Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work as to how you would calculate this on your financial calculator. Ex) N = ?, I = ?, PV = ?,

Please show your work as to how you would calculate this on your financial calculator. Ex) N = ?, I = ?, PV = ?, PMT = ?, FV = What we are solving for. Also include P/YR, and if you use BEG for annuity due calculations.

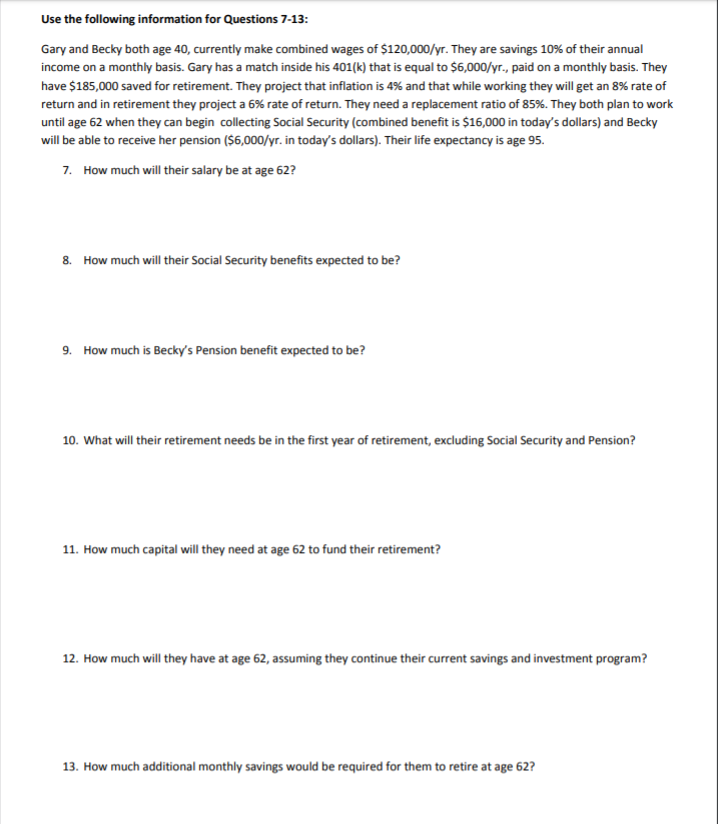

Use the following information for Questions 7-13: Gary and Becky both age 40, currently make combined wages of $120,000/yr. They are savings 10% of their annual income on a monthly basis. Gary has a match inside his 401(k) that is equal to $6,000/yr., paid on a monthly basis. They have $185,000 saved for retirement. They project that inflation is 4% and that while working they will get an 8% rate of return and in retirement they project a 6% rate of return. They need a replacement ratio of 85%. They both plan to work until age 62 when they can begin collecting Social Security (combined benefit is $16,000 in today's dollars) and Becky will be able to receive her pension ($6,000/yr. in today's dollars). Their life expectancy is age 95. How much will their salary be at age 62? 7. How much will their Social Security benefits expected to be? 8. How much is Becky's Pension benefit expected to be? 9. 10. What will their retirement needs be in the first year of retirement, excluding Social Security and Pension? 11. How much capital will they need at age 62 to fund their retirement? 12. How much will they have at age 62, assuming they continue their current savings and investment program? 13. How much additional monthly savings would be required for them to retire at age 62? Use the following information for Questions 7-13: Gary and Becky both age 40, currently make combined wages of $120,000/yr. They are savings 10% of their annual income on a monthly basis. Gary has a match inside his 401(k) that is equal to $6,000/yr., paid on a monthly basis. They have $185,000 saved for retirement. They project that inflation is 4% and that while working they will get an 8% rate of return and in retirement they project a 6% rate of return. They need a replacement ratio of 85%. They both plan to work until age 62 when they can begin collecting Social Security (combined benefit is $16,000 in today's dollars) and Becky will be able to receive her pension ($6,000/yr. in today's dollars). Their life expectancy is age 95. How much will their salary be at age 62? 7. How much will their Social Security benefits expected to be? 8. How much is Becky's Pension benefit expected to be? 9. 10. What will their retirement needs be in the first year of retirement, excluding Social Security and Pension? 11. How much capital will they need at age 62 to fund their retirement? 12. How much will they have at age 62, assuming they continue their current savings and investment program? 13. How much additional monthly savings would be required for them to retire at age 62Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started