Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work Question 1 10 pts For simplicity and clarity in illustrating the different results produced by the different data gathering approaches, assume in

please show work

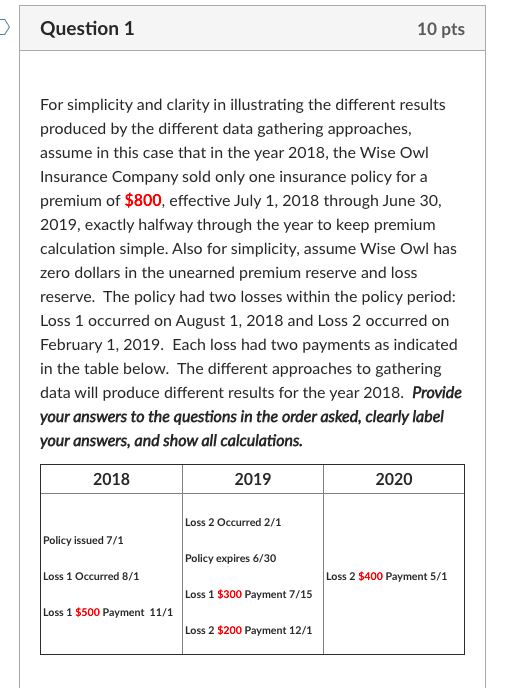

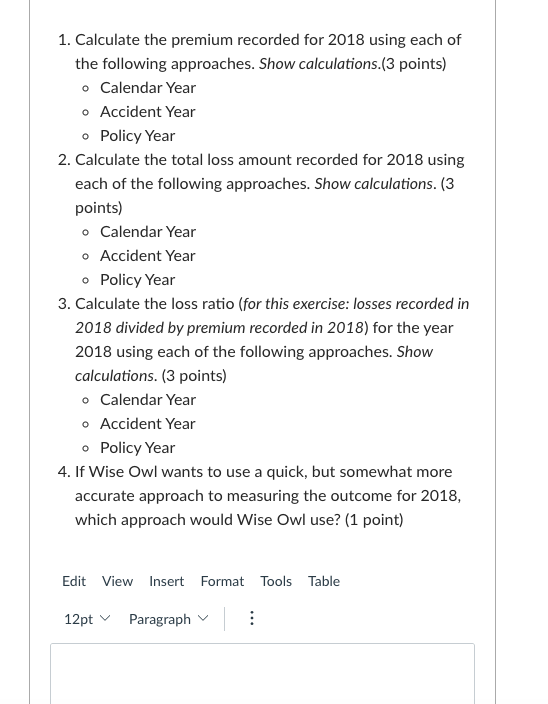

Question 1 10 pts For simplicity and clarity in illustrating the different results produced by the different data gathering approaches, assume in this case that in the year 2018, the Wise Owl Insurance Company sold only one insurance policy for a premium of $800, effective July 1, 2018 through June 30, 2019, exactly halfway through the year to keep premium calculation simple. Also for simplicity, assume Wise Owl has zero dollars in the unearned premium reserve and loss reserve. The policy had two losses within the policy period: Loss 1 occurred on August 1, 2018 and Loss 2 occurred on February 1, 2019. Each loss had two payments as indicated in the table below. The different approaches to gathering data will produce different results for the year 2018. Provide your answers to the questions in the order asked, clearly label your answers, and show all calculations. 2018 2019 2020 Loss 2 Occurred 2/1 Policy issued 7/1 Policy expires 6/30 Loss 1 Occurred 8/1 Loss 2 $400 Payment 5/1 Loss 1 $300 Payment 7/15 Loss 1 $500 Payment 11/1 Loss 2 $200 Payment 12/1 1. Calculate the premium recorded for 2018 using each of the following approaches. Show calculations.(3 points) o Calendar Year o Accident Year o Policy Year 2. Calculate the total loss amount recorded for 2018 using each of the following approaches. Show calculations. (3 points) o Calendar Year o Accident Year o Policy Year 3. Calculate the loss ratio (for this exercise: losses recorded in 2018 divided by premium recorded in 2018) for the year 2018 using each of the following approaches. Show calculations. (3 points) o Calendar Year o Accident Year o Policy Year 4. If Wise Owl wants to use a quick, but somewhat more accurate approach to measuring the outcome for 2018, which approach would Wise Owl use? (1 point) Edit View Insert Format Tools Table 12pt v Paragraph : Question 1 10 pts For simplicity and clarity in illustrating the different results produced by the different data gathering approaches, assume in this case that in the year 2018, the Wise Owl Insurance Company sold only one insurance policy for a premium of $800, effective July 1, 2018 through June 30, 2019, exactly halfway through the year to keep premium calculation simple. Also for simplicity, assume Wise Owl has zero dollars in the unearned premium reserve and loss reserve. The policy had two losses within the policy period: Loss 1 occurred on August 1, 2018 and Loss 2 occurred on February 1, 2019. Each loss had two payments as indicated in the table below. The different approaches to gathering data will produce different results for the year 2018. Provide your answers to the questions in the order asked, clearly label your answers, and show all calculations. 2018 2019 2020 Loss 2 Occurred 2/1 Policy issued 7/1 Policy expires 6/30 Loss 1 Occurred 8/1 Loss 2 $400 Payment 5/1 Loss 1 $300 Payment 7/15 Loss 1 $500 Payment 11/1 Loss 2 $200 Payment 12/1 1. Calculate the premium recorded for 2018 using each of the following approaches. Show calculations.(3 points) o Calendar Year o Accident Year o Policy Year 2. Calculate the total loss amount recorded for 2018 using each of the following approaches. Show calculations. (3 points) o Calendar Year o Accident Year o Policy Year 3. Calculate the loss ratio (for this exercise: losses recorded in 2018 divided by premium recorded in 2018) for the year 2018 using each of the following approaches. Show calculations. (3 points) o Calendar Year o Accident Year o Policy Year 4. If Wise Owl wants to use a quick, but somewhat more accurate approach to measuring the outcome for 2018, which approach would Wise Owl use? (1 point) Edit View Insert Format Tools Table 12pt v ParagraphStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started