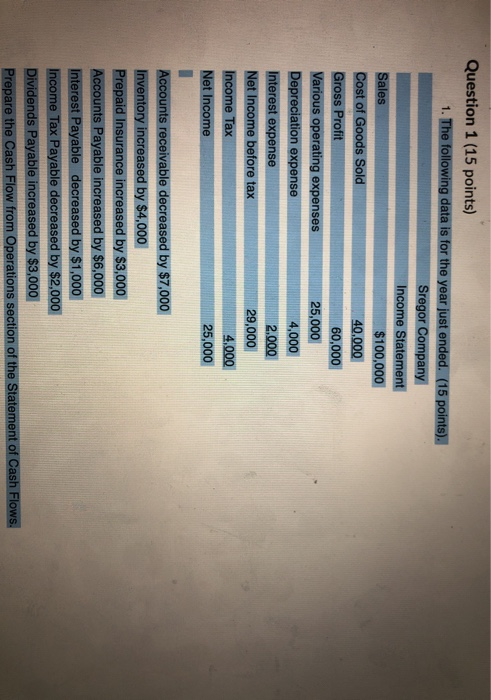

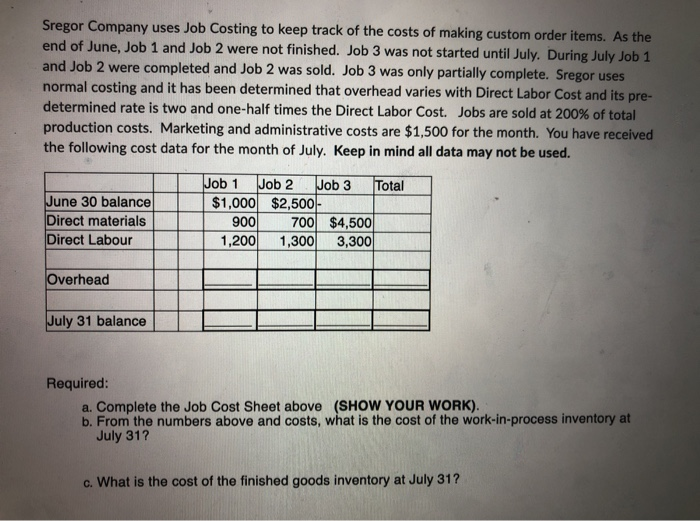

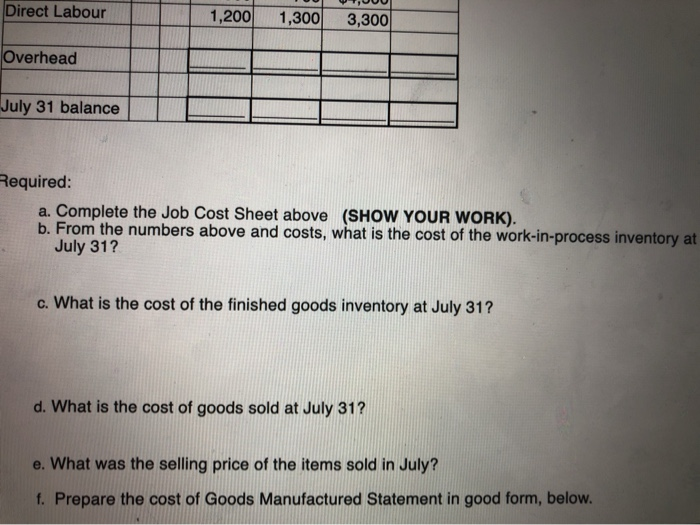

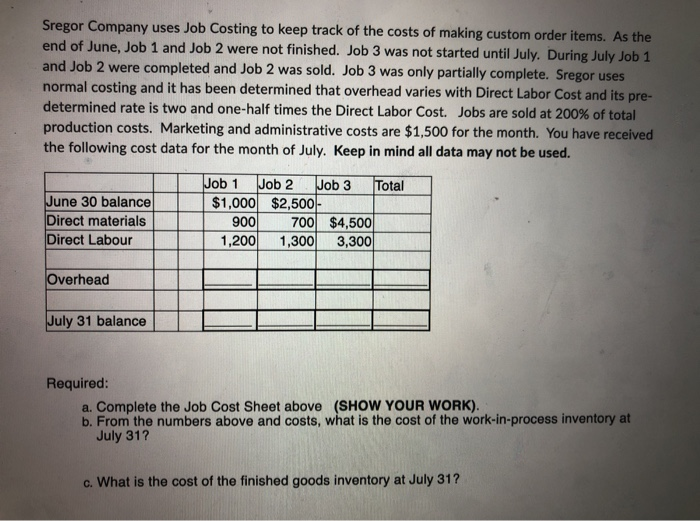

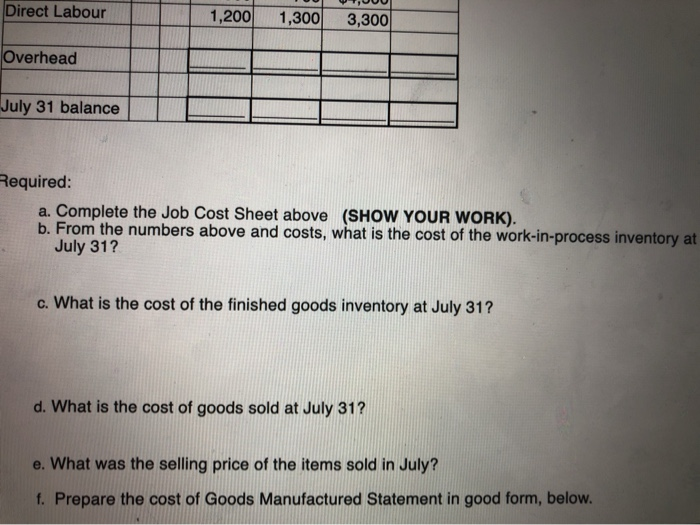

Question 1 (15 points) 1. The following data is for the year just ended. (15 points). Sregor Company Income Statement Sales $100,000 Cost of Goods Sold 40,000 Gross Profit 60,000 Various operating expenses 25,000 Depreciation expense 4,000 Interest expense 2.000 Net Income before tax 29,000 Income Tax 14,000 Net Income 25,000 Accounts receivable decreased by $7,000 Inventory increased by $4,000 Prepaid Insurance increased by $3,000 Accounts Payable increased by $6,000 Interest Payable decreased by $1,000 Income Tax Payable decreased by $2,000 Dividends Payable increased by $3,000 Prepare the Cash Flow from Operations section of the Statement of Cash Flows. Sregor Company uses Job Costing to keep track of the costs of making custom order items. As the end of June, Job 1 and Job 2 were not finished. Job 3 was not started until July. During July Job 1 and Job 2 were completed and Job 2 was sold. Job 3 was only partially complete. Sregor uses normal costing and it has been determined that overhead varies with Direct Labor Cost and its pre- determined rate is two and one-half times the Direct Labor Cost. Jobs are sold at 200% of total production costs. Marketing and administrative costs are $1,500 for the month. You have received the following cost data for the month of July. Keep in mind all data may not be used. June 30 balance Direct materials Direct Labour Job 1 Job 2 Job 3 Total $1,000 $2,500 - 900 700 $4,500 1,200 1,300 3,300 Overhead July 31 balance Required: a. Complete the Job Cost Sheet above (SHOW YOUR WORK). b. From the numbers above and costs, what is the cost of the work-in-process inventory at July 312 c. What is the cost of the finished goods inventory at July 31? V TUUU Direct Labour 1,200 1,300 3,300 Overhead July 31 balance Required: a. Complete the Job Cost Sheet above (SHOW YOUR WORK). b. From the numbers above and costs, what is the cost of the work-in-process inventory at July 31? c. What is the cost of the finished goods inventory at July 31? d. What is the cost of goods sold at July 31? e. What was the selling price of the items sold in July? f. Prepare the cost of Goods Manufactured Statement in good form, below