Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work, steps, formulas, etc. Thank you! This is what I have done for B and C but it may be incorrect. Please let

Please show work, steps, formulas, etc. Thank you!

This is what I have done for B and C but it may be incorrect. Please let me know if it is.

B. (.50 x .08) + (.50 x .16) = .12 or 12%

STD of TBill = 0

STD of Portfolio = .50 x .10 = .05 or 5%

C. E(r) (.125 x .16) - (.25 x .08) = 0

STD of TBill = 0

STD of Portfolio = .125 x .10 = 12.50%

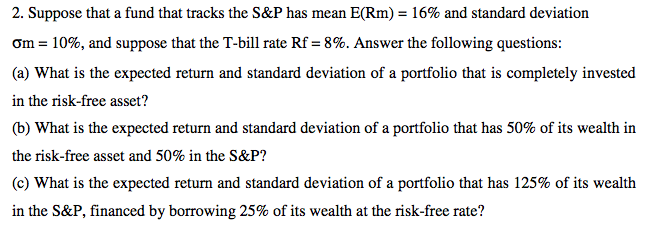

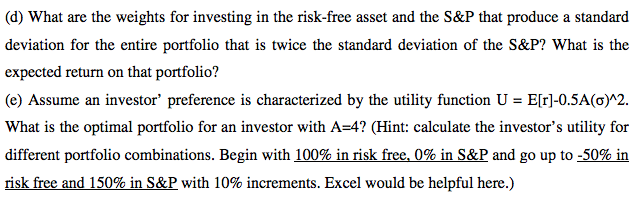

2. Suppose that a fund that tracks the S&P has mean E(Rm) 16% and standard deviation (a) What is the expected return and standard deviation of a portfolio that is completely invested in the risk-free asset? (b) What is the expected return and standard deviation of a portfolio that has 50% of its wealth in the risk-free asset and 50% in the S&P? (c) What is the expected return and standard deviation of a portfolio that has 125% of its wealth in the S&P, financed by borrowing 25% of its wealth at the risk-free rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started