please show work!

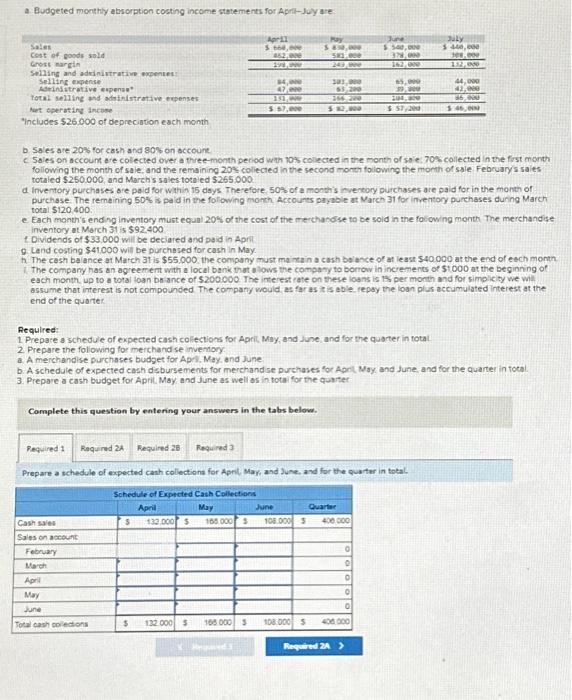

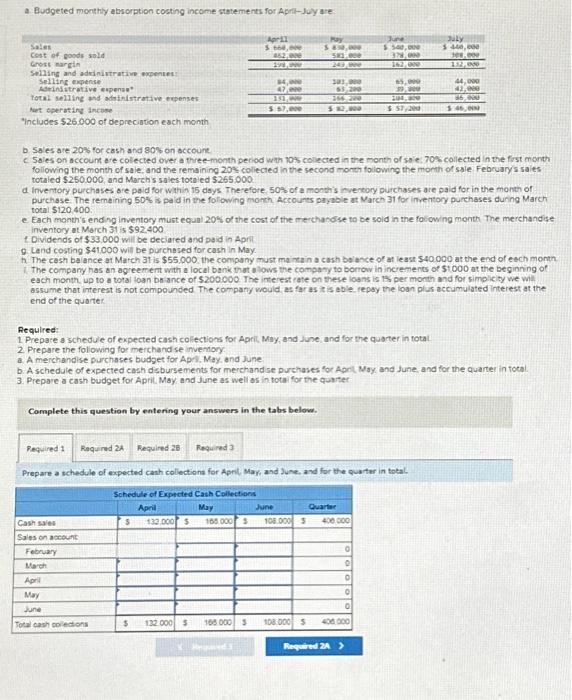

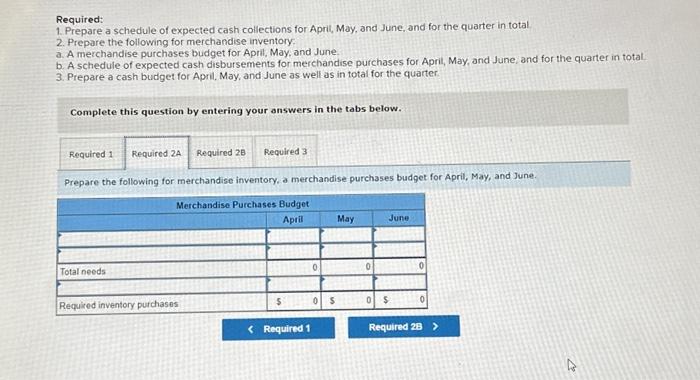

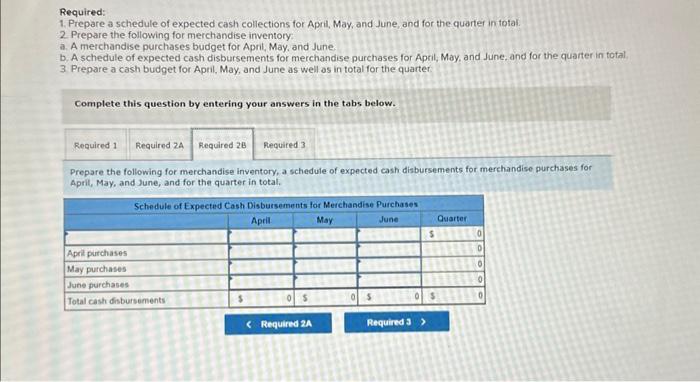

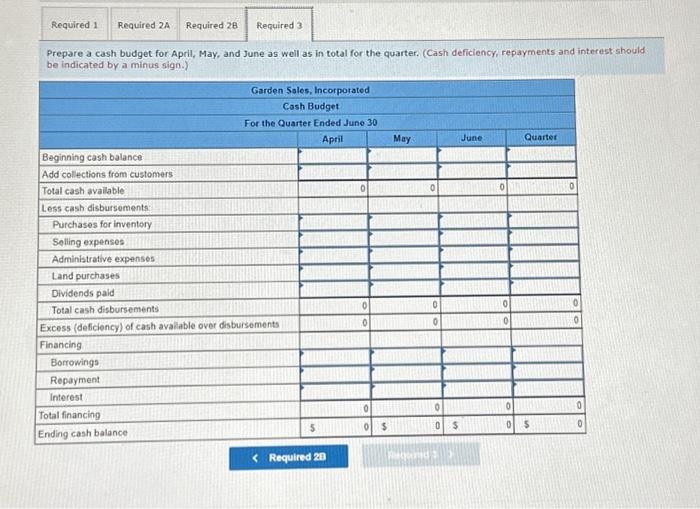

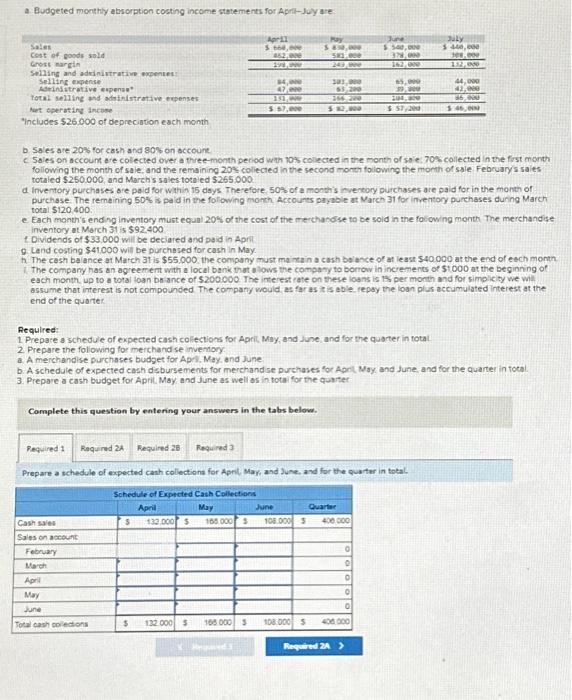

Required: 1. Prepare a schedule of expected cash collections for Aprit, May, and June, and for the quarter in total: 2. Prepare the following for merchandise inventory: a. A merchandise purchases budget for Aprit, May, and June. b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. 3 Prepare a cash budget for April, May, and June as well as in total for the quarter: Complete this question by entering your answers in the tabs below. Prepare the following for merchandise inventory, a schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. Required: 1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total 2. Prepare the following for merchandise inventory: a. A merchandise purchases budget for Aprit, May, and June. b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. 3. Prepare a cash budget for April, May, and June as well as in total for the quarter. Complete this question by entering your answers in the tabs below. Prepare the following for merchandise inventory, a merchandise purchases budget for April, May, and June. Prepare a cash budget for April, May, and June as well as in total for the quarter. (Cash deficiency, repayments and interest should be indicated by a minus sign.) a Budgeted monthly absorption costing income stetements for April-july are: b. Sales are 20 s for cash and 80 s on sccoune. foliowing the month of sale, and the remaining 205 soliected in the second month folowing the month of sale Februarys sales totaled \$250.000, and March s sales toteled $265,000 d inventory purchases ore paid for within 15 dsys. Therefore, 50% of a monthis invereory purchases are paid for in the month of purchase. The remeining 502 s is paid in the folowing nonch. Accourts payable at Narch 31 for invertory purehases durng Mardh tocal 5120400 : e. Each moner's end ng inventory must equal 20% of the cost of the merchandse to be soid in the foliowing month The merchandise inventory at March 31 is $92,400 1 Dividends of $33,000 will be deciared and paid in Aprit 9. Lend costing $41000 will be purchased for cash in May. h. The cesh balance at Match 31 is $55,000 the company must mainea in a cash balance of at least $40000 at the end of each month 1. The company has an agreement with a local bank that alows the company to borrow in increments of 5 t. o00 at the beginning of each month. up to a toral loan bs ance of $200000. The irterest rate on these loans is Bs per month and for simplicity we wil. assume that interest is not compounded. The company vould as far as it is able. repay the loan plus accumulated interest at the end of the quarter. Required: 1 Prepare a schedule of expected cash collections for Aprit, May, and June, and for the quorter in total. 2. Prepare the foliowing for merchand se inventory: a. A merchandise Durchases budget for Apri, May, and June b. Aschedule of expected cash ds bursements for merchand se purchases for April May, and June, and for the quarter in tocal. 3. Prepare a cash budget for Aprit May and June as well as in total for the quarter Complete this question by entering your answers in the tabs belovi. Prepare a schedule of expected cash collectiona for Aprit, Mar, and June, and for the quarter in total