please show your work and explain your answer thank you!!

please show your work and explain your answer thank you!!

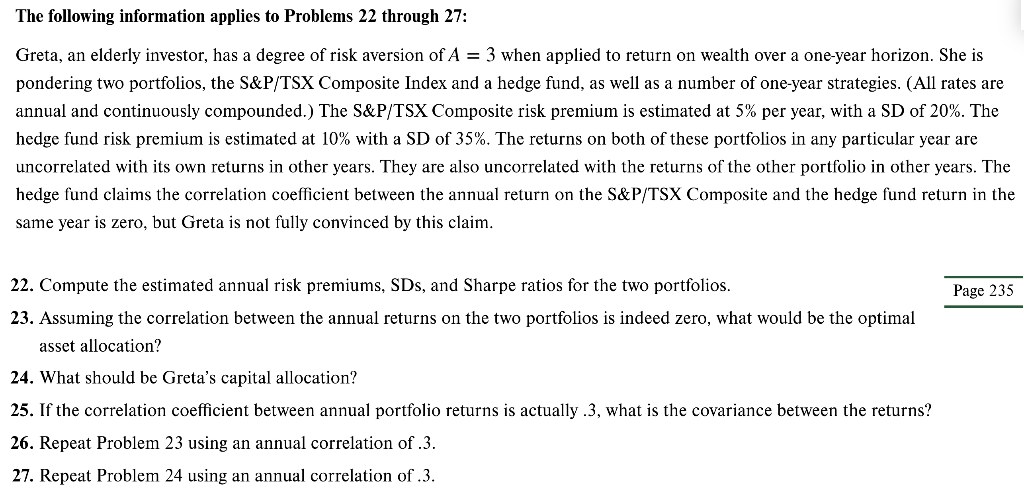

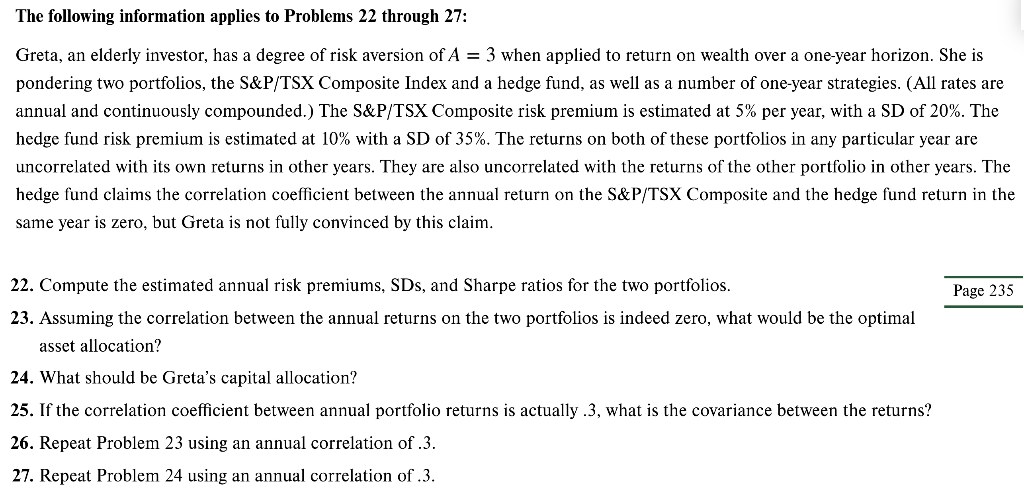

The following information applies to Problems 22 through 27: Greta, an elderly investor, has a degree of risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P/TSX Composite Index and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The S&P/TSX Composite risk premium is estimated at 5% per year, with a SD of 20%. The hedge fund risk premium is estimated at 10% with a SD of 35%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P/TSX Composite and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim 22. Compute the estimated annual risk premiums, SDs, and Sharpe ratios for the two portfolios Page 235 23. Assuming the correlation between the annual returns on the two portfolios is indeed zero, what would be the optimal asset allocation? 24. What should be Greta's capital allocation? 25. If the correlation coefficient between annual portfolio returns is actually .3, what is the covariance between the returns? 26. Repeat Problem 23 using an annual correlation of .3 27. Repeat Problem 24 using an annual correlation of .3 The following information applies to Problems 22 through 27: Greta, an elderly investor, has a degree of risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P/TSX Composite Index and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The S&P/TSX Composite risk premium is estimated at 5% per year, with a SD of 20%. The hedge fund risk premium is estimated at 10% with a SD of 35%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P/TSX Composite and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim 22. Compute the estimated annual risk premiums, SDs, and Sharpe ratios for the two portfolios Page 235 23. Assuming the correlation between the annual returns on the two portfolios is indeed zero, what would be the optimal asset allocation? 24. What should be Greta's capital allocation? 25. If the correlation coefficient between annual portfolio returns is actually .3, what is the covariance between the returns? 26. Repeat Problem 23 using an annual correlation of .3 27. Repeat Problem 24 using an annual correlation of .3

please show your work and explain your answer thank you!!

please show your work and explain your answer thank you!!