Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work! thank you! PROBLEM 2 30 points On December 31, 20X1, Parent Company purchased 80% of the common stock of Subsidiary Company for

please show work! thank you!

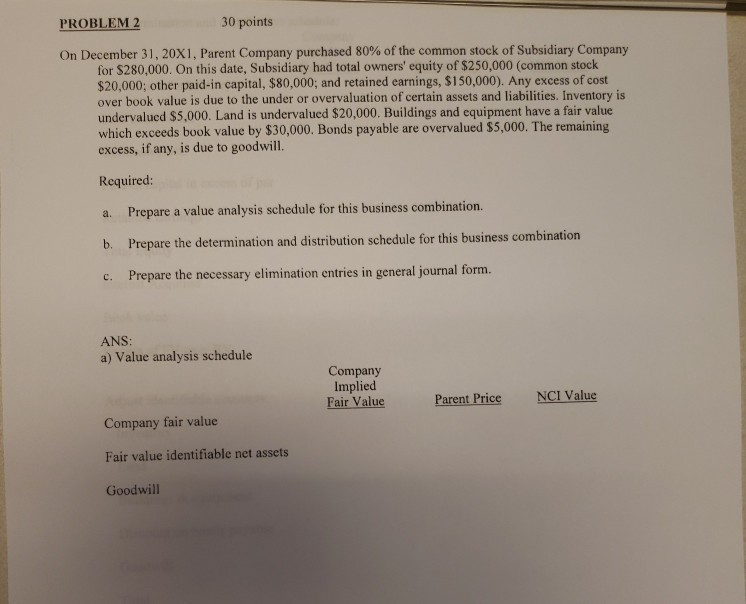

PROBLEM 2 30 points On December 31, 20X1, Parent Company purchased 80% of the common stock of Subsidiary Company for $280,000. On this date, Subsidiary had total owners' equity of $250,000 (common stock $20,000; other paid-in capital, $80,000; and retained earnings, $150,000). Any excess of cost over book value is due to the under or overvaluation of certain assets and liabilities. Inventory is undervalued $5,000. Land is undervalued $20,000. Buildings and equipment have a fair value which exceeds book value by $30,000. Bonds payable are overvalued $5,000. The remaining excess, if any, is due to goodwill. Required: a. Prepare a value analysis schedule for this business combination. b. Prepare the determination and distribution schedule for this business combination c. Prepare the necessary elimination entries in general journal form. ANS: a) Value analysis schedule Company Implied Fair Value Parent Price NCI Value Company fair value Fair value identifiable net assets Goodwill b) Determination and distribution schedule: Company Implied Fair Value Fair value of subsidiary Parent Price NCI Value Less book value: Common stock Paid-in capital in excess of par Retained earnings Total Equity Interest Acquired Book value Excess of FV over BV Adjust identifiable accounts: Inventory Land Buildings & equipment Discount on bonds payable Goodwill Total c) Elimination entries: PROBLEM 2 30 points On December 31, 20X1, Parent Company purchased 80% of the common stock of Subsidiary Company for $280,000. On this date, Subsidiary had total owners' equity of $250,000 (common stock $20,000; other paid-in capital, $80,000; and retained earnings, $150,000). Any excess of cost over book value is due to the under or overvaluation of certain assets and liabilities. Inventory is undervalued $5,000. Land is undervalued $20,000. Buildings and equipment have a fair value which exceeds book value by $30,000. Bonds payable are overvalued $5,000. The remaining excess, if any, is due to goodwill. Required: a. Prepare a value analysis schedule for this business combination. b. Prepare the determination and distribution schedule for this business combination c. Prepare the necessary elimination entries in general journal form. ANS: a) Value analysis schedule Company Implied Fair Value Parent Price NCI Value Company fair value Fair value identifiable net assets Goodwill b) Determination and distribution schedule: Company Implied Fair Value Fair value of subsidiary Parent Price NCI Value Less book value: Common stock Paid-in capital in excess of par Retained earnings Total Equity Interest Acquired Book value Excess of FV over BV Adjust identifiable accounts: Inventory Land Buildings & equipment Discount on bonds payable Goodwill Total c) Elimination entriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started