PLEASE SHOW YOUR LABELLED WORK

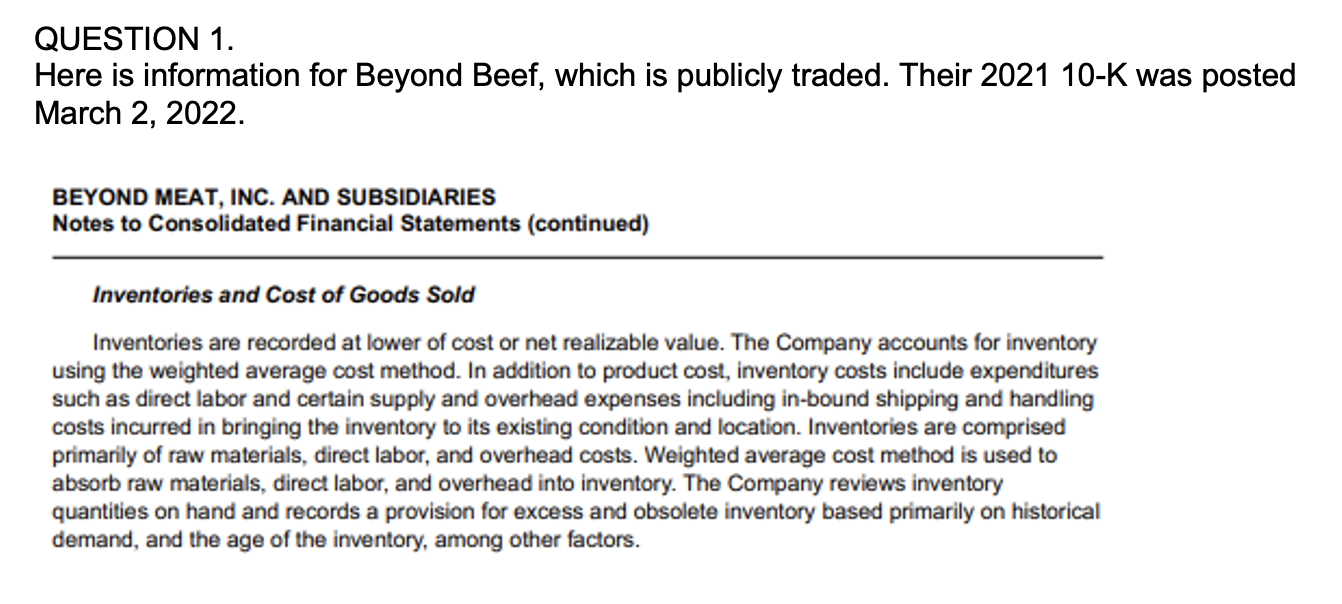

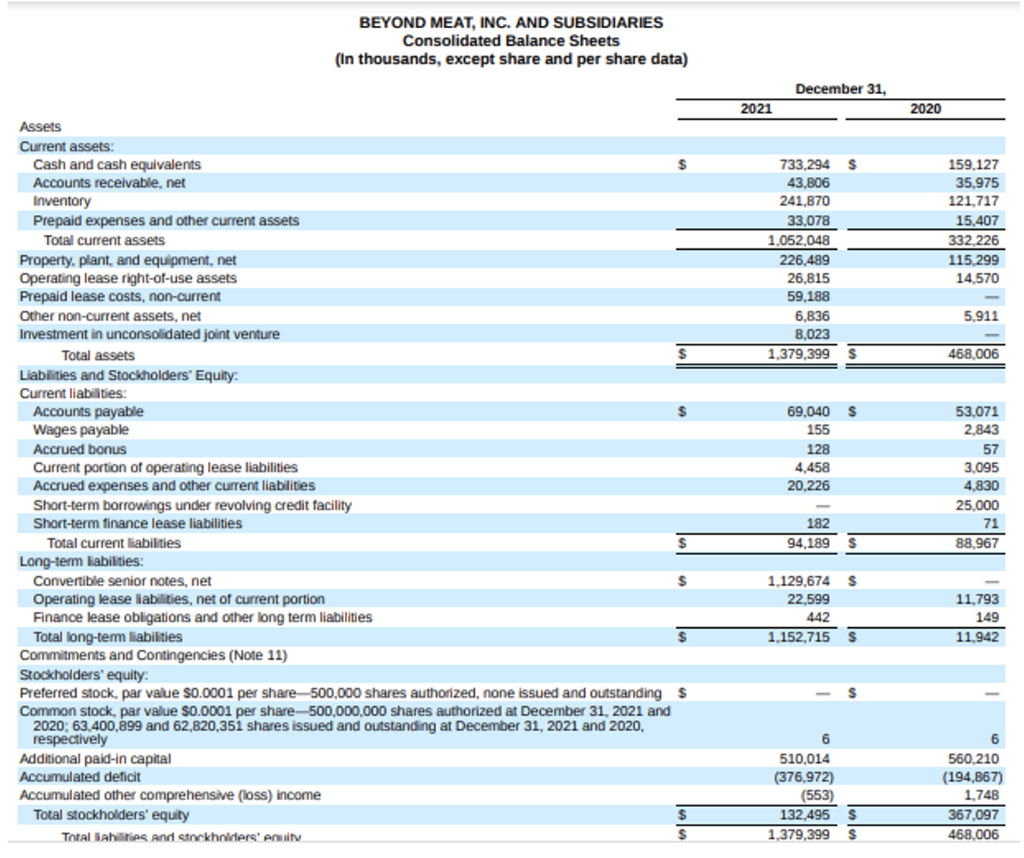

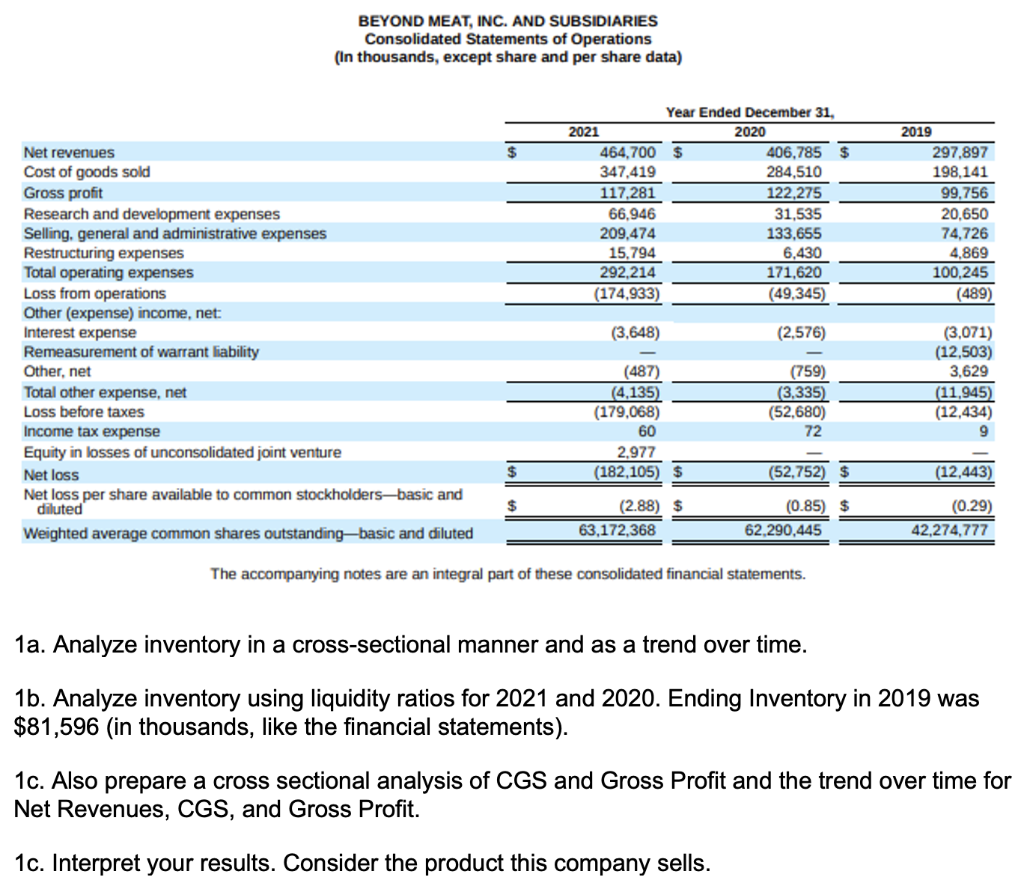

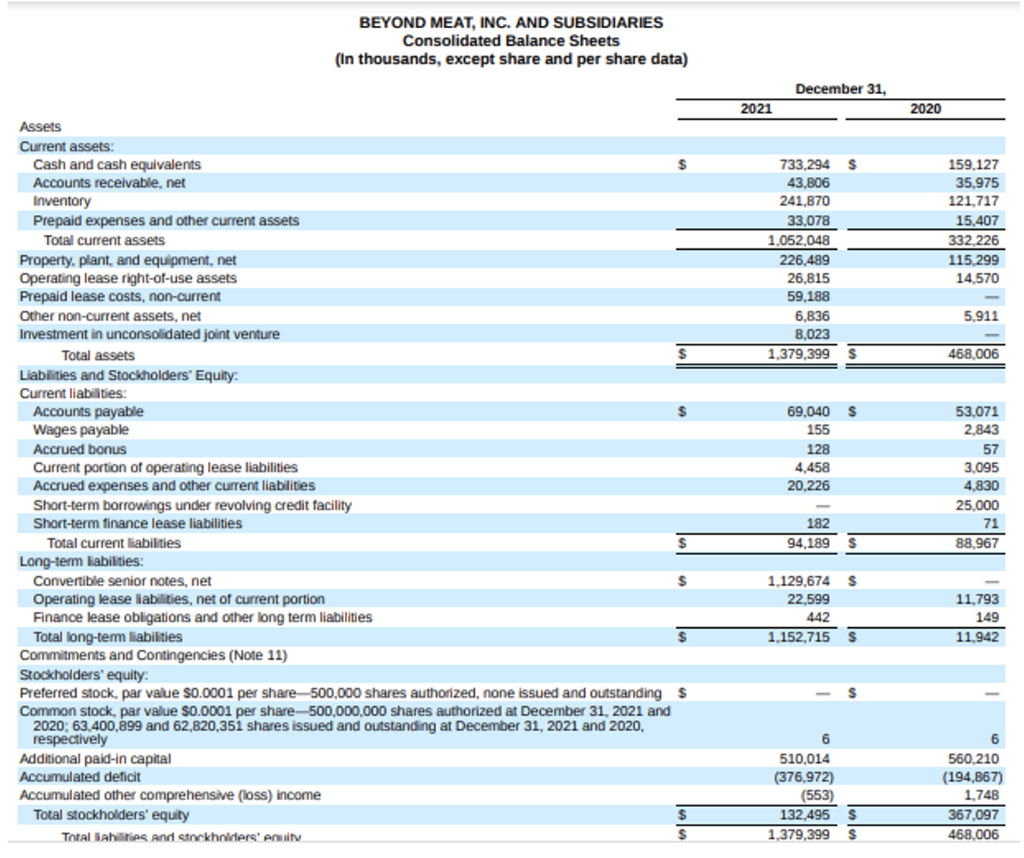

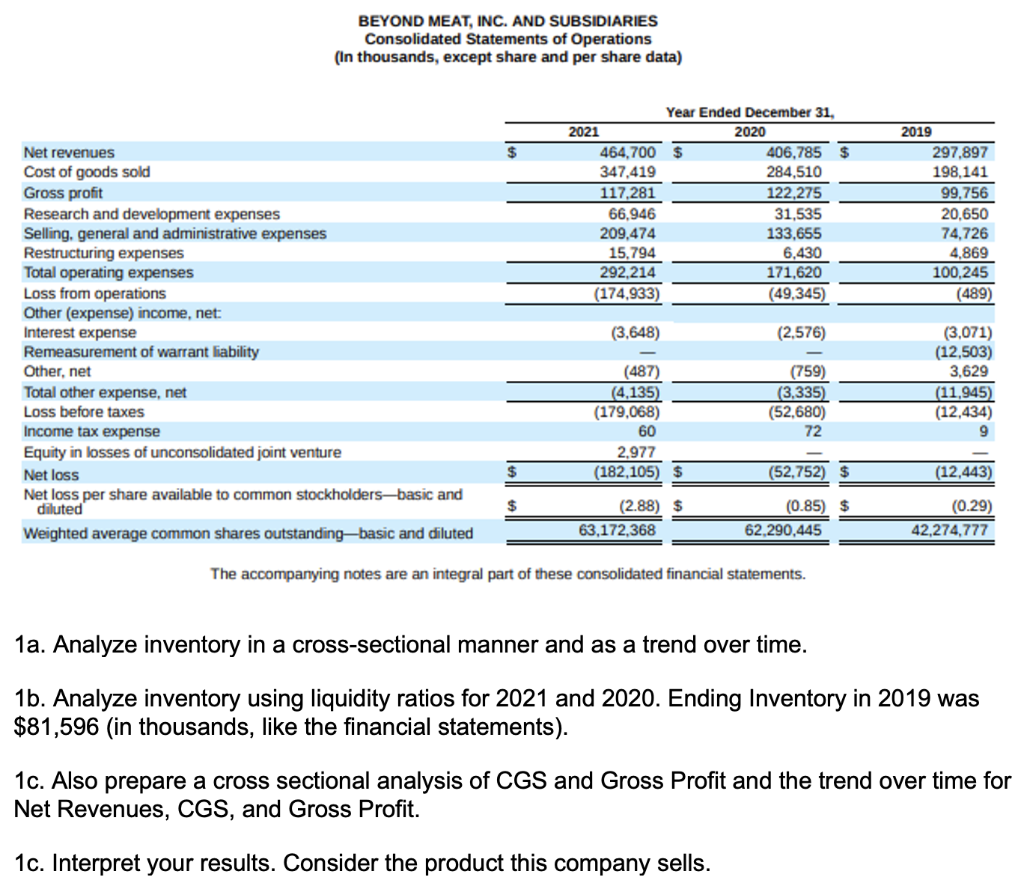

QUESTION 1. Here is information for Beyond Beef, which is publicly traded. Their 2021 10-K was posted March 2, 2022. BEYOND MEAT, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (continued) Inventories and Cost of Goods Sold Inventories are recorded at lower of cost or net realizable value. The Company accounts for inventory using the weighted average cost method. In addition to product cost, inventory costs include expenditures such as direct labor and certain supply and overhead expenses including in-bound shipping and handling costs incurred in bringing the inventory to its existing condition and location. Inventories are comprised primarily of raw materials, direct labor, and overhead costs. Weighted average cost method is used to absorb raw materials, direct labor, and overhead into inventory. The Company reviews inventory quantities on hand and records a provision for excess and obsolete inventory based primarily on historical demand, and the age of the inventory, among other factors. BEYOND MEAT, INC. AND SUBSIDIARIES Consolidated Balance Sheets (In thousands, except share and per share data) December 31, 2021 2020 733,294 43,806 241,870 33,078 1.052,048 226.489 26,815 59,188 6,836 8,023 1.379,399 159,127 35.975 121,717 15,407 332 226 115.299 14.570 5.911 468.006 $ Assets Current assets: Cash and cash equivalents $ Accounts receivable, net Inventory Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net Operating lease right-of-use assets Prepaid lease costs, non-current Other non-current assets, net Investment in unconsolidated joint