Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your formulas and work so I can understand the concepts!! Thanks!! The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO,

Please show your formulas and work so I can understand the concepts!! Thanks!!

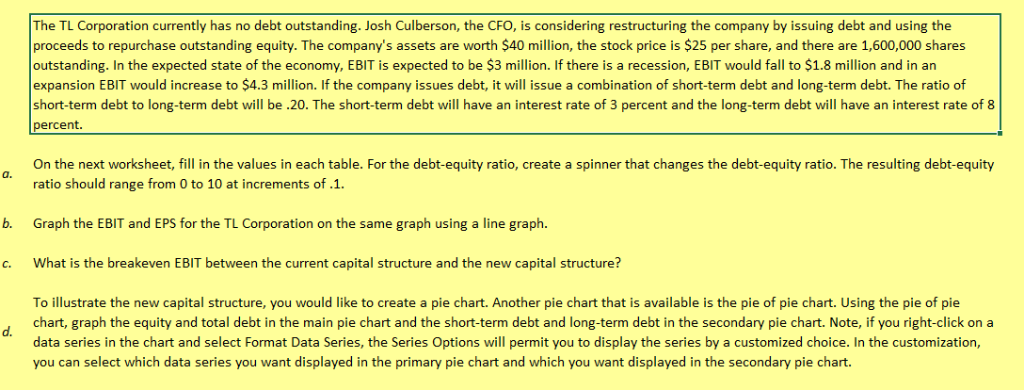

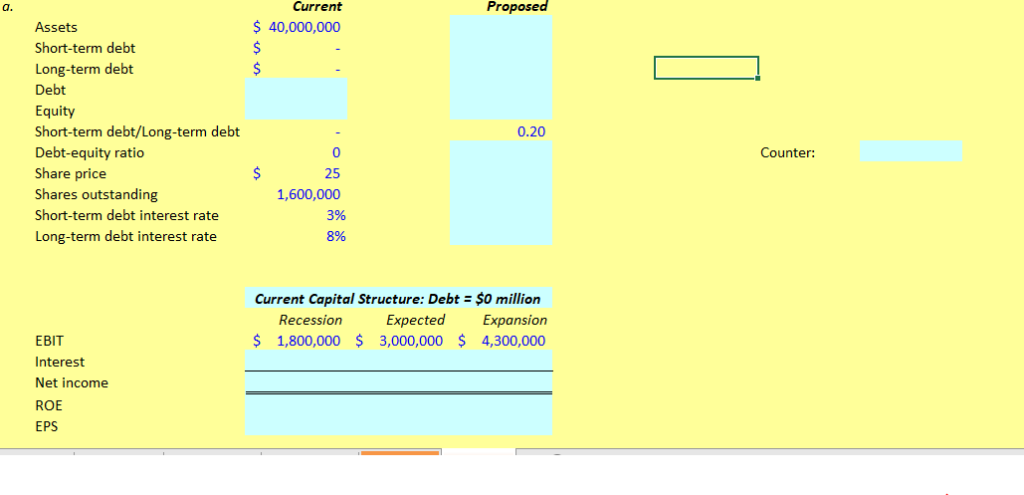

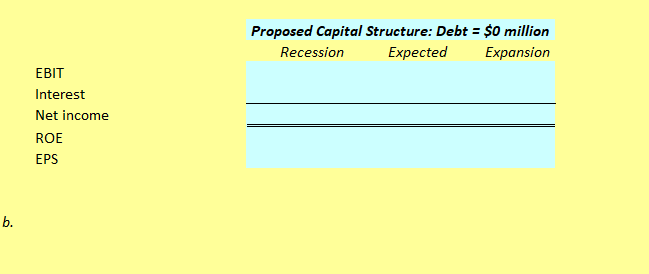

The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the company by issuing debt and using the proceeds to repurchase outstanding equity. The company's assets are worth $40 million, the stock price is $25 per share, and there are 1,600,000 shares outstanding. In the expected state of the economy, EBIT is expected to be $3 million. If there is a recession, EBIT would fall to $1.8 million and in an expansion EBIT would increase to $4.3 million. If the company issues debt, it will issue a combination of short-term debt and long-term debt. The ratio of short-term debt to long-term debt will be .20. The short-term debt will have an interest rate of 3 percent and the long-term debt will have an interest rate of 8 percent. On the next worksheet, fill in the values in each table. For the debt-equity ratio, create a spinner that changes the debt-equity ratio. The resulting debt-equity a. ratio should range from 0 to 10 at increments of .1. Graph the EBIT and EPS for the TL Corporation on the same graph using a line graph. What is the breakeven EBIT between the current capital structure and the new capital structure? To illustrate the new capital structure, you would like to create a pie chart. Another pie chart that is available is the pie of pie chart. Using the pie of pie data series in the chart and select Format Data Series, the Series Options will permit you to display the series by a customized choice. In the customization, b. c. d chart, graph the equity and total debt in the main pie chart and the short-term debt and long-term debt in the secondary pie chart. Note, if you right-click on a you can select which data series you want displayed in the primary pie chart and which you want displayed in the secondary pie chart. Current 40,000,000 Proposea Assets Short-term debt Long-term debt Debt Equity Short-term debt/Long-term debt Debt-equity ratio Share price Shares outstanding Short-term debt interest rate Long-term debt interest rate 0.20 Counter: 25 1,600,000 3% 8% Current Capital Structure: Debt $0 million Recession Expected Expansion 1,800,000 $ 3,000,000 4,300,000 EBIT Interest Net income ROE EPS Proposed Capital Structure: Debt $0 million Expansion Recession Expected EBIT Interest Net income ROE EPS b. c. Breakeven EBIT d. The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the company by issuing debt and using the proceeds to repurchase outstanding equity. The company's assets are worth $40 million, the stock price is $25 per share, and there are 1,600,000 shares outstanding. In the expected state of the economy, EBIT is expected to be $3 million. If there is a recession, EBIT would fall to $1.8 million and in an expansion EBIT would increase to $4.3 million. If the company issues debt, it will issue a combination of short-term debt and long-term debt. The ratio of short-term debt to long-term debt will be .20. The short-term debt will have an interest rate of 3 percent and the long-term debt will have an interest rate of 8 percent. On the next worksheet, fill in the values in each table. For the debt-equity ratio, create a spinner that changes the debt-equity ratio. The resulting debt-equity a. ratio should range from 0 to 10 at increments of .1. Graph the EBIT and EPS for the TL Corporation on the same graph using a line graph. What is the breakeven EBIT between the current capital structure and the new capital structure? To illustrate the new capital structure, you would like to create a pie chart. Another pie chart that is available is the pie of pie chart. Using the pie of pie data series in the chart and select Format Data Series, the Series Options will permit you to display the series by a customized choice. In the customization, b. c. d chart, graph the equity and total debt in the main pie chart and the short-term debt and long-term debt in the secondary pie chart. Note, if you right-click on a you can select which data series you want displayed in the primary pie chart and which you want displayed in the secondary pie chart. Current 40,000,000 Proposea Assets Short-term debt Long-term debt Debt Equity Short-term debt/Long-term debt Debt-equity ratio Share price Shares outstanding Short-term debt interest rate Long-term debt interest rate 0.20 Counter: 25 1,600,000 3% 8% Current Capital Structure: Debt $0 million Recession Expected Expansion 1,800,000 $ 3,000,000 4,300,000 EBIT Interest Net income ROE EPS Proposed Capital Structure: Debt $0 million Expansion Recession Expected EBIT Interest Net income ROE EPS b. c. Breakeven EBIT d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started