Please show work/equations.

Please show work/equations.

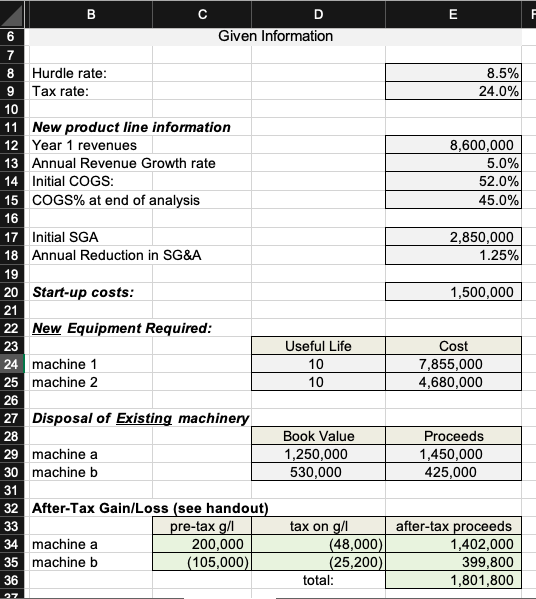

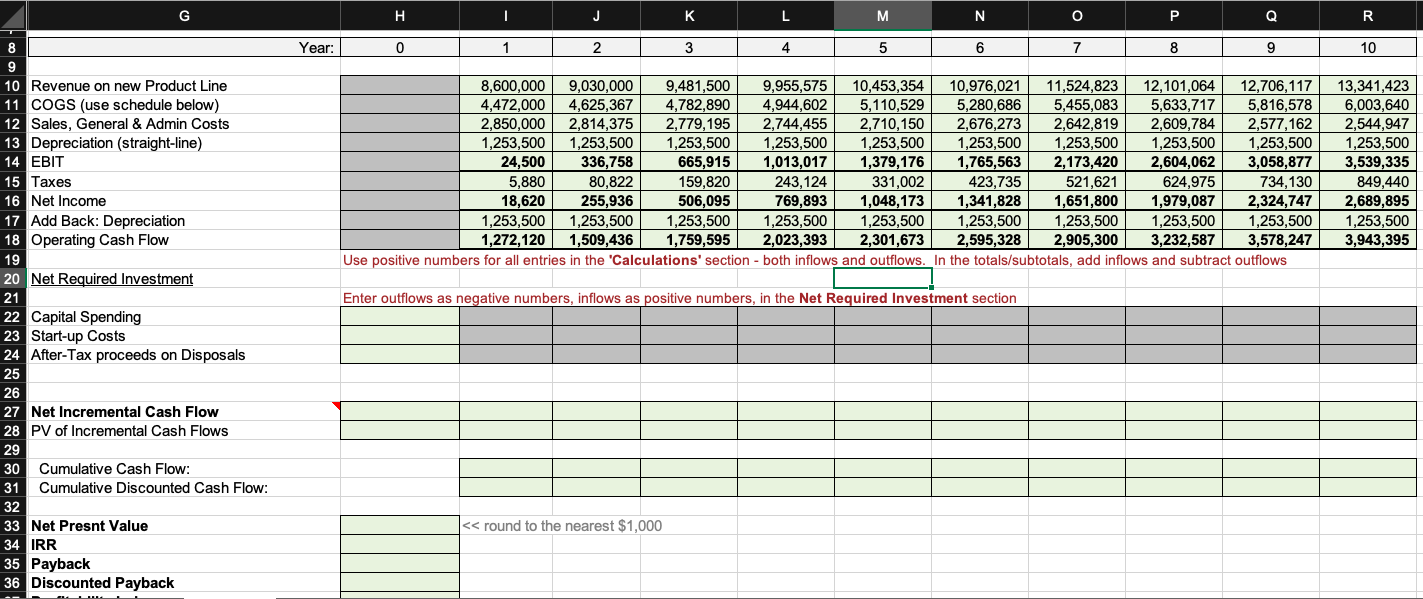

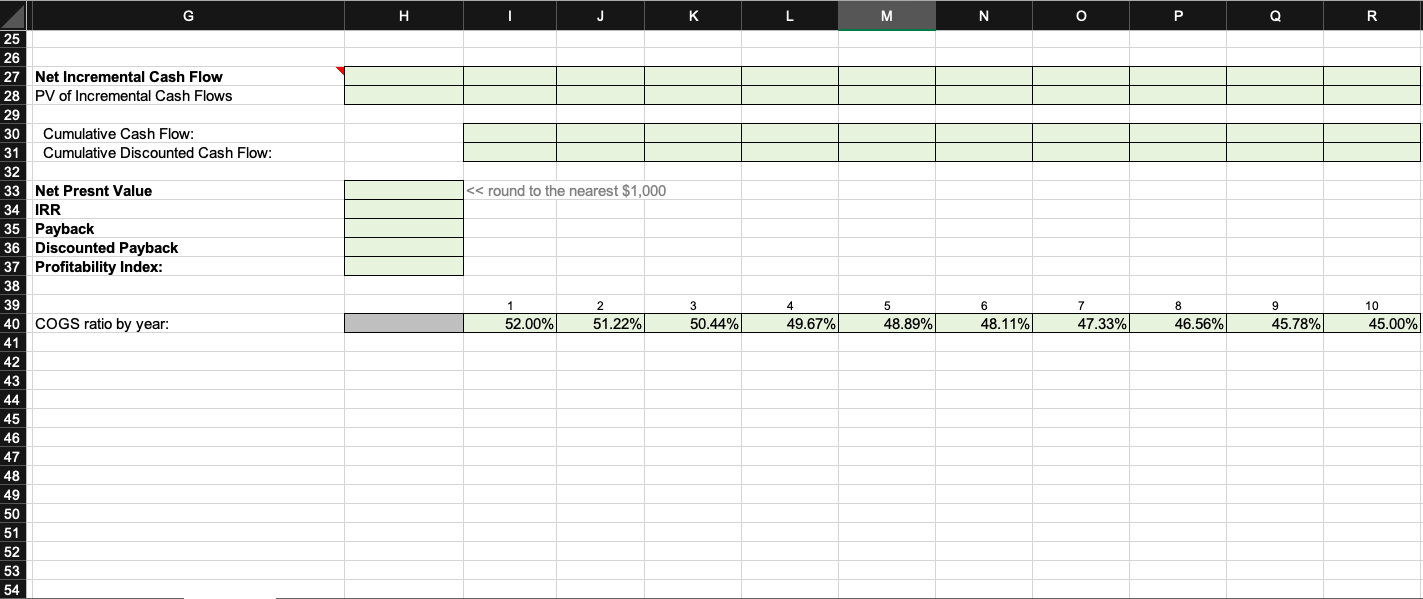

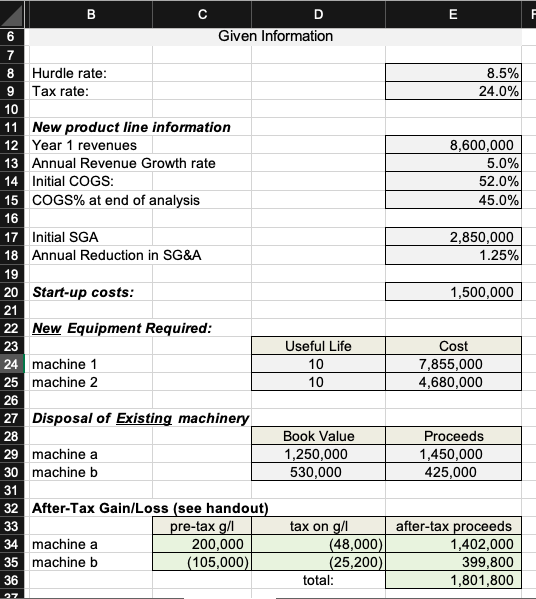

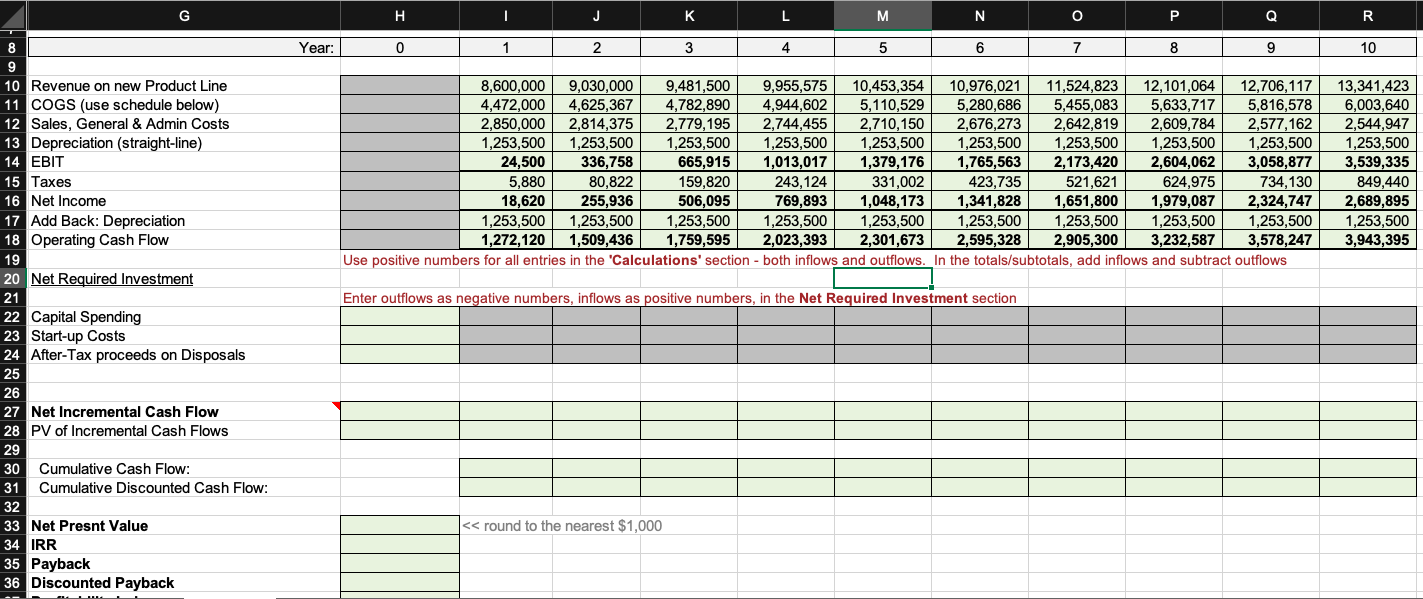

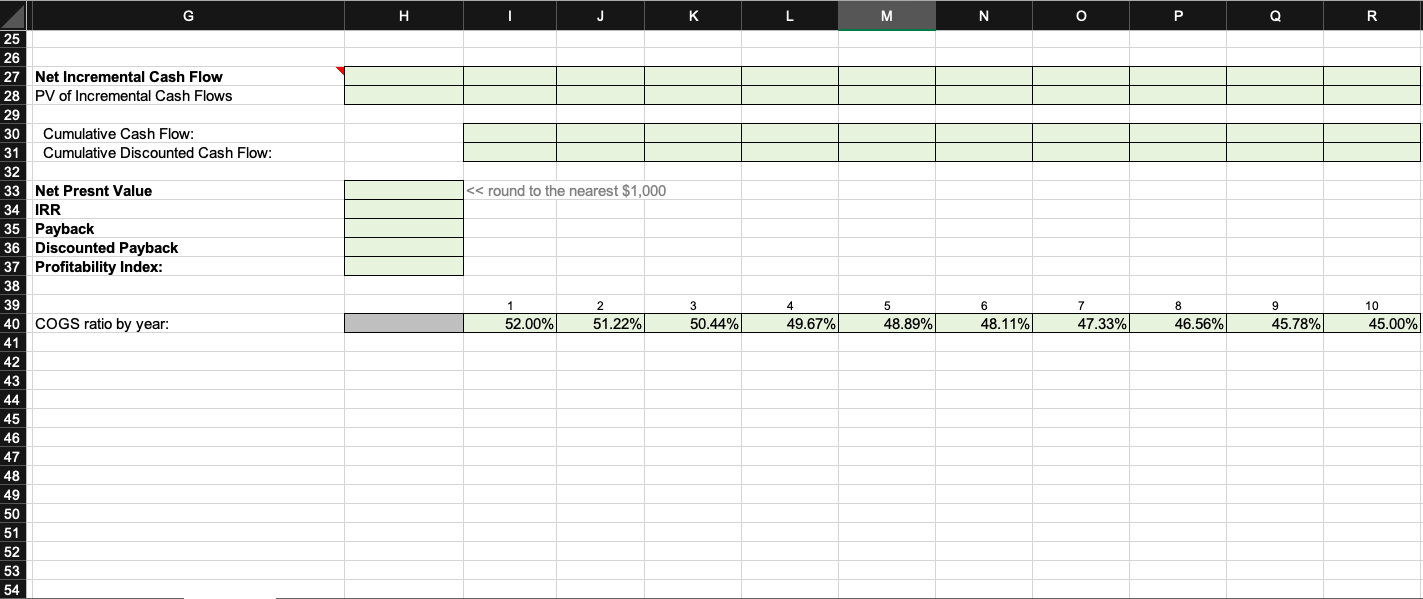

Bi D Given Information 6. 8 Hurdle rate: 9 Tax rate: 8.5% 24.0% 10 11 New product line information 12 Year 1 revenues 13 Annual Revenue Growth rate 14 Initial COGS: 15 COGS% at end of analysis 8,600,000 5.0% 52.0% 45.0% 16 17 Initial SGA 18 Annual Reduction in SG&A 2,850,000 1.25% 19 20 Start-up costs: 1,500,000 21 22 New Equipment Required: 23 Useful Life Cost 24 machine 