Answered step by step

Verified Expert Solution

Question

1 Approved Answer

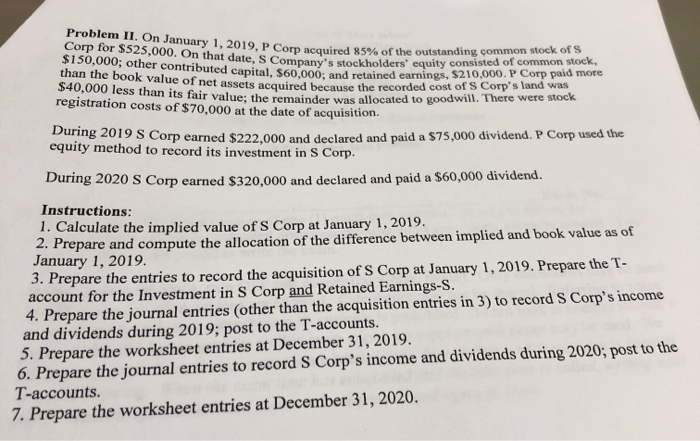

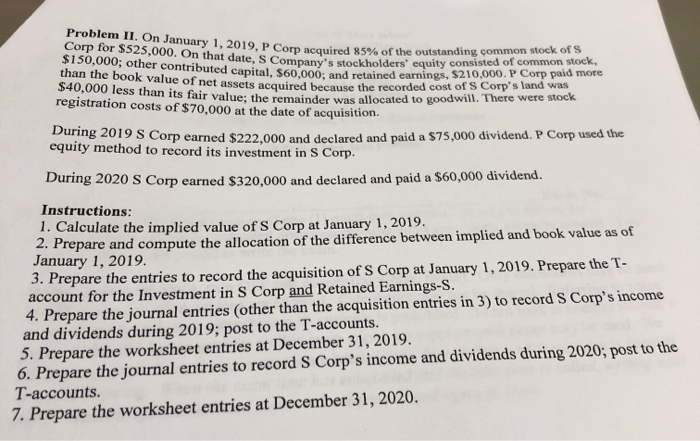

please show your work and number your work. this is the only information Problem II. On January 1, 2019, P Corp acquired Corp for $525,000.

please show your work and number your work.

this is the only information

Problem II. On January 1, 2019, P Corp acquired Corp for $525,000. On that date, S Company's stockholders 019, P Corp acquired 85% of the outstanding common stock of s On that date, S Companyat holders eauity consisted of common stock, $150,000; other contributed canital 560 000 - and retained earnings, than the book value of net assets acquired because the recorded cost capital, $60,000; and retained earnings, $210.000. P Corp paid more $40,000 less than its fair value; the remainder was net assets acquired because the recorded cost of S Corp's land was TS fair value; the remainder was allocated to goodwill. There were stock registration costs of $70,000 at the date of acquisition. Corp earned $222,000 and declared and paid a $75,000 dividend. P Corp used the equity method to record its investment in S Corp. During 2020 S Corp earned $320,000 and declared and paid a $60,000 dividend. Instructions: 1. Calculate the implied value of S Corp at January 1, 2019. 2. Prepare and compute the allocation of the difference between implied and book value as of January 1, 2019. 3. Prepare the entries to record the acquisition of S Corp at January 1, 2019. Prepare the T- account for the Investment in S Corp and Retained Earnings-S. 4. Prepare the journal entries (other than the acquisition entries in 3) to record S Corp's income and dividends during 2019; post to the T-accounts. 5. Prepare the worksheet entries at December 31, 2019. 6. Prepare the journal entries to record S Corp's income and dividends during 2020; post to the T-accounts. 7. Prepare the worksheet entries at December 31, 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started