venture Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Wages payable Accrued bonus Current portion of operating lease liabilities Accrued expenses and other current liabilities Short-term borrowings under revolving credit facility Short-term finance lease liabilities Total current liabilities Long-term liabilities: Convertible senior notes, net $ Operating lease liabilities, net of current portion Finance lease obligations and other long term liabilities Total long-term liabilities Commitments and Contingencies (Note 11) Stockholders' equity Preferred stock. par value S0.0001 per share-500,000 shares authorized, none issued and outstanding S Common stock, par value S0.0001 per share-500,000,000 shares authorized at December 31, 2021 and 2020: 63.400,899 and 62,820,351 shares issued and outstanding at December 31, 2021 and 2020, respectively Additional paid-in capital Accumulated deficit Accumulated other comprehensive (loss) income Total stockholders' equity Total liabilities and stockholders' enuit 69,040 155 128 4,458 20.226 53,071 2.843 57 3.095 4.830 25.000 71 88.967 182 94.189 1.129,674 22,599 442 1.152.715 11.793 149 11,942 6 510,014 (376,972) (553) 132,495 1.379,399 6 560.210 (194,867) 1.748 367,097 468,006 BEYOND MEAT, INC. AND SUBSIDIARIES Consolidated Statements of Operations (In thousands, except share and per share data) Year Ended December 31, 2021 2020 464,700 406,785 347,419 284,510 117,281 122,275 66,946 31,535 209,474 133,655 15,794 6,430 292,214 171,620 (174,933) (49,345) 2019 297,897 198,141 99,756 20.650 74,726 4,869 100,245 (489) (3,648) (2,576) Net revenues Cost of goods sold Gross profit Research and development expenses Selling, general and administrative expenses Restructuring expenses Total operating expenses Loss from operations Other (expense) income, net: