Answered step by step

Verified Expert Solution

Question

1 Approved Answer

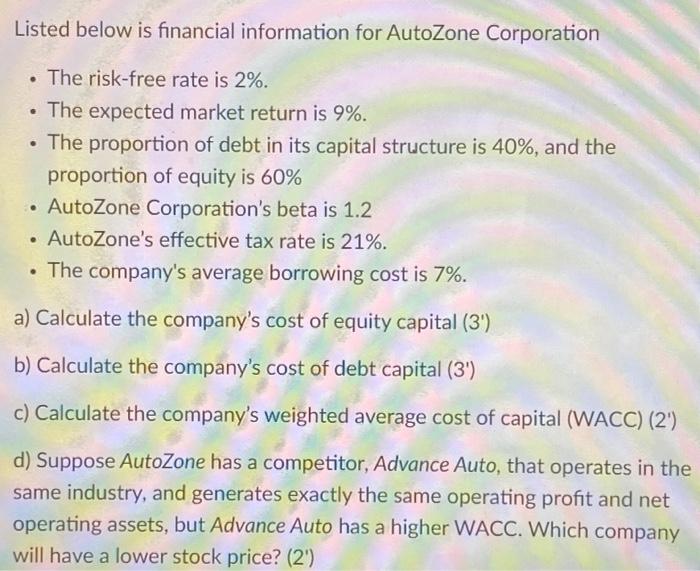

please show work! thank you! Listed below is financial information for AutoZone Corporation . The risk-free rate is 2%. The expected market return is 9%.

please show work! thank you!

Listed below is financial information for AutoZone Corporation . The risk-free rate is 2%. The expected market return is 9%. The proportion of debt in its capital structure is 40%, and the proportion of equity is 60% AutoZone Corporation's beta is 1.2 AutoZone's effective tax rate is 21%. The company's average borrowing cost is 7%. a) Calculate the company's cost of equity capital (3) b) Calculate the company's cost of debt capital (3') c) Calculate the company's weighted average cost of capital (WACC) (2) d) Suppose AutoZone has a competitor, Advance Auto, that operates in the same industry, and generates exactly the same operating profit and net operating assets, but Advance Auto has a higher WACC. Which company will have a lower stock price? (2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started