Answered step by step

Verified Expert Solution

Question

1 Approved Answer

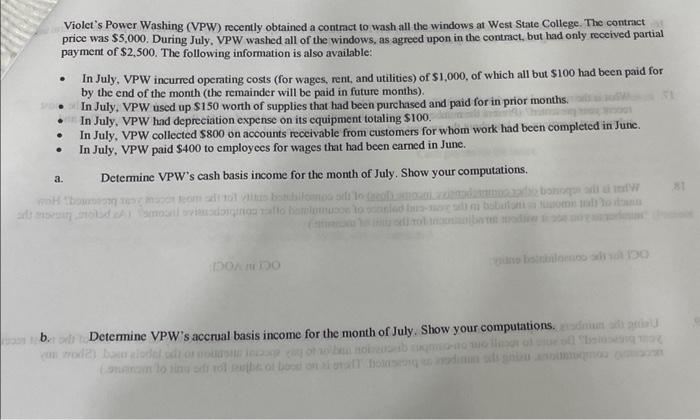

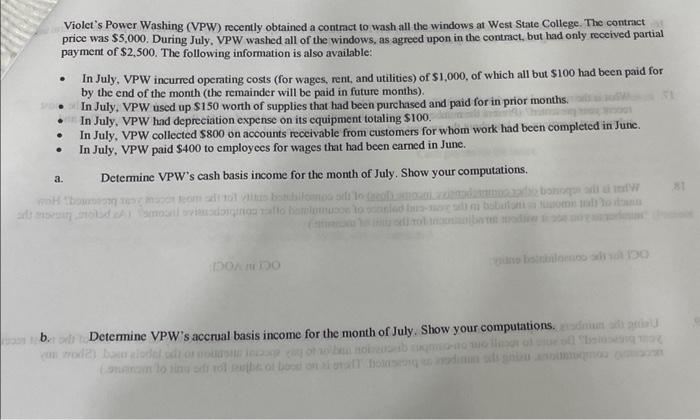

please show work Violet's Power Washing (VPW) recently obtained a contract to wash all the windows at West State College. The contract price was $5,000.

please show work

Violet's Power Washing (VPW) recently obtained a contract to wash all the windows at West State College. The contract price was \$5,000. During July. VPW washed all of the windows, as agreed upon in the contract, but had only received partial payment of $2,500. The following information is also available: - In July, VPW incurred operating costs (for wages, rent, and utilities) of $1,000, of which all but $100 had been paid for by the end of the month (the remainder will be paid in future months). - In July, VPW used up \$150 worth of supplies that had been purchased and paid for in prior months. - In July, VPW had depreciation expense on its equipment totaling \$100. - In July, VPW collected $800 on accounts receivable from customers for whom work had been completed in June. - In July, VPW paid $400 to employees for wages that had been carned in June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started