Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show works and answer in finance calculation way (not in excel) and highlight the answers. Thank you 5. How much are you willing to

Please show works and answer in finance calculation way (not in excel) and highlight the answers. Thank you

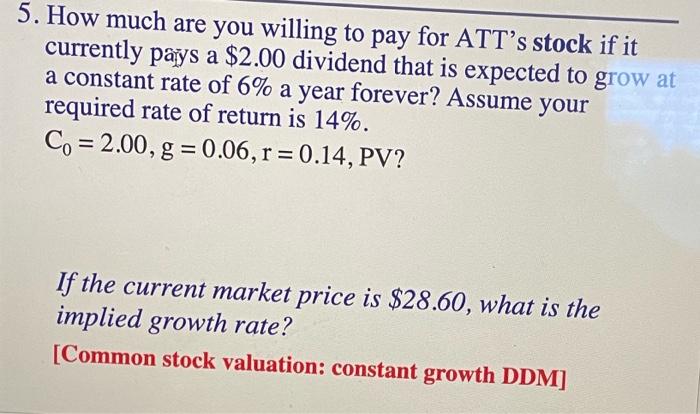

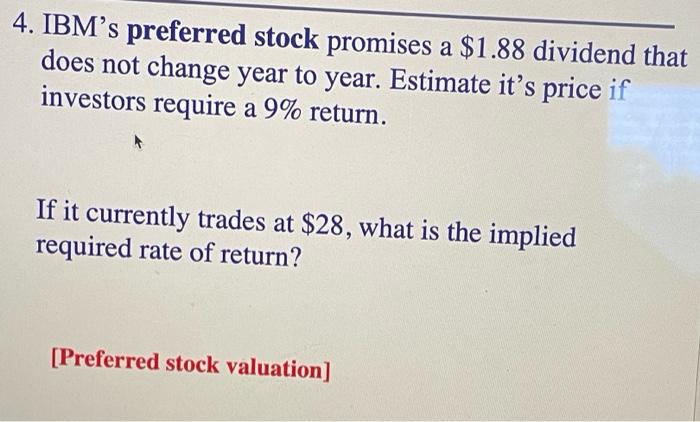

5. How much are you willing to pay for ATT's stock if it currently pays a $2.00 dividend that is expected to grow at a constant rate of 6% a year forever? Assume your required rate of return is 14%. Co= 2.00, g = 0.06, r = 0.14, PV? If the current market price is $28.60, what is the implied growth rate? [Common stock valuation: constant growth DDM] 4. IBM's preferred stock promises a $1.88 dividend that does not change year to year. Estimate it's price if investors require a 9% return. If it currently trades at $28, what is the implied required rate of return? [Preferred stock valuation]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started