1 25 machine 2 7,855,000 4,680,000 10 10 26 27 Disposal of Existing machinery 28 Book Value Proceeds 29 machine a 30 machine b 1,250,000 530,000 1,450,000 425,000 31 32 After-Tax Gain/Loss (see handout) pre-tax g/l 200,000 (105,000)| after-tax proceeds 1,402,000 399,800 1,801,800 tax on g/l (48,000) (25,200) total: 33 34 machine a 35 machine b 36 K Year: 3 4 6 8 10 10 Revenue on new Product Line 11 COGS (use schedule below) 12 Sales, General & Admin Costs 13 Depreciation (straight-line) 14 EBIT 15 Taxes 16 Net Income 8,600,000 4,472,000 2,850,000 9.955.575 9.481.500 9.030.000 10,453,354 5,110,529 10,976,021 11,524,823 5,455,083 2,642,819 1,253,500 2,173,420 12,101,064 5,633,717 2,609,784 1,253,500 12,706,117 5,816,578 2,577,162 1,253,500 13,341,423 6,003,640 4,625,367 4,782,890 2,779,195 1,253,500 665,915 4,944,602 2,744,455 1,253,500 1,013,017 5,280,686 2,676,273 1,253,500 1,765,563 2,710,150 1,253,500 1,379,176 331,002 1,048,173 2.814.375 2.544.947 1,253,500 24,500 1,253,500 336,758 1,253,500 2,604,062 3,058,877 734,130 2,324,747 3,539,335 5,880 80,822 159,820 243,124 423,735 521,621 624,975 849,440 2,689,895 1,253,500 3,943,395 255,936 1,253,500 506,095 18,620 769,893 1,341,828 1,253,500 2,595,328 1,651,800 1,979,087 17 Add Back: Depreciation 18 Operating Cash Flow 1,253,500 1,272,120 1,253,500 2,023,393 Use positive numbers for all entries in the 'Calculations' section - both inflows and outflows. In the totals/subtotals, add inflows and subtract outflows 1,253,500 1,253,500 1,253,500 1,253,500 3,232,587 1,253,500 3,578,247 1,509,436 1,759,595 2,301,673 2,905,300 19 20 Net Required Investment 21 Enter outflows as negative numbers, inflows as positive numbers, in the Net Required Investment section 22 Capital Spending 23 Start-up Costs 24 After-Tax proceeds on Disposals 25 26 27 Net Incremental Cash Flow 28 PV of Incremental Cash Flows 29 Cumulative Cash Flow: 30 Cumulative Discounted Cash Flow: 31 32 33 Net Presnt Value 34 IRR 35 Payback 36 Discounted Payback

Please show work/equations.

Please show work/equations.