Interest expense Remeasurement of warrant liability Other, net Total other expense, net Loss before taxes Income tax expense Equity in losses of unconsolidated joint venture Net loss Net loss per share available to common stockholdersbasic and diluted Weighted average common shares outstanding-basic and diluted (487) (4,135) (179,068) 60 2.977 (182,105) $ (759) (3,335) (52,680) 72 (3,071) (12,503) 3,629 (11,945) (12,434) 9 $ (52,752) (12,443) $ (2.88) $ 63,172,368 (0.85) $ 62.290,445 (0.29) 42,274,777 The accompanying notes are an integral part of these consolidated financial statements. 1a. Analyze inventory in a cross-sectional manner and as a trend over time. 1b. Analyze inventory using liquidity ratios for 2021 and 2020. Ending Inventory in 2019 was $81,596 (in thousands, like the financial statements). 1c. Also prepare a cross sectional analysis of CGS and Gross Profit and the trend over time for Net Revenues, CGS, and Gross Profit. 1c. Interpret your results. Consider the product this company sells. QUESTION 1. Here is information for Beyond Beef, which is publicly traded. Their 2021 10-K was posted March 2, 2022. BEYOND MEAT, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (continued) Inventories and Cost of Goods Sold Inventories are recorded at lower of cost or net realizable value. The Company accounts for inventory using the weighted average cost method. In addition to product cost, inventory costs include expenditures such as direct labor and certain supply and overhead expenses including in-bound shipping and handling costs incurred in bringing the inventory to its existing condition and location. Inventories are comprised primarily of raw materials, direct labor, and overhead costs. Weighted average cost method is used to absorb raw materials, direct labor, and