Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show workings on paper with appropriate mcqs number 1. The difference occurs in FV at the end of year 1 due to the compounding

please show workings on paper with appropriate mcqs number

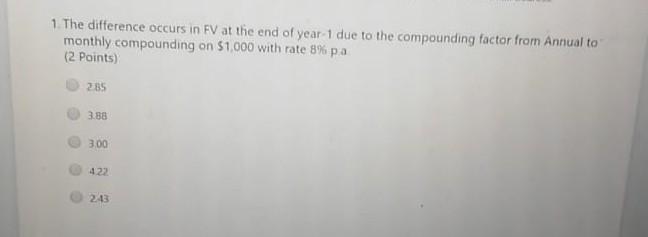

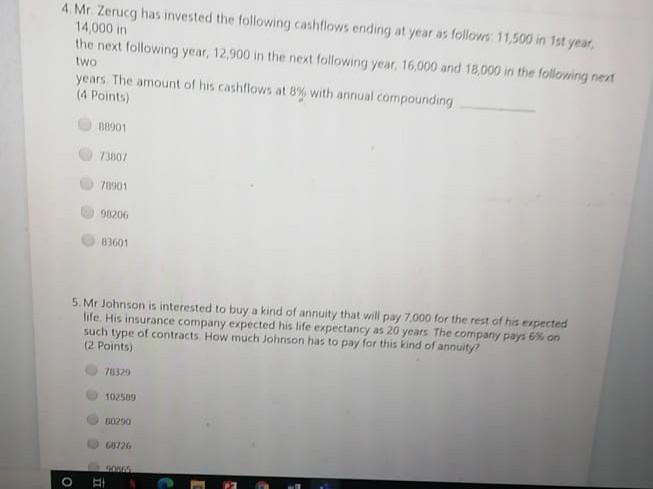

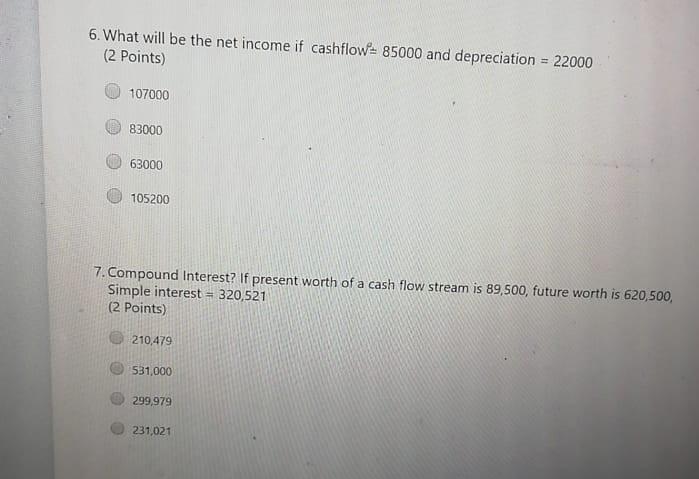

1. The difference occurs in FV at the end of year 1 due to the compounding factor from Annual to monthly compounding on $1,000 with rate 8% pa (2 Points) 2.85 3.88 3.00 243 4 Mr Zerug has invested the following cashflows ending at year as follows: 11.500 in 1st year 14,000 in the next following year, 12,900 in the next following year 16,000 and 18,000 in the following next years. The amount of his cashflows at 8% with annual compounding (4 Points) two 1.8901 73807 70901 90206 33601 5. Mr Johnson is interested to buy a kind of annuity that will pay 7.000 for the rest of his expected life. His insurance company expected his life expectancy as 20 years. The company pays 6% on such type of contracts How much Johnson has to pay for this kind of annuity? (2 points) 70320 102509 10250 O i E 6. What will be the net income if cashflow= 85000 and depreciation = 22000 (2 points) 107000 83000 63000 105200 7. Compound Interest? If present worth of a cash flow stream is 89,500, future worth is 620,500, Simple interest = 320,521 (2 points) 210,479 531,000 299,979 231,021 23. A plan has stated Mr Zyne 8% Interest with semi-annual compounding for single year investment What is actual rate on this stated rate 12 Points) 3247 1569 7.241 8.16 24. What would be the expected value of hundred dollars in 3 years if the interest rate is 8% compounded monthly? (2 points) 12252 1272 12450 11255Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started