Answered step by step

Verified Expert Solution

Question

1 Approved Answer

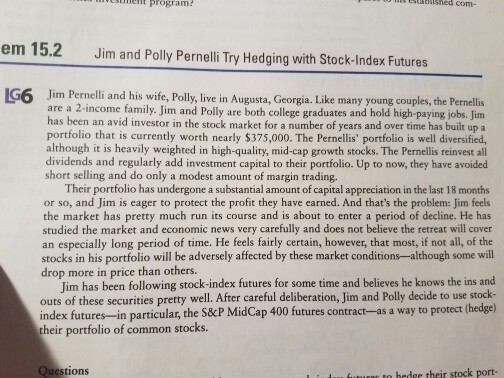

please show work, thank you! program? 3hed com- em 15.2 Jim and Polly Pernelli Try Hedging with Stock-Index Futures IG6 Jim Pernelli and his wife,

please show work, thank you!

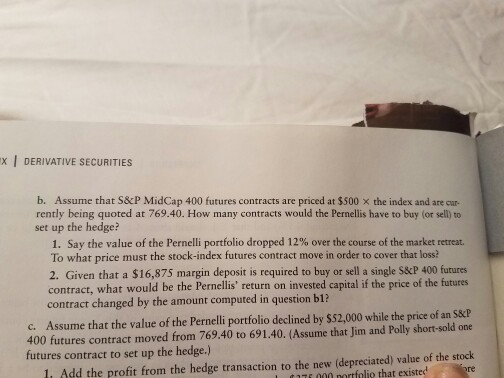

program? 3hed com- em 15.2 Jim and Polly Pernelli Try Hedging with Stock-Index Futures IG6 Jim Pernelli and his wife, Polly, live in Augusta, Georgia. Like many young couples, the Pernellis are a 2-income family. Jim and Polly are both college graduates and hold high-paying jobs. Jim has been an avid investor in the stock market for a number of years and over time has built up a portfolio that is currently worth nearly $375,000. The Pernellis' portfolio is well diversified, although it is heavily weighted in high-quality, mid-cap growth stocks. The Pernellis reinvest all dividends and regularly add investment capital to their portfolio. Up to now, they have avoided short selling and do only a modest amount of margin trading. Their portfolio has undergone a substantial amount of capital appreciation in the last 18 months or so, and Jim is eager to protect the profit they have earned. And that's the problem: Jim feels the market has pretty much run its course and is about to enter a period of decline. He has studied the market and economic news very carefully and does not believe the retreat will cover an especially long period of time. He feels fairly certain, however, that most, if not all, of the stocks in his portfolio will be adversely affected by these market conditions-although some will drop more in price than others. Jim has been following stock-index futures for some time and believes he knows the ins and outs of these securities pretty well After careful deliberation, Jim and Polly decide to use stock- index futures in particular, the S MidCap400 futures contract as a way to protect (hedge) their portfolio of common stocks. Questions hrdgr their stock portStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started