Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Show your work! 1. If you put $1,300 into a bank account that pays 4% annual interest, how much would you have in the

Please Show your work!

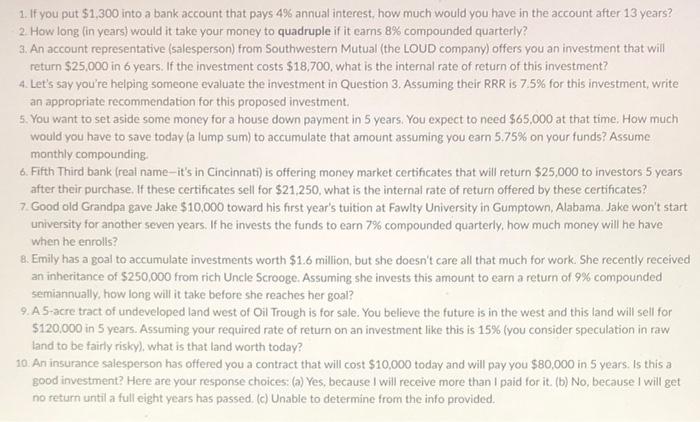

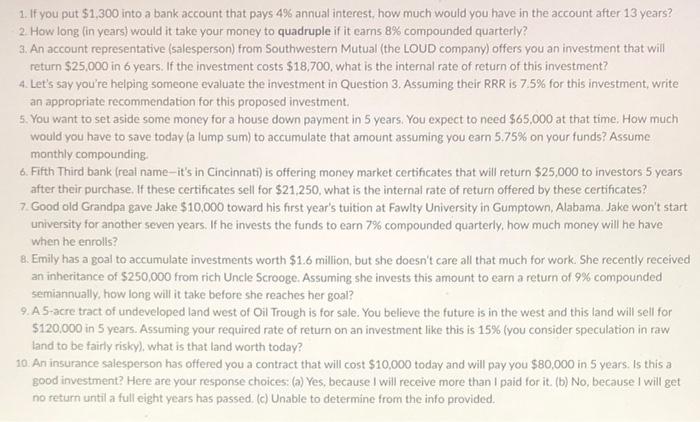

1. If you put $1,300 into a bank account that pays 4% annual interest, how much would you have in the account after 13 years? 2. How long (in years) would it take your money to quadruple if it cams 8% compounded quarterly? 3. An account representative (salesperson) from Southwestern Mutual (the LOUD company) offers you an investment that will return $25,000 in 6 years. If the investment costs $18,700, what is the internal rate of return of this investment? 4. Let's say you're helping someone evaluate the investment in Question 3. Assuming their RRR is 7.5% for this investment, write an appropriate recommendation for this proposed investment, 5. You want to set aside some money for a house down payment in 5 years. You expect to need $65.000 at that time. How much would you have to save today (a lump sum) to accumulate that amount assuming you earn 5,75% on your funds? Assume monthly compounding 6. Fifth Third bank (real name-it's in Cincinnati) is offering money market certificates that will return $25,000 to investors 5 years after their purchase. If these certificates sell for $21,250, what is the internal rate of return offered by these certificates? 7. Good old Grandpa gave Jake $10,000 toward his first year's tuition at Fawlty University in Gumptown, Alabama. Jake won't start university for another seven years. If he invests the funds to earn 7% compounded quarterly, how much money will he have when he enrolls? 8. Emily has a goal to accumulate investments worth $1.6 million, but she doesn't care all that much for work. She recently received an inheritance of $250,000 from rich Uncle Scrooge. Assuming she invests this amount to earn a return of 9% compounded semiannually, how long will it take before she reaches her goal? 9. A 5-acre tract of undeveloped land west of Oil Trough is for sale. You believe the future is in the west and this land will sell for $120.000 in 5 years. Assuming your required rate of return on an investment like this is 15% (you consider speculation in raw land to be fairly risky), what is that land worth today? 10. An insurance salesperson has offered you a contract that will cost $10,000 today and will pay you $80,000 in 5 years. Is this a good investment? Here are your response choices: (a) Yes, because I will receive more than I paid for it. (b) No, because I will get no return until a full eight years has passed. (c) Unable to determine from the info provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started