Answered step by step

Verified Expert Solution

Question

1 Approved Answer

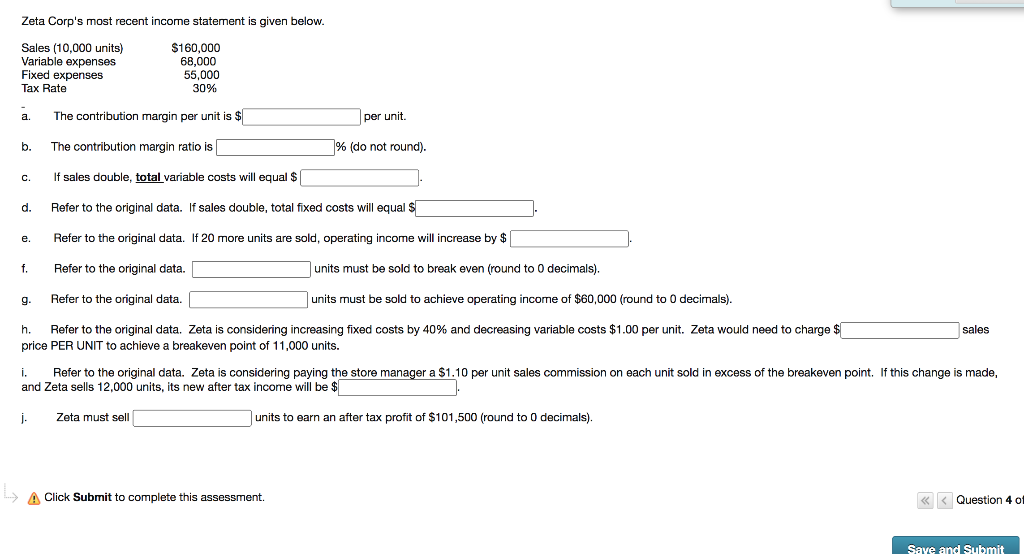

Please show work. thank you! Zeta Corp's most recent income statement is given below. Sales (10,000 units) Variable expenses Fixed expenses Tax Rate $160,000 68,000

Please show work. thank you!

Zeta Corp's most recent income statement is given below. Sales (10,000 units) Variable expenses Fixed expenses Tax Rate $160,000 68,000 55,000 30% The contribution margin per unit is $ per unit. b The contribution margin ratio is % (do not round). C. If sales double, total variable costs will equal $ d. Refer to the original data. If sales double, total fixed costs will equal $ e. Refer to the original data. If 20 more units are sold, operating income will increase by $ Refer to the original data. units must be sold to break even (round to 0 decimals). g. Refer to the original data. units must be sold to achieve operating income of $60,000 (round to 0 decimals). sales h. Refer to the original data. Zeta is considering increasing fixed costs by 40% and decreasing variable costs $1.00 per unit. Zeta would need to charge $ price PER UNIT to achieve a breakeven point of 11,000 units. i. Refer to the original data. Zeta is considering paying the store manager a $1.10 per unit sales commission on each unit sold in excess of the breakeven point. If this change is made, and Zeta sells 12,000 units, its new after tax income will be $ 1. Zeta must sell units to earn an after tax profit of $101,500 (round to 0 decimals). --> Click Submit complete this assessment. Question 4 of Save and SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started