Answered step by step

Verified Expert Solution

Question

1 Approved Answer

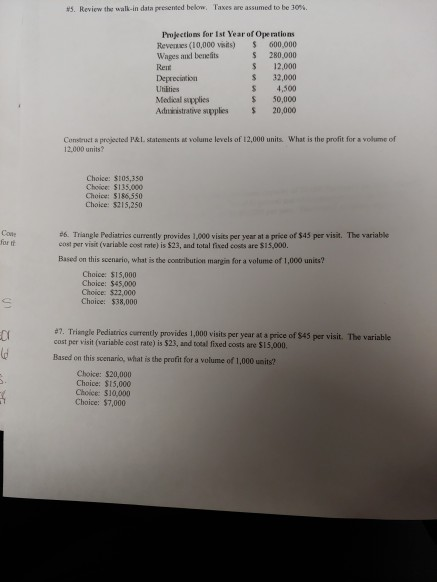

please show work please show work #5. Review the walk-in data presented below. Taxes are assumed to be 10% Projections for 1st Year of Options

please show work

please show work

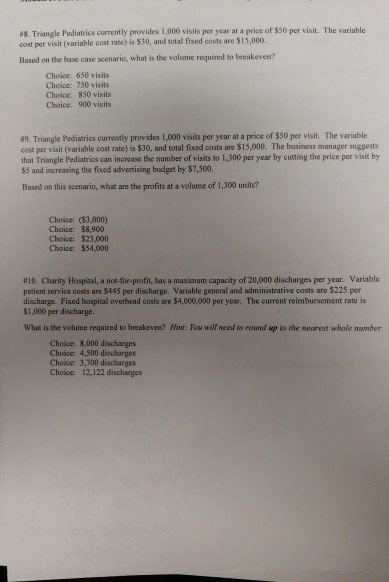

#5. Review the walk-in data presented below. Taxes are assumed to be 10% Projections for 1st Year of Options Revents (10,000 visits 600,000 Wages and benefits $ 280.000 Rene $ 12.000 Depreciation $ 32,000 Utilities $ 4,500 Medical supplies $ 50,000 Administrative supplies $ 20,000 Construct a projected PR statements et volume levels of 12,000 units. What is the profit for a volume of 12.000 units? Choice: $105,350 Choice $135.000 Choice: $185,550 Choice: $215,250 Cove 86. Triangle Pediatrics currently provides 1,000 visits per year at a price of $45 per visit. The variable cost per visit(variable cost rate) is $23, and total fixed costs are $15,000 Based on this scenario, what is the contribution margin for a volume of 1,000 units? Choice: $15,000 Choice: $45.000 Choice: $22.000 Choice: $38,000 $ DO 27. Triangle Pediatries currently provides 1,000 visits per year at a price of $45 per visit. The variable cost per visit(variable cost rate) is $23, and total fixed costs are $15,000 Based on this scenario, what is the profit for a volume of 1,000 units? Chokce: $20,000 Choice: $15,000 Choice: $10,000 Choice: $7,000 08. Triangle Pediatrics currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000 Based on the base case scenario, what is the volume required to breakeven? Choice: 650 visits Choice: 750 visits Choice: 850 visits Choice: 900 visits 19. Triangle Pediatrics currently provides 1.000 visits per year at a price of $50 per visit. The variable cost per visit(variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Triangle Pediatrics can increase the number of visits to 1,300 per year by cutting the price per visit by $5 and increasing the fixed advertising budget by $7,500 Based on this scenario, what are the profits at a volume of 1,300 units? Choice: ($3,000) Choice: $8.900 Choice: $23,000 Choices $54,000 810. Charity Hospital, a not-for-profit, has a maximum capacity of 20,000 discharges per year. Variable patient service costs are $145 per discharge. Variable general and administrative costs are $225 per discharge. Fixed hospital overhead costs are $4,000,000 per year. The current reimbursement rate is $1,000 per discharge What is the volume required to breakeven? Hint: You will need to round up to the nearest whole number Choice: 8,000 discharges Choice: 4.500 discharges Choice: 3.700 discharges Choice: 12,122 dischargesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started