Answered step by step

Verified Expert Solution

Question

1 Approved Answer

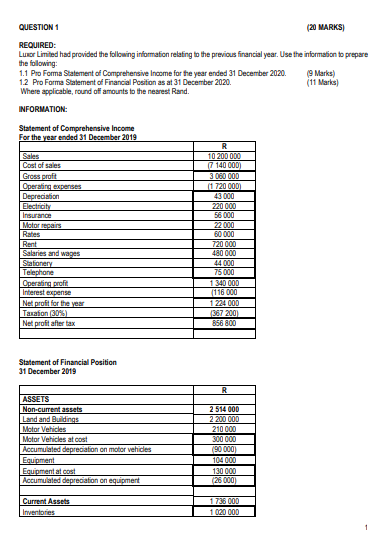

Please show working out QUESTION 1 (20 MARKS) REQUIRED: Lumer Limited had provided the following information relating to the previous financial year. Use the information

Please show working out

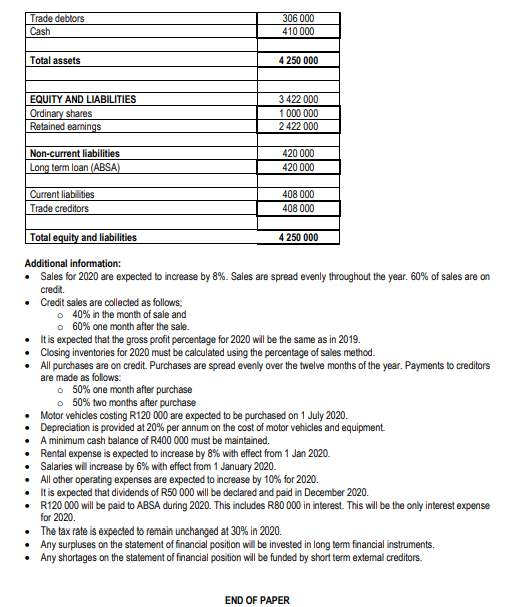

QUESTION 1 (20 MARKS) REQUIRED: Lumer Limited had provided the following information relating to the previous financial year. Use the information to prepare the following: 1.1 Pro Forma Statement of Comprehensive Income for the year ended 31 December 2020. 9 Marks) 1.2 Pro Forma Statement of Financial Position as at 31 December 2020 (11 Marks Where applicable, round off amounts to the nearest Rand. INFORMATION: Statement of Comprehensive Income For the year ended 31 December 2019 Sales Cost of sales Gross profit Operating expenses Depreciation Electricity Insurance Motor repairs Rates Rent Salaries and wagas Stationery Telephone Operating profil Interest expense Net profit for the Taxation 30% Net profit after tax R 10 200 000 (140 000) 3 060 000 (1 720 000 43 000 220 000 56 000 22 000 60 000 720000 480 000 44000 75 000 1 340 000 1116 000 1 224 000 367 200 856 800 Statement of Financial Position 31 December 2019 ASSETS Non-current assets Land and Buildings Motor Vehicles Motor Vehicles at cost Accumulated depreciation on motor vehides Equipment Equipmentales Accumulated depreciation on equipment 2 514 000 2 200 000 210 000 300 000 (90000) 104.000 130 000 (26 000) Current Assets Inventories 1 736 000 1 020 000 1 Trade debtors Cash 306 000 410 000 Total assets 4 250 000 EQUITY AND LIABILITIES Ordinary shares Retained earnings 3422 000 1 000 000 2 422 000 Non-current liabilities Long term loan (ABSA) 420 000 420 000 Current liabilities Trade creditors 408 000 408 000 credit. Total equity and liabilities 4 250 000 Additional information: Sales for 2020 are expected to increase by 8%. Sales are spread evenly throughout the year. 60% of sales are on Credit sales are collected as follows; o 40% in the month of sale and o 60% one month after the sale. It is expected that the gross profit percentage for 2020 will be the same as in 2019. Closing inventories for 2020 must be calculated using the percentage of sales method. All purchases are on credit Purchases are spread evenly over the twelve months of the year. Payments to creditors are made as follows: 50% one month after purchase 50% two months after purchase Motor vehicles costing R120 000 are expected to be purchased on 1 July 2020. Depreciation is provided at 20% per annum on the cost of motor vehicles and equipment A minimum cash balance of R400 000 must be maintained. Rental expense is expected to increase by 8% with effect from 1 Jan 2020. Salaries will increase by 6% with effect from 1 January 2020. All other operating expenses are expected to increase by 10% for 2020. . It is expected that dividends of R50 000 will be declared and paid in December 2020. R120 000 will be paid to ABSA during 2020. This includes R80 000 in interest. This will be the only interest expense for 2020. The tax rate is expected to remain unchanged at 30% in 2020. Any surpluses on the statement of financial position will be invested in long term financial instruments. Any shortages on the statement of financial position will be funded by short term external creditors. . END OF PAPERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started