Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work. Please dont use excel Estimation of Project Cash Flows (Ch. 10) Assignment: Do the following three end-of-chapter problems from Chapters 9 and

please show work. Please dont use excel

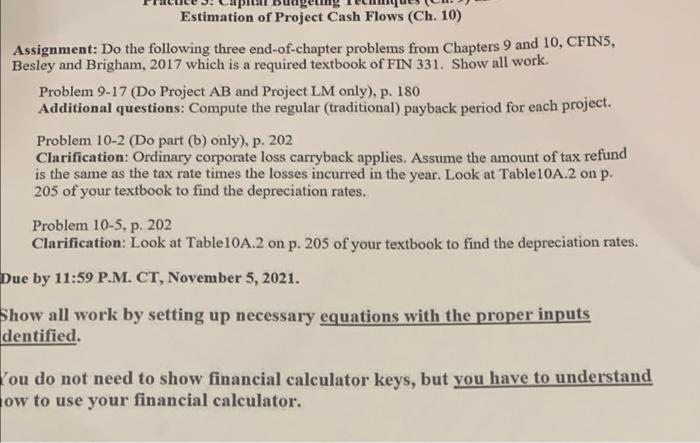

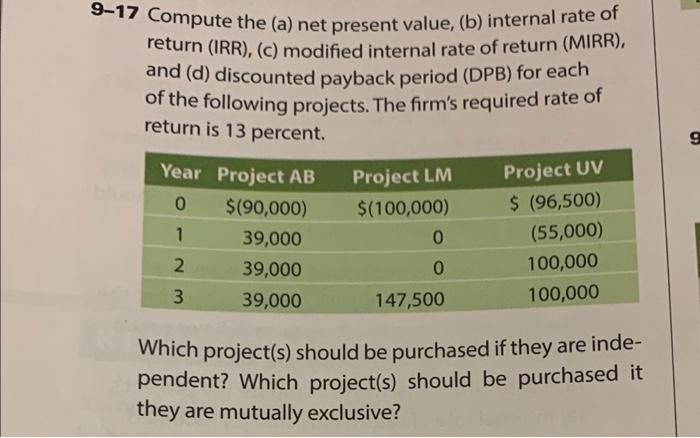

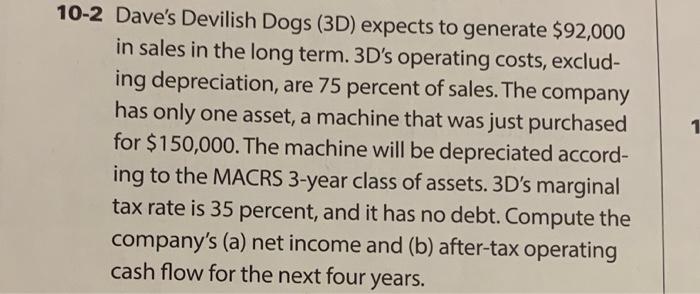

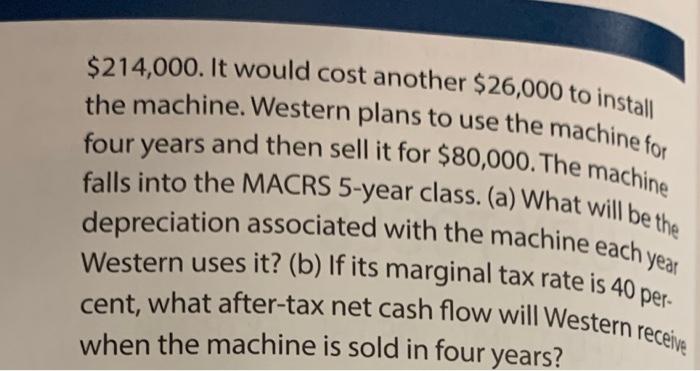

Estimation of Project Cash Flows (Ch. 10) Assignment: Do the following three end-of-chapter problems from Chapters 9 and 10, CFIN5, Besley and Brigham, 2017 which is a required textbook of FIN 331. Show all work. Problem 9-17 (Do Project AB and Project LM only), p. 180 Additional questions: Compute the regular (traditional) payback period for each project. Problem 10-2 (Do part (b) only), p. 202 Clarification: Ordinary corporate loss carryback applies. Assume the amount of tax refund is the same as the tax rate times the losses incurred in the year. Look at Table10A.2 on p. 205 of your textbook to find the depreciation rates. Problem 10-5, p. 202 Clarification: Look at Table10A.2 on p. 205 of your textbook to find the depreciation rates. Due by 11:59 P.M. CT, November 5, 2021. Show all work by setting up necessary equations with the proper inputs dentified. You do not need to show financial calculator keys, but you have to understand How to use your financial calculator. 9-17 Compute the (a) net present value, (b) internal rate of return (IRR), (c) modified internal rate of return (MIRR), and (d) discounted payback period (DPB) for each of the following projects. The firm's required rate of return is 13 percent. 9 Year Project AB 0 $(90,000) 1 39,000 2 39,000 3 39,000 Project LM $(100,000) 0 Project UV $ (96,500) (55,000) 100,000 100,000 0 147,500 Which project(s) should be purchased if they are inde- pendent? Which project(s) should be purchased it they are mutually exclusive? 1 10-2 Dave's Devilish Dogs (3D) expects to generate $92,000 in sales in the long term. 3D's operating costs, exclud- ing depreciation, are 75 percent of sales. The company has only one asset, a machine that was just purchased for $150,000. The machine will be depreciated accord- ing to the MACRS 3-year class of assets. 3D's marginal tax rate is 35 percent, and it has no debt. Compute the company's (a) net income and (b) after-tax operating cash flow for the next four years. $214,000. It would cost another $26,000 to install the machine. Western plans to use the machine for four years and then sell it for $80,000. The machine falls into the MACRS 5-year class. (a) What will be the depreciation associated with the machine each y Western uses it? (b) If its marginal tax rate is 40 per- cent, what after-tax net cash flow will Western receive when the machine is sold in four years? year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started