Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show your work for each sub question, thanks! 1. A consumer organization studied the effect of age of automobile owner on size of cash

please show your work for each sub question, thanks!

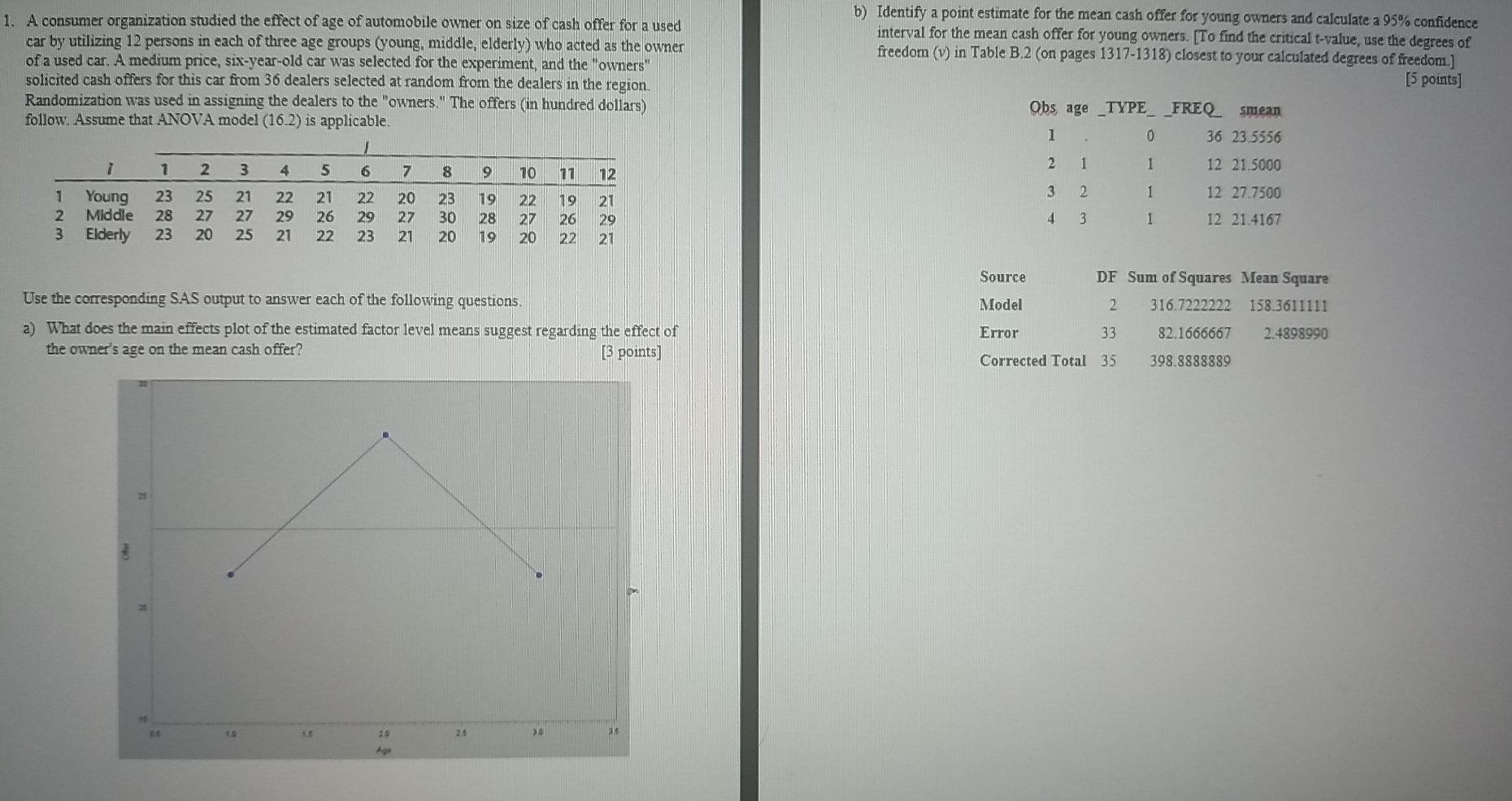

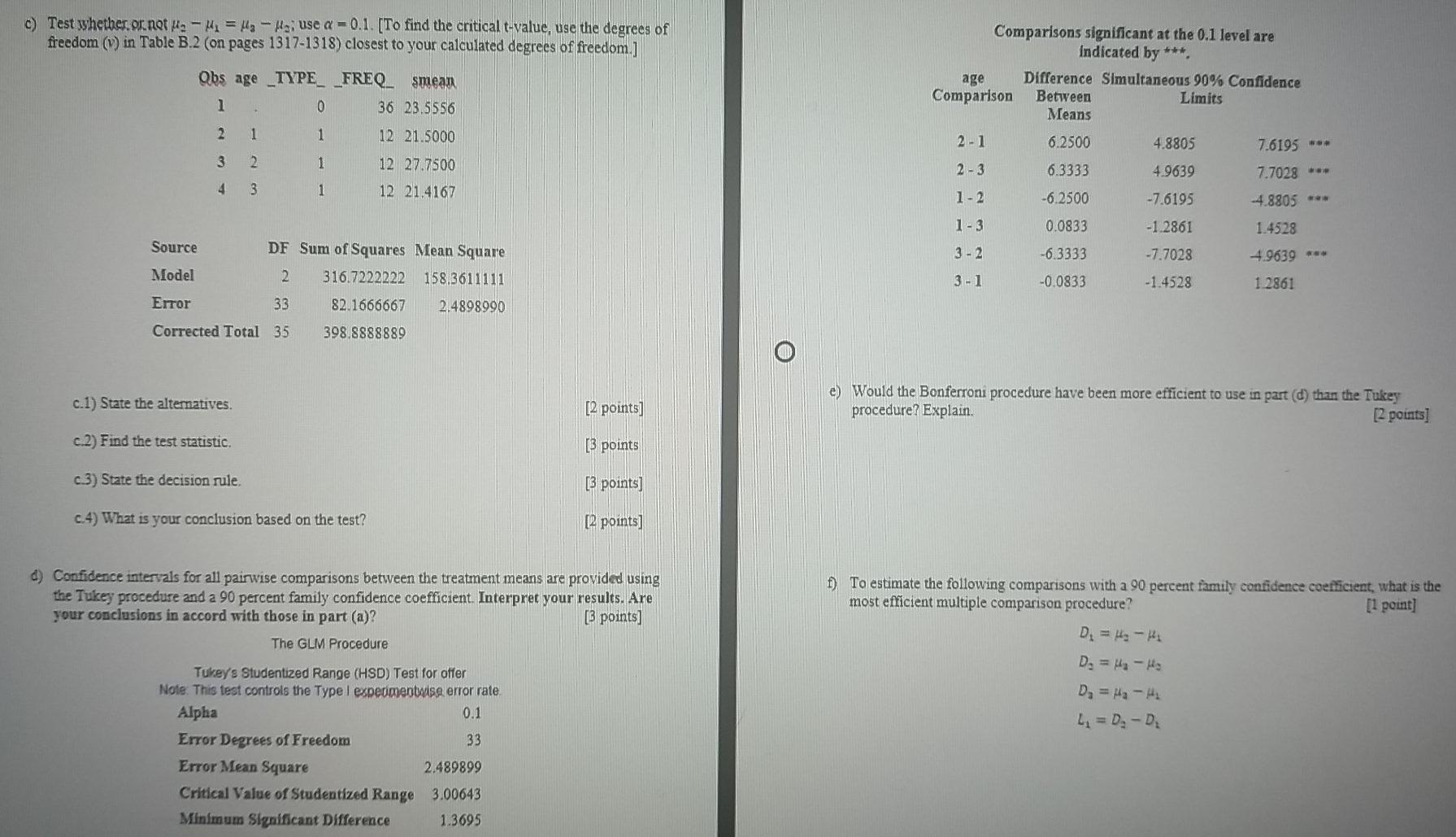

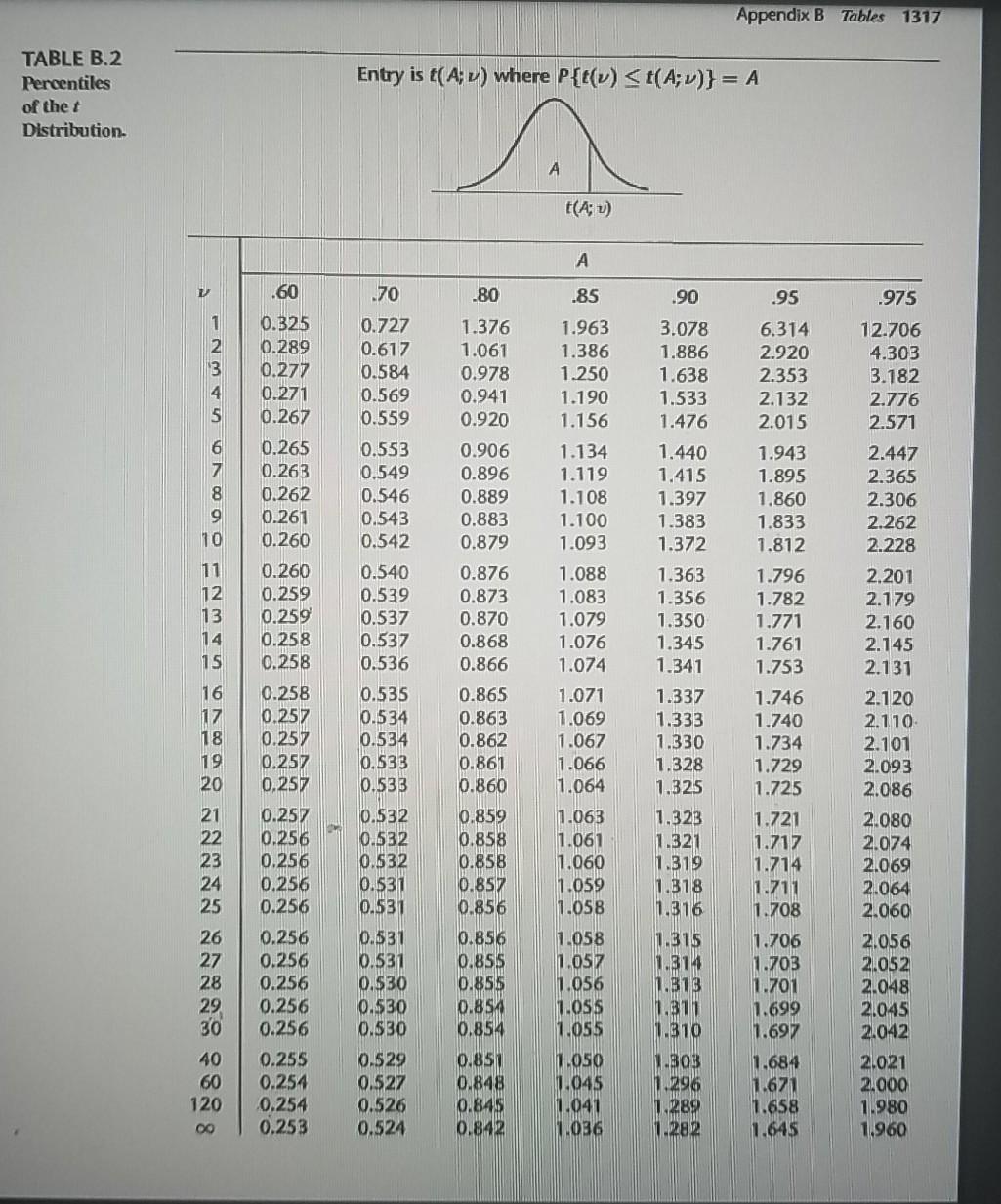

