Answered step by step

Verified Expert Solution

Question

1 Approved Answer

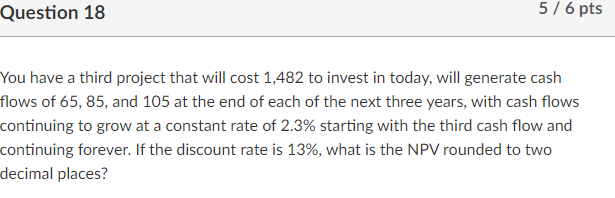

Please show work. Thank you. Question 18 5/6 pts You have a third project that will cost 1,482 to invest in today, will generate cash

Please show work. Thank you.

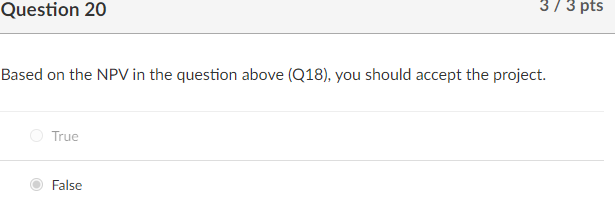

Question 18 5/6 pts You have a third project that will cost 1,482 to invest in today, will generate cash flows of 65, 85, and 105 at the end of each of the next three years, with cash flows continuing to grow at a constant rate of 2.3% starting with the third cash flow and continuing forever. If the discount rate is 13%, what is the NPV rounded to two decimal places? Question 20 3/3 pts Based on the NPV in the question above (18), you should accept the project. True FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started