Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show your quick work A3 What is the Annual Worth for the Wenger X-185 model? A $113,500 B. $120,800 C. $135,000 D. $152,300 (10)

please show your quick work

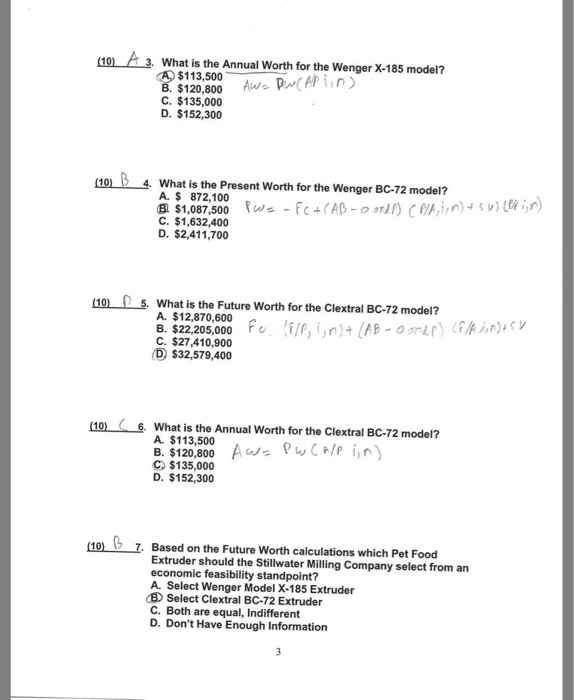

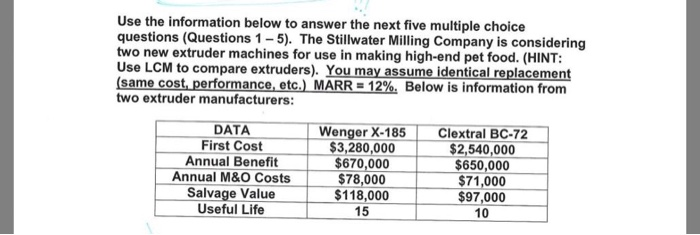

A3 What is the Annual Worth for the Wenger X-185 model? A $113,500 B. $120,800 C. $135,000 D. $152,300 (10) Aw Piu Ap isn (10) B 4. What is the Present Worth for the Wenger BC-72 model? A. S 872,100 $1,087,500 isn) - fc+(AB-o anP CPAin) C. $1,632,400 D. $2,411,700 (10) 5. What is the Future Worth for the Clextral BC-72 model? A. $12,870,600 B. $22,205,000 F C. $27,410,900 D $32,579,400 (f/e,in)+ (AB - OonLf) (F/Ain)SV (10) 6. What is the Annual Worth for the Clextral BC-72 model? A. $113,500 B. $120,800 C $135,000 D. $152,300 Aws PuCP i,n) (10) G 7. Based on the Future Worth calculations which Pet Food Extruder should the Stillwater Milling Company select from an economic feasibility standpoint? A. Select Wenger Model X-185 Extruder B Select Clextral BC-72 Extruder C. Both are equal, Indifferent D. Don't Have Enough Information 3 Use the information below to answer the next five multiple choice questions (Questions 1-5). The Stillwater Milling Company is considering two new extruder machines for use in making high-end pet food. (HINT: Use LCM to compare extruders). You may assume identical replacement (same cost, performance, etc.) MARR = 12%, Below is information from two extruder manufacturers: Wenger X-185 $3,280,000 $670,000 $78,000 $118,000 15 DATA First Cost Annual Benefit Annual M&O Costs Salvage Value Useful Life Clextral BC-72 $2,540,000 $650,000 $71,000 $97,000 10 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started