Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work Problem 6-14 At the end of 2017, Flint Company is conducting an impairment test and needs to develop a fair value estimate

Please show work

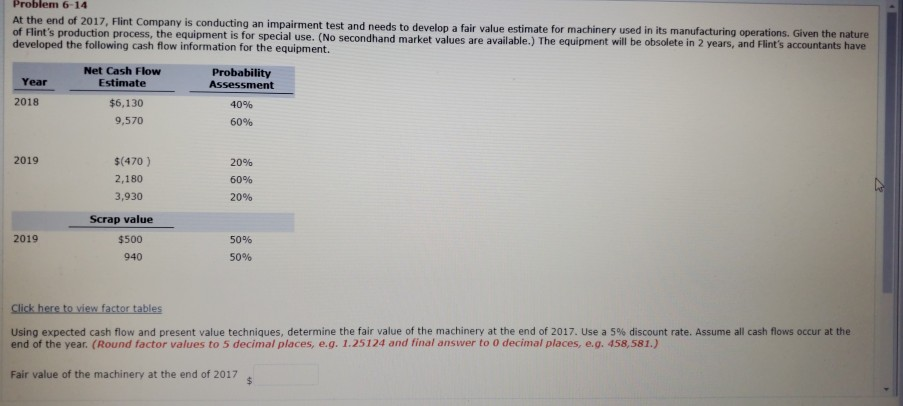

Problem 6-14 At the end of 2017, Flint Company is conducting an impairment test and needs to develop a fair value estimate for machinery used in its manufacturing operations. Given the nature of Flint's production process, the equipment is for special use. (No secondhand market values are available.) The equipment will be obsolete in 2 years, and Flint's accountants have developed the following cash flow information for the equipment. Year Probability Assessment 2018 Net Cash Flow Estimate $6,130 9,570 40% 60% 2019 $(470) 2,180 3,930 20% 60% 20% 2019 Scrap value $500 940 50% 50% Click here to view factor tables Using expected cash flow and present value techniques, determine the fair value of the machinery at the end of 2017. Use a 5% discount rate. Assume all cash flows occur at the end of the year. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to o decimal places, e.. 458,581.) Fair value of the machinery at the end of 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started