Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show working Question 2 a) 50 futures contracts are used to hedge an exposure to the price of silver. Each futures contract is on

please show working

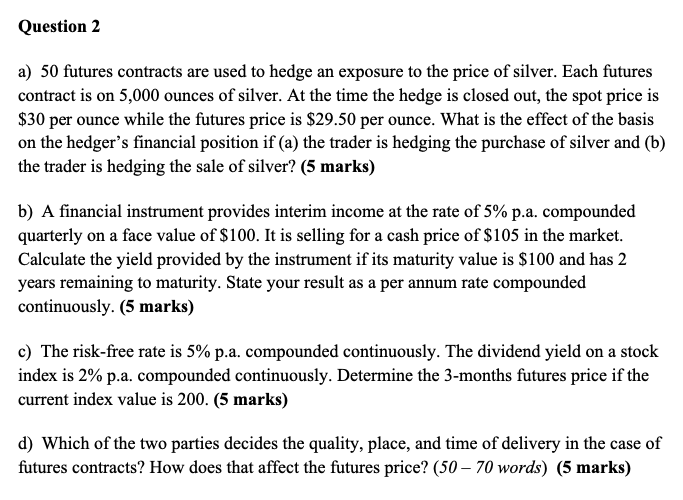

Question 2 a) 50 futures contracts are used to hedge an exposure to the price of silver. Each futures contract is on 5,000 ounces of silver. At the time the hedge is closed out, the spot price is $30 per ounce while the futures price is $29.50 per ounce. What is the effect of the basis on the hedgers financial position if (a) the trader is hedging the purchase of silver and (b) the trader is hedging the sale of silver? (5 marks) b) A financial instrument provides interim income at the rate of 5% p.a. compounded quarterly on a face value of $100. It is selling for a cash price of $105 in the market. Calculate the yield provided by the instrument if its maturity value is $100 and has 2 years remaining to maturity. State your result as a per annum rate compounded continuously. (5 marks) c) The risk-free rate is 5% p.a. compounded continuously. The dividend yield on a stock index is 2% p.a. compounded continuously. Determine the 3-months futures price if the current index value is 200. (5 marks) d) Which of the two parties decides the quality, place, and time of delivery in the case of futures contracts? How does that affect the futures price? (50 70 words) (5 marks) Question 2 a) 50 futures contracts are used to hedge an exposure to the price of silver. Each futures contract is on 5,000 ounces of silver. At the time the hedge is closed out, the spot price is $30 per ounce while the futures price is $29.50 per ounce. What is the effect of the basis on the hedgers financial position if (a) the trader is hedging the purchase of silver and (b) the trader is hedging the sale of silver? (5 marks) b) A financial instrument provides interim income at the rate of 5% p.a. compounded quarterly on a face value of $100. It is selling for a cash price of $105 in the market. Calculate the yield provided by the instrument if its maturity value is $100 and has 2 years remaining to maturity. State your result as a per annum rate compounded continuously. (5 marks) c) The risk-free rate is 5% p.a. compounded continuously. The dividend yield on a stock index is 2% p.a. compounded continuously. Determine the 3-months futures price if the current index value is 200. (5 marks) d) Which of the two parties decides the quality, place, and time of delivery in the case of futures contracts? How does that affect the futures price? (50 70 words)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started