Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show working answer ( A) John Phelps has run a small business for many years and has never kept adequate accounting records. However, a

please show working

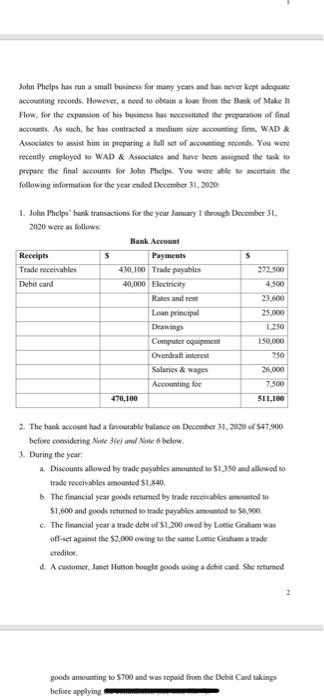

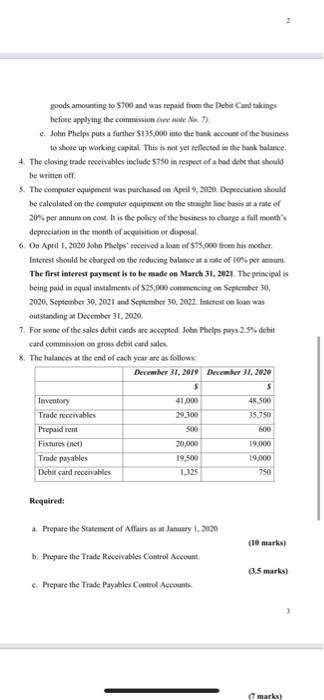

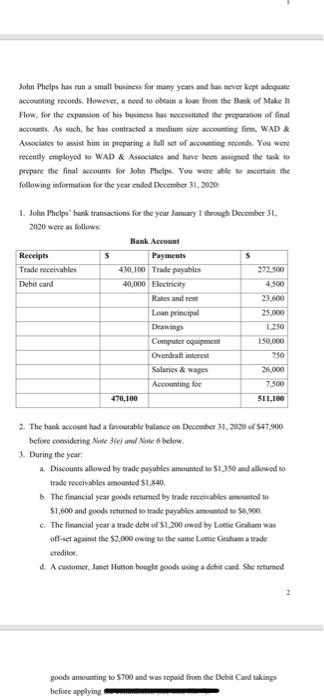

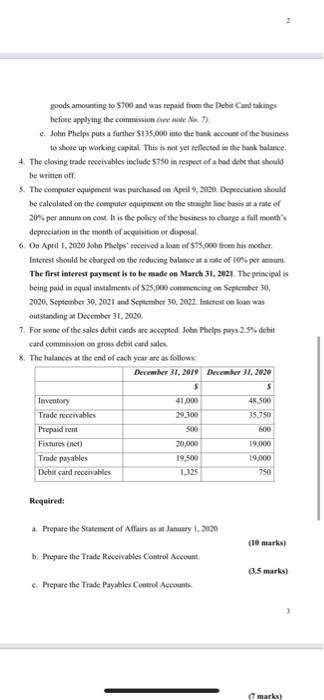

John Phelps has run a small business for many years and has never kept adequate accounting records. However, a need to obtain a loan from the Bank of Maket Flow, for the expansion of his business has necesitated the peoparation of final accounts. As such, he has contracted a medium size accounting firm, WAD & Associates to assist him in preparing a full set of accounting toode. You were recently employed to WAD & Associates and huve been assigned the task to prepare the final accounts for Sohn Phelps. You were able ascertain the following information for the year endod December 31, 2000 1. John l'helpe" bank transactions for the year January I thorough December 31, 2020 were as follows Bank Account Receipts Payments Trade receivables 430,100 Trade payables 272.500 Debit card 40,000 Electricity Rates and on 23.600 Lean principal 25.000 Drawings Computer equipment 750 Salones & Accounting for 7.500 470,100 $11.100 5 5 4.500 1.250 150.000 Ohendraft interest 2. The bank account had a favorable balance on December 31, 2020 of 547.900 before considering Note 3te) und Note 6 below. 3. During the year 1. Discounts allowed by trade payables amounted to $1390 and allowed to trade receivables amounted $1.840 The financial year goods returned by trade rechables amounts to $1,600 and goods returned to trade payable amounted so 56.900. 4. The financial year a trade debt of $1.200 owed by Lottie Graham was off-set against the $2,000 wing to the same Lottie Golam a trade creditor 4. A customet. Janet Hutton bought goods using a chi cand she retumed goods amounting to $700 and was repaid from the Debit Cand takings before applying goods amounting to $700 and was repaid from the Debt Cand takings before applying the commission is not N. 7) c. John Phelps puts a further $135.000 into the bank account of the business to share up working capital. This is not yet reflected in the bank balance. 4. The closing trade receivables include 5750 in respect of a had debe that should be written or 5. The computer equipment was purchased on April 9, 2000 Depreciation sold be calculated on the computer equipment on the straight line beses at a rate of 20% per annum on cost, is the policy of the business to change a full month's depreciation in the month of acquisition or disposal 6. On April 1, 2020 John Phelps received a loan ofS75.000 from his mother Interest should be charged on the reducing balance at an oft per annum. The first interest payment is to be made on March 31, 2021. The principal is being paid in equal instalmente of $25,000 commencing on September 30, 2020, September 30, 2021 and September 30, 2022. Interest een was outstanding December 31, 2020 7. For some of the sales debit cards are accepted Jobe Phelps pays 2.5% debit card commission on gross debit card sales. 8. The balances at the end of each year e as follow December 31, 2019 December 31, 2020 5 48.500 5 41.000 29,00 500 35,750 100 Inventory Trade receivables Prepaid rent Fixtures (net) Trade payables Debit card receivables 20.000 19.500 19.000 19.000 750 1.125 Required: (10 marks) 2. Prepare the Statement of Affairs as a way I.2020 b. Prepare the Trade Receivables Control Account c. Prepare the Trade Payables Control Accounts 3.5 marks) marks) 03 marks Prepare the Trade Payables Control Accounts. mark 4. Prepare the Debit Card Receivables Account 25 marks) c. Prepare the income Statement for the year ended December 31, 2020 (25 marks) 1. Prepare the Statement of changes in owner's equity for the year endel December 31, 2020 marks) Prepare comparatively the Statement of Financial Position at the year ended December 31, 2020 25 marks) h. Prepare a Statement of Cashflow for the ended December 31, 2020. (20 marks) answer ( A)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started