Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work PROBLEM 5-26 Schedule of Cost of Goods Manufactured: Overhead Analysis ILO3, The Pacific Manufacturing Company operates a job-order costing system and applies

please show work

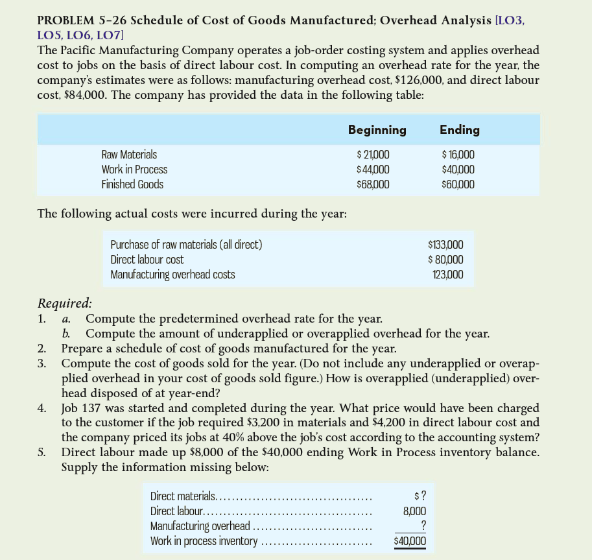

PROBLEM 5-26 Schedule of Cost of Goods Manufactured: Overhead Analysis ILO3, The Pacific Manufacturing Company operates a job-order costing system and applies overhead cost to jobs on the basis of direct labour cost. In computing an overhead rate for the year, the company's estimates were as follows: manufacturing overhead cost, $126,000, and direct labour cost, $84,000. The company has provided the data in the following table: Beginning Ending Raw Materials Work in Process Finished Goods 21000 44,000 68000 $16.000 $40000 60000 The following actual costs were incurred during the year: Purchase of raw materials (all direct) Direct labour cost Manufacturing overhead costs $133,000 80,000 123,000 Required 1. a. Compute the predetermined overhead rate for the year. b. Compute the amount of underapplied or overapplied overhead for the year 2. Prepare a schedule of cost of goods manufactured for the year. 3. Compute the cost of goods sold for the year. (Do not include any underapplied or overap- plied overhead in your cost of goods sold figure.) How is overapplied (underapplied) over- ead disposed of at year-end? Job 137 was started and completed during the year. What price would have been charged to the customer if the job required $3.200 in materials and $4,200 in direct labour cost and the company priced its jobs at 40% above the job's cost according to the accounting system? Direct labour made up $8,000 of the $40,000 ending Work in Process inventory balance. Supply the information missing below: 4. S. s? 8000 Direct labour... Work in process inventoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started