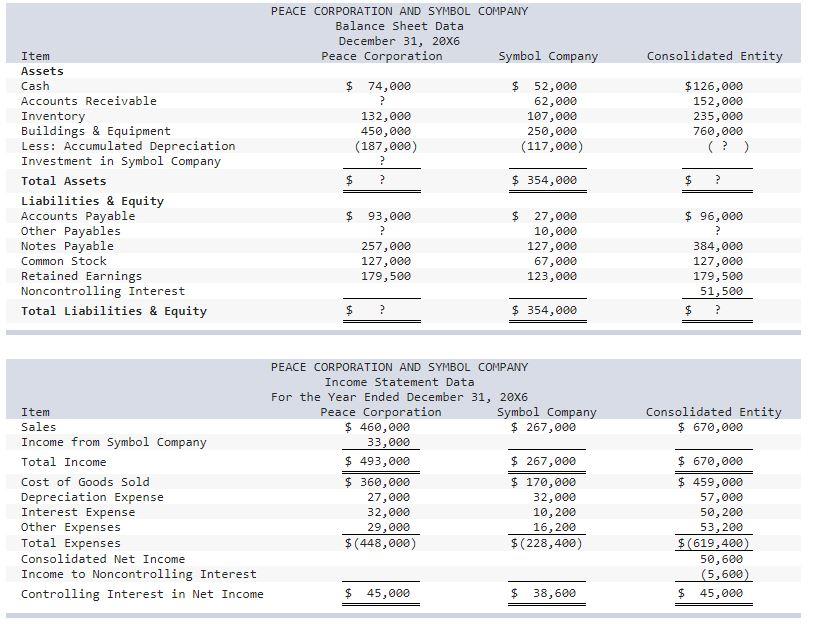

Peace Corporation acquired 75 percent of the ownership of Symbol Company on January 1, 20X1. The fair value of the noncontrolling interest at acquisition was equal to its proportionate share of the fair value of the net assets of Symbol. The full amount of the differential at acquisition was attributable to buildings and equipment, which had a remaining useful life of eight years. Financial statement data for the two companies and the consolidated entity at December 31, 20X6, are as follows:

Required: a. For the buildings and equipment held by Symbol when Peace acquired it and still on hand on December 31, 20X6, by what amount had buildings and equipment increased in value from their acquisition to the date of combination with Peace? b. What amount should be reported as accumulated depreciation for the consolidated entity at December 31, 20X6 (assuming Peace does not make the optional accumulated depreciation consolidation entry)? c. If Symbol reported capital stock outstanding of $67,000 and retained earnings of $37,000 on January 1, 20X1, what amount did Peace pay to acquire its ownership of Symbol? d. What balance does Peace report as its investment in Symbol at December 31, 20X6? e. What amount of intercorporate sales of inventory occurred in 20X6? f. What amount of unrealized inventory profit exists at December 31, 20X6? g. Prepare the consolidation entry used in eliminating intercompany inventory sales during 20X6. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) h. What was the amount of unrealized inventory profit at January 1, 20X6? i. What balance in accounts receivable did Peace report at December 31, 20X6?

Consolidated Entity PEACE CORPORATION AND SYMBOL COMPANY Balance Sheet Data December 31, 20X6 Peace Corporation Symbol Company $ 74,000 $ 52,000 ? 62,000 132,000 107,000 450,000 250,000 (187,000) (117,000) ? $ $ 354,000 $126,000 152,000 235,000 760,000 Item Assets Cash Accounts Receivable Inventory Buildings & Equipment Less: Accumulated Depreciation Investment in Symbol Company Total Assets Liabilities & Equity Accounts Payable Other Payables Notes Payable Common Stock Retained Earnings Noncontrolling Interest Total Liabilities & Equity ? $ $ 93,000 ? 257,000 127,000 179,500 27,000 10,000 127,000 67,000 123,000 $ 96,000 ? 384,000 127,000 179,500 51,500 $ ? $ ? $ 354,000 Consolidated Entity $ 670,000 Item Sales Income from Symbol Company Total Income Cost of Goods Sold Depreciation Expense Interest Expense Other Expenses Total Expenses Consolidated Net Income Income to Noncontrolling Interest Controlling Interest in Net Income PEACE CORPORATION AND SYMBOL COMPANY Income Statement Data For the Year Ended December 31, 20x6 Peace Corporation Symbol Company $ 460,000 $ 267,000 33,000 $ 493,000 $ 267,000 $ 360,000 $ 170,000 27,000 32,000 32,000 10,200 29,000 16,200 $(448,000) $(228,400) $ 670,000 $ 459,000 57,000 50,200 53,200 $ (619,400) 50,600 (5,600) $ 45,000 $ 45,000 $ 38,600 Consolidated Entity PEACE CORPORATION AND SYMBOL COMPANY Balance Sheet Data December 31, 20X6 Peace Corporation Symbol Company $ 74,000 $ 52,000 ? 62,000 132,000 107,000 450,000 250,000 (187,000) (117,000) ? $ $ 354,000 $126,000 152,000 235,000 760,000 Item Assets Cash Accounts Receivable Inventory Buildings & Equipment Less: Accumulated Depreciation Investment in Symbol Company Total Assets Liabilities & Equity Accounts Payable Other Payables Notes Payable Common Stock Retained Earnings Noncontrolling Interest Total Liabilities & Equity ? $ $ 93,000 ? 257,000 127,000 179,500 27,000 10,000 127,000 67,000 123,000 $ 96,000 ? 384,000 127,000 179,500 51,500 $ ? $ ? $ 354,000 Consolidated Entity $ 670,000 Item Sales Income from Symbol Company Total Income Cost of Goods Sold Depreciation Expense Interest Expense Other Expenses Total Expenses Consolidated Net Income Income to Noncontrolling Interest Controlling Interest in Net Income PEACE CORPORATION AND SYMBOL COMPANY Income Statement Data For the Year Ended December 31, 20x6 Peace Corporation Symbol Company $ 460,000 $ 267,000 33,000 $ 493,000 $ 267,000 $ 360,000 $ 170,000 27,000 32,000 32,000 10,200 29,000 16,200 $(448,000) $(228,400) $ 670,000 $ 459,000 57,000 50,200 53,200 $ (619,400) 50,600 (5,600) $ 45,000 $ 45,000 $ 38,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started