Answered step by step

Verified Expert Solution

Question

1 Approved Answer

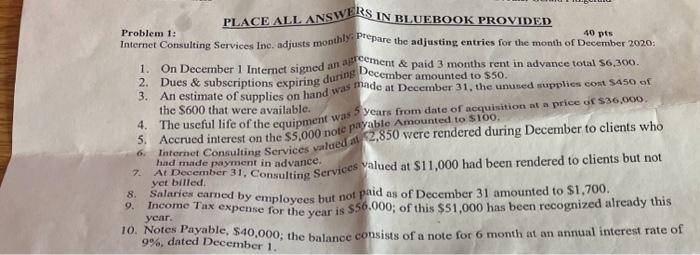

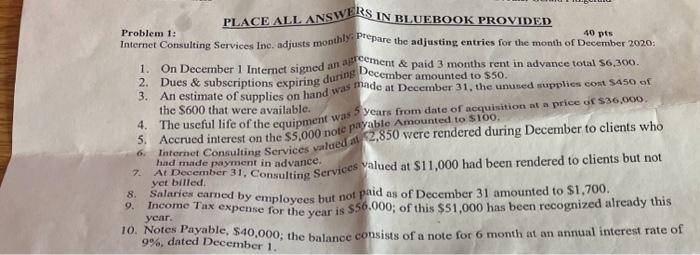

please show work Problem 1: Internet Consulting Services Ine, adjusts monthly; Prepare the adjusting entries for the month of December 2020 : PLACE ALI. ANSWYFRS

please show work

Problem 1: Internet Consulting Services Ine, adjusts monthly; Prepare the adjusting entries for the month of December 2020 : PLACE ALI. ANSWYFRS IN BLUEBOOK PROVIDED 1. On December 1 Internet signed an aigrcement \& paid 3 months rent in advance total $6,300. 2. Dues \& subscriptions expiring during December amounted to $50. 3. An estimate of supplies on hand was made at December 31 , the unused supplies cont saso of the $600 that were available. 4. The useful life of the equipment was 5 years from date of acquisition at a price ar 536,000. 5. Accrued interest on the $5,000 note payabte Amounted to $100. 6. Internet Consulting Services valued at 2,850 were rendered during December to clients who had made payment in advance. 7. At December 31, Consulting Services yalued at $11,000 had been rendered to clients but not 8. Salaries carned by employees but not paid as of December 31 amounted to $1,700. 9. Income Tax expense for the ycar is $56,000; of this $51,000 has been recognized already this 10. Notes Payable, $40,000; the balance consists of a note for 6 month at an annual interest rate of 9%, dated December 1. Problem 1: Internet Consulting Services Ine, adjusts monthly; Prepare the adjusting entries for the month of December 2020 : PLACE ALI. ANSWYFRS IN BLUEBOOK PROVIDED 1. On December 1 Internet signed an aigrcement \& paid 3 months rent in advance total $6,300. 2. Dues \& subscriptions expiring during December amounted to $50. 3. An estimate of supplies on hand was made at December 31 , the unused supplies cont saso of the $600 that were available. 4. The useful life of the equipment was 5 years from date of acquisition at a price ar 536,000. 5. Accrued interest on the $5,000 note payabte Amounted to $100. 6. Internet Consulting Services valued at 2,850 were rendered during December to clients who had made payment in advance. 7. At December 31, Consulting Services yalued at $11,000 had been rendered to clients but not 8. Salaries carned by employees but not paid as of December 31 amounted to $1,700. 9. Income Tax expense for the ycar is $56,000; of this $51,000 has been recognized already this 10. Notes Payable, $40,000; the balance consists of a note for 6 month at an annual interest rate of 9%, dated December 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started