overhead into inventory. The Company reviews inventory quantities on hand and records a provision for excess and obsolete inventory based primarily on historical demand, and the age of the inventory, among other factors. BEYOND MEAT, INC. AND SUBSIDIARIES Consolidated Balance Sheets (In thousands, except share and per share data) December 31, 2021 2020 733,294 43,806 241,870 33,078 1.052,048 226.489 26,815 59,188 6,836 8,023 1.379,399 159,127 35.975 121,717 15,407 332 226 115.299 14.570 5.911 468.006 $ Assets Current assets: Cash and cash equivalents $ Accounts receivable, net Inventory Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net Operating lease right-of-use assets Prepaid lease costs, non-current Other non-current assets, net Investment in unconsolidated joint venture Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Wages payable Accrued bonus Current portion of operating lease liabilities Accrued expenses and other current liabilities Short-term borrowings under revolving credit facility Short-term finance lease liabilities Total current liabilities Long-term liabilities: Convertible senior notes, net $ Operating lease liabilities, net of current portion Finance lease obligations and other long term liabilities Total long-term liabilities Commitments and Contingencies (Note 11) Stockholders' equity Preferred stock. par value S0.0001 per share-500,000 shares authorized, none issued and outstanding S Common stock, par value S0.0001 per share-500,000,000 shares authorized at December 31, 2021 and 2020: 63.400,899 and 62,820,351 shares issued and outstanding at December 31, 2021 and 2020, respectively Additional paid-in capital Accumulated deficit Accumulated other comprehensive (loss) income Total stockholders' equity Total liabilities and stockholders' enuit 69,040 