Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work, Thanks! Your first assignment in your new position as assistant financial analyst at Caledonia Products is to evaluate two new capital-budgeting proposals.

Please show work, Thanks!

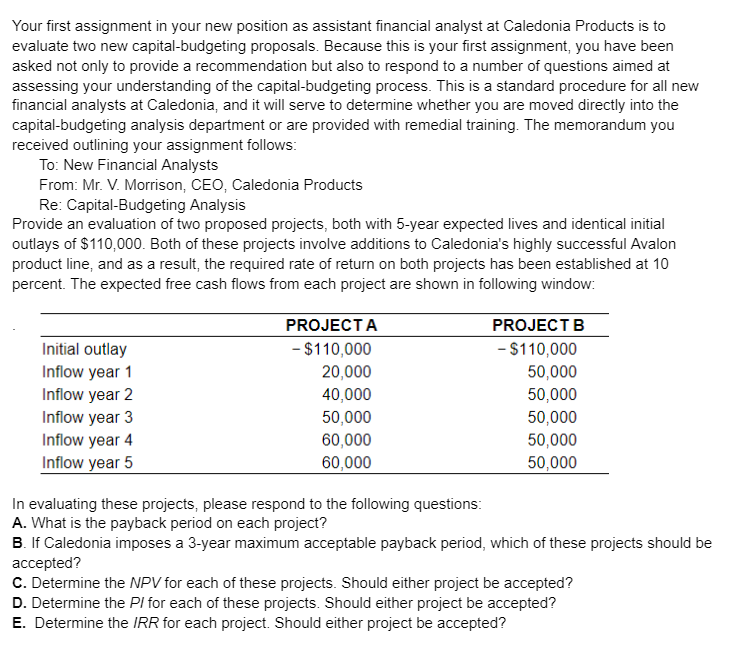

Your first assignment in your new position as assistant financial analyst at Caledonia Products is to evaluate two new capital-budgeting proposals. Because this is your first assignment, you have been asked not only to provide a recommendation but also to respond to a number of questions aimed at assessing your understanding of the capital-budgeting process. This is a standard procedure for all new financial analysts at Caledonia, and it will serve to determine whether you are moved directly into the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis Provide an evaluation of two proposed projects, both with 5-year expected lives and identical initial outlays of $110,000. Both of these projects involve additions to Caledonia's highly successful Avalon product line, and as a result, the required rate of return on both projects has been established at 10 percent. The expected free cash flows from each project are shown in following window: In evaluating these projects, please respond to the following questions: A. What is the payback period on each project? B. If Caledonia imposes a 3-year maximum acceptable payback period, which of these projects should be accepted? C. Determine the NPV for each of these projects. Should either project be accepted? D. Determine the PI for each of these projects. Should either project be accepted? E. Determine the IRR for each project. Should either project be acceptedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started