Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work thank you! . c. 13.8 WestGas Conveyance, Inc. WestGas Conveyance, Inc., is a large U.S. natural gas pipeline company Cost of Problem

please show work thank you!

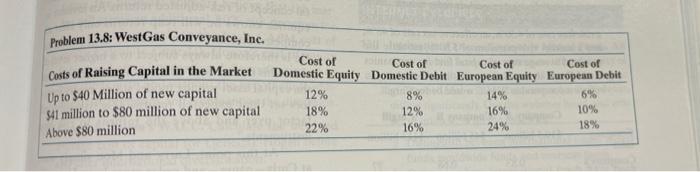

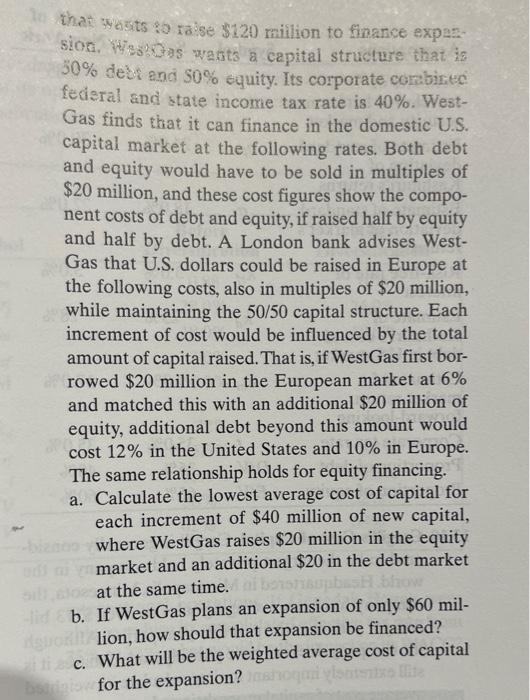

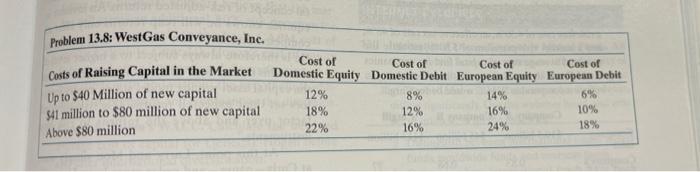

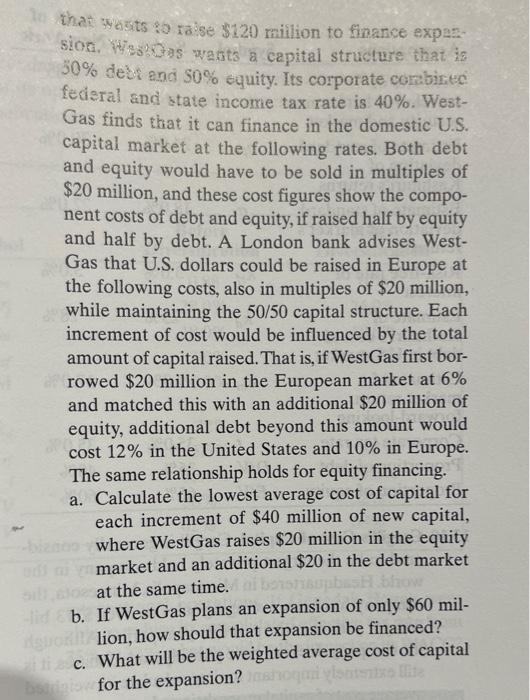

. c. 13.8 WestGas Conveyance, Inc. WestGas Conveyance, Inc., is a large U.S. natural gas pipeline company Cost of Problem 13.8: WestGas Conveyance, Inc. Cost of Cost of Costs of Raising Capital in the Market Cost of Domestic Equity Domestic Debit European Equity European Debit Up to $40 Million of new capital 12% 8% 14% 6% 541 million to $80 million of new capital 18% 12% 16% 10% Above $80 million 22% 16% 24% 18% that osts to raise $120 million to finance expan. sion. W38?0s wasts a capital structure that is 30% dels and 50% equity. Its corporate corbice federal and state income tax rate is 40%. West- Gas finds that it can finance in the domestic U.S. capital market at the following rates. Both debt and equity would have to be sold in multiples of $20 million, and these cost figures show the compo- nent costs of debt and equity, if raised half by equity and half by debt. A London bank advises West- Gas that U.S. dollars could be raised in Europe at the following costs, also in multiples of $20 million, while maintaining the 50/50 capital structure. Each increment of cost would be influenced by the total amount of capital raised. That is, if WestGas first bor- rowed $20 million in the European market at 6% and matched this with an additional $20 million of equity, additional debt beyond this amount would cost 12% in the United States and 10% in Europe. The same relationship holds for equity financing. a. Calculate the lowest average cost of capital for each increment of $40 million of new capital, where WestGas raises $20 million in the equity market and an additional $20 in the debt market at the same time. b. If WestGas plans an expansion of only $60 mil- Olion, how should that expansion be financed? c. What will be the weighted average cost of capital bis for the expansion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started