Please show you work with explanation

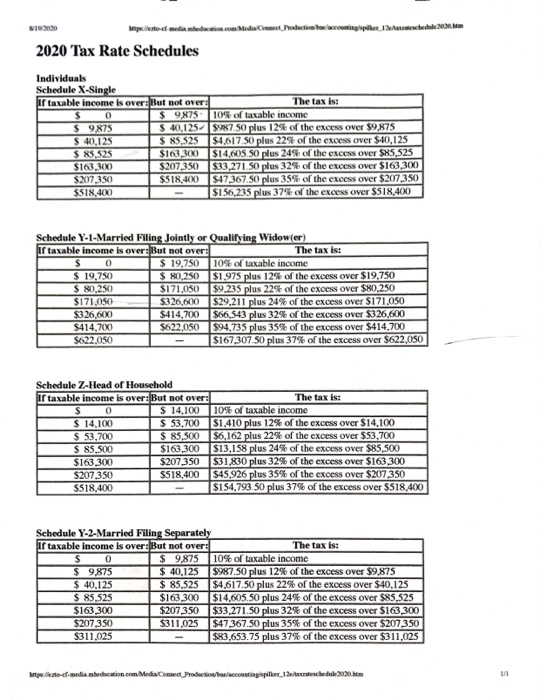

Moana is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $250,000, of which $200,000 is attributed to her sole proprietorship. Moana is contemplating incorporating her sole proprietorship. (Use the tax rate schedule.) a. Using the single individual tax brackets and the corporate tax rate, find out how much current tax this strategy could save Moana (ignore any Social Security, Medicare, or self-employment tax issues). (Round your intermediate calculations and final answer to nearest whole dollar amount.) Answer is complete but not entirely correct. Current tax saved $ 16,078 b. How much of the income should be converted into corporate income to maximize tax savings? Answer is complete and correct. Income left $200,000 1930:30 alestina bela conting paket Taetareschedule 2020.em 2020 Tax Rate Schedules Individuals Schedule X-Single Ir taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,1255987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4.617.50 plus 22% of the excess over $40,125 $ 85.525 $103,300 $14,605 50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271 50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1.975 plus 12% of the excess over $19.750 $ 80,250 $171.050 $9,235 plus 22% of the excess over $80,250 $171.050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household Ir taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53.700 $1.410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207 350 $518.400 $154.793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately Ir taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9.875 $ 40,125 5987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4.617.50 plus 22% of the excess over $40.125 $ 85,525 $163,300 $14.605.50 plus 24% of the excess over $85,525 $163,300 $207 350 $33.271.50 plus 32% of the excess over $163,300 $207350 $311,025 $47367.50 plus 35% of the excess over $207,350 $311,025 $83,653.75 plus 37% of the excess over $311,025 Iztof media nedocation.com Media Conect_Production conting spiller_1/anschedule 2020.htm in