Answered step by step

Verified Expert Solution

Question

1 Approved Answer

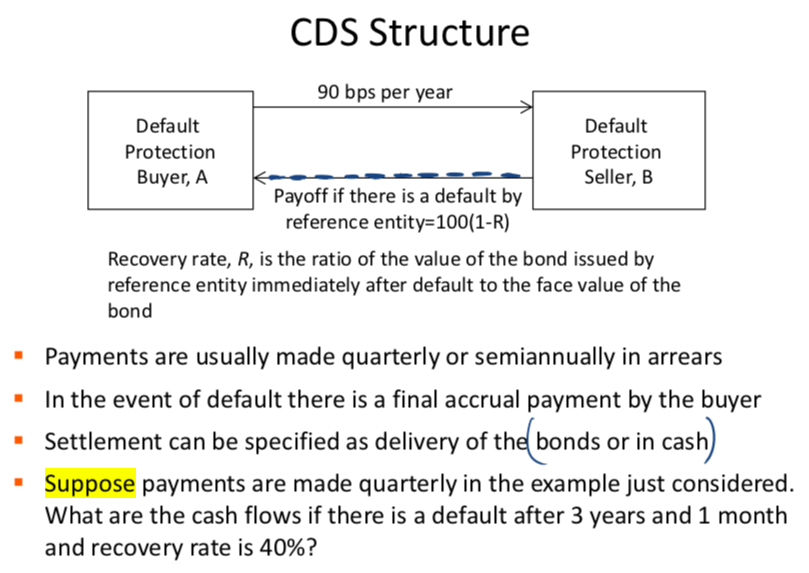

Please show workings thank you :) CDS Structure 90 bps per year Default Default Protection Protection Buyer, A Seller, B Payoff if there is a

Please show workings thank you :)

CDS Structure 90 bps per year Default Default Protection Protection Buyer, A Seller, B Payoff if there is a default by reference entity=100(1-R) Recovery rate, R, is the ratio of the value of the bond issued by reference entity immediately after default to the face value of the bond Payments are usually made quarterly or semiannually in arrears In the event of default there is a final accrual payment by the buyer Settlement can be specified as delivery of the bonds or in cash) Suppose payments are made quarterly in the example just considered. What are the cash flows if there is a default after 3 years and 1 month and recovery rate is 40%? CDS Structure 90 bps per year Default Default Protection Protection Buyer, A Seller, B Payoff if there is a default by reference entity=100(1-R) Recovery rate, R, is the ratio of the value of the bond issued by reference entity immediately after default to the face value of the bond Payments are usually made quarterly or semiannually in arrears In the event of default there is a final accrual payment by the buyer Settlement can be specified as delivery of the bonds or in cash) Suppose payments are made quarterly in the example just considered. What are the cash flows if there is a default after 3 years and 1 month and recovery rate is 40%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started