Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show your work Bonds 12.14 A bond has face amount of $1000, matures in seven years, and pays $80 interest every year. To yield

please show your work

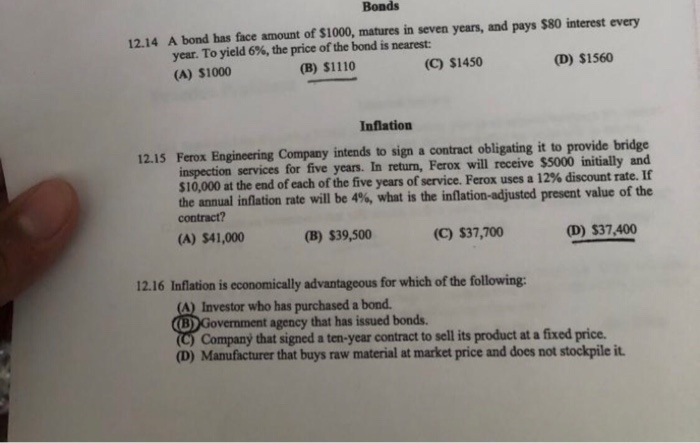

Bonds 12.14 A bond has face amount of $1000, matures in seven years, and pays $80 interest every year. To yield 6%, the price of the bond is nearest: (A) S1000 (B) $1110 (C) $1450 (D) $1560 Inflation 12.15 Ferox Engineering Company intends to sign a contract obligating it to provide bridge inspection services for five years. In return, Ferox will receive $5000 initially and $10,000 at the end of each of the five years of service. Ferox uses a 12% discount rate. If the annual inflation rate will be 4%, what is the inflation-adjusted present value of the contract? (A) S41,000 (B) $39,500 (C) $37,700 (D) $37,400 12.16 Inflation is economically advantageous for which of the following: (A) Investor who has purchased a bond. (B) Government agency that has issued bonds. (C) Company that signed a ten-year contract to sell its product at a fixed price. (D) Manufacturer that buys raw material at market price and does not stockpile it Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started