155 128 4,458 20.226 53,071 2.843 57 3.095 4.830 25.000 71 88.967 182 94.189 1.129,674 22,599 442 1.152.715 11.793 149 11,942 6 510,014 (376,972) (553) 132,495 1.379,399 6 560.210 (194,867) 1.748 367,097 468,006 BEYOND MEAT, INC. AND SUBSIDIARIES Consolidated Statements of Operations (In thousands, except share and per share data) Year Ended December 31, 2021 2020 464,700 406,785 347,419 284,510 117,281 122,275 66,946 31,535 209,474 133,655 15,794 6,430 292,214 171,620 (174,933) (49,345) 2019 297,897 198,141 99,756 20.650 74,726 4,869 100,245 (489) (3,648) (2,576) Net revenues Cost of goods sold Gross profit Research and development expenses Selling, general and administrative expenses Restructuring expenses Total operating expenses Loss from operations Other (expense) income, net: Interest expense Remeasurement of warrant liability Other, net Total other expense, net Loss before taxes Income tax expense Equity in losses of unconsolidated joint venture Net loss Net loss per share available to common stockholdersbasic and diluted Weighted average common shares outstanding-basic and diluted (487) (4,135) (179,068) 60 2.977 (182,105) $ (759) (3,335) (52,680) 72 (3,071) (12,503) 3,629 (11,945) (12,434) 9 $ (52,752) (12,443) $ (2.88) $ 63,172,368 (0.85) $ 62.290,445 (0.29) 42,274,777 The accompanying notes are an integral part of these consolidated financial statements. 1a. Analyze inventory in a cross-sectional manner and as a trend over time. 1b. Analyze inventory using liquidity ratios for 2021 and 2020. Ending Inventory in 2019 was $81,596 (in thousands, like the financial statements). 1c. Also prepare a cross sectional analysis of CGS and Gross Profit and the trend over time for Net Revenues, CGS, and Gross Profit. 1c. Interpret your results. Consider the product this company sells