Answered step by step

Verified Expert Solution

Question

1 Approved Answer

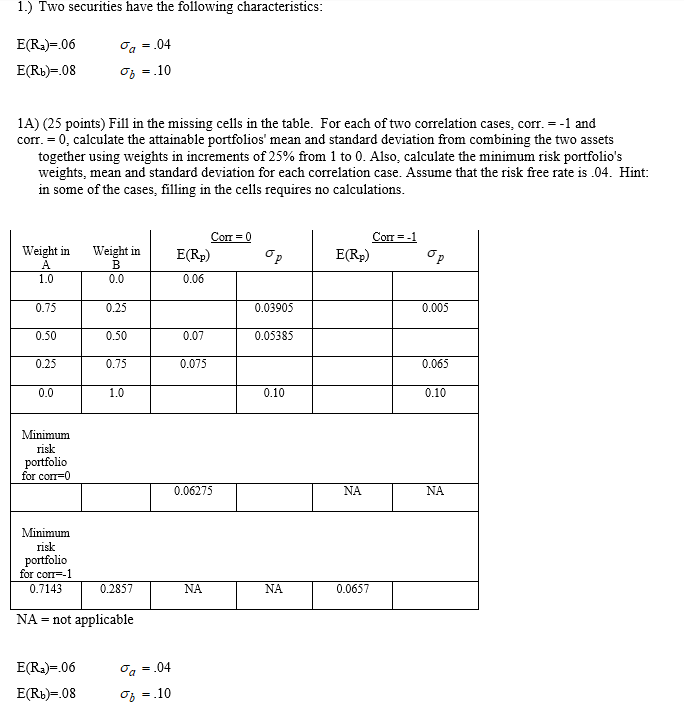

please show your work 1.) Two securities have the following characteristics: a = .04 E(Ra)=.06 E(Rb)=.08 = 10 1A) (25 points) Fill in the missing

please show your work

1.) Two securities have the following characteristics: a = .04 E(Ra)=.06 E(Rb)=.08 = 10 1A) (25 points) Fill in the missing cells in the table. For each of two correlation cases, corr. = -1 and corr. = 0, calculate the attainable portfolios' mean and standard deviation from combining the two assets together using weights in increments of 25% from 1 to 0. Also, calculate the minimum risk portfolio's weights, mean and standard deviation for each correlation case. Assume that the risk free rate is .04. Hint: in some of the cases, filling in the cells requires no calculations. Weight in A Con = 0 E(Rp) 0.06 Corr-.1 E(Rp) Weight in B 0.0 1.0 0.75 0.25 0.03905 0.005 0.50 0.50 0.07 0.05385 0.25 0.75 0.075 0.065 0.0 1.0 0.10 0.10 Minimum risk portfolio for corr=0 0.06275 NA NA Minimum risk portfolio for con=-1 0.7143 0.2857 NA NA 0.0657 NA = not applicable a = .04 E(Ra)=.06 E(Rb)=.08 = 10 1.) Two securities have the following characteristics: a = .04 E(Ra)=.06 E(Rb)=.08 = 10 1A) (25 points) Fill in the missing cells in the table. For each of two correlation cases, corr. = -1 and corr. = 0, calculate the attainable portfolios' mean and standard deviation from combining the two assets together using weights in increments of 25% from 1 to 0. Also, calculate the minimum risk portfolio's weights, mean and standard deviation for each correlation case. Assume that the risk free rate is .04. Hint: in some of the cases, filling in the cells requires no calculations. Weight in A Con = 0 E(Rp) 0.06 Corr-.1 E(Rp) Weight in B 0.0 1.0 0.75 0.25 0.03905 0.005 0.50 0.50 0.07 0.05385 0.25 0.75 0.075 0.065 0.0 1.0 0.10 0.10 Minimum risk portfolio for corr=0 0.06275 NA NA Minimum risk portfolio for con=-1 0.7143 0.2857 NA NA 0.0657 NA = not applicable a = .04 E(Ra)=.06 E(Rb)=.08 = 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started