Answered step by step

Verified Expert Solution

Question

1 Approved Answer

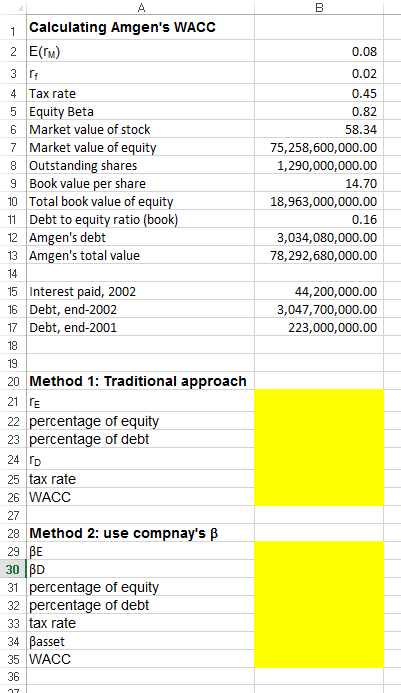

Please show work to answer the highlighted areas. Thank you! Calculating Amgen's WACC E (r_M) 0.08 r_f 0.02 Tax rate 0.45 Equity Beta 0.82 Market

Please show work to answer the highlighted areas.

Thank you!

Calculating Amgen's WACC E (r_M) 0.08 r_f 0.02 Tax rate 0.45 Equity Beta 0.82 Market value of stock 58.34 Market value of equity 75,258,600,000.00 Outstanding shares 1,290,000,000.00 Book value per share 14.70 Total book value of equity 18,963,000,000.00 Debt to equity ratio (book) 0.16 Amgen's debt 3,034,080,000.00 Amgen's total value 78,292,680,000.00 Interest paid, 2002 44,200,000.00 Debt, end - 2002 3,047,700,000.00 Debt, end - 2001 223,000,000.00 Method 1: Traditional approach r_E percentage of equity percentage of debt r_D tax rate WACC Method 2: use compnay's beta betaE betaD percentage of equity percentage of debt tax rate beta asset WACC Calculating Amgen's WACC E (r_M) 0.08 r_f 0.02 Tax rate 0.45 Equity Beta 0.82 Market value of stock 58.34 Market value of equity 75,258,600,000.00 Outstanding shares 1,290,000,000.00 Book value per share 14.70 Total book value of equity 18,963,000,000.00 Debt to equity ratio (book) 0.16 Amgen's debt 3,034,080,000.00 Amgen's total value 78,292,680,000.00 Interest paid, 2002 44,200,000.00 Debt, end - 2002 3,047,700,000.00 Debt, end - 2001 223,000,000.00 Method 1: Traditional approach r_E percentage of equity percentage of debt r_D tax rate WACC Method 2: use compnay's beta betaE betaD percentage of equity percentage of debt tax rate beta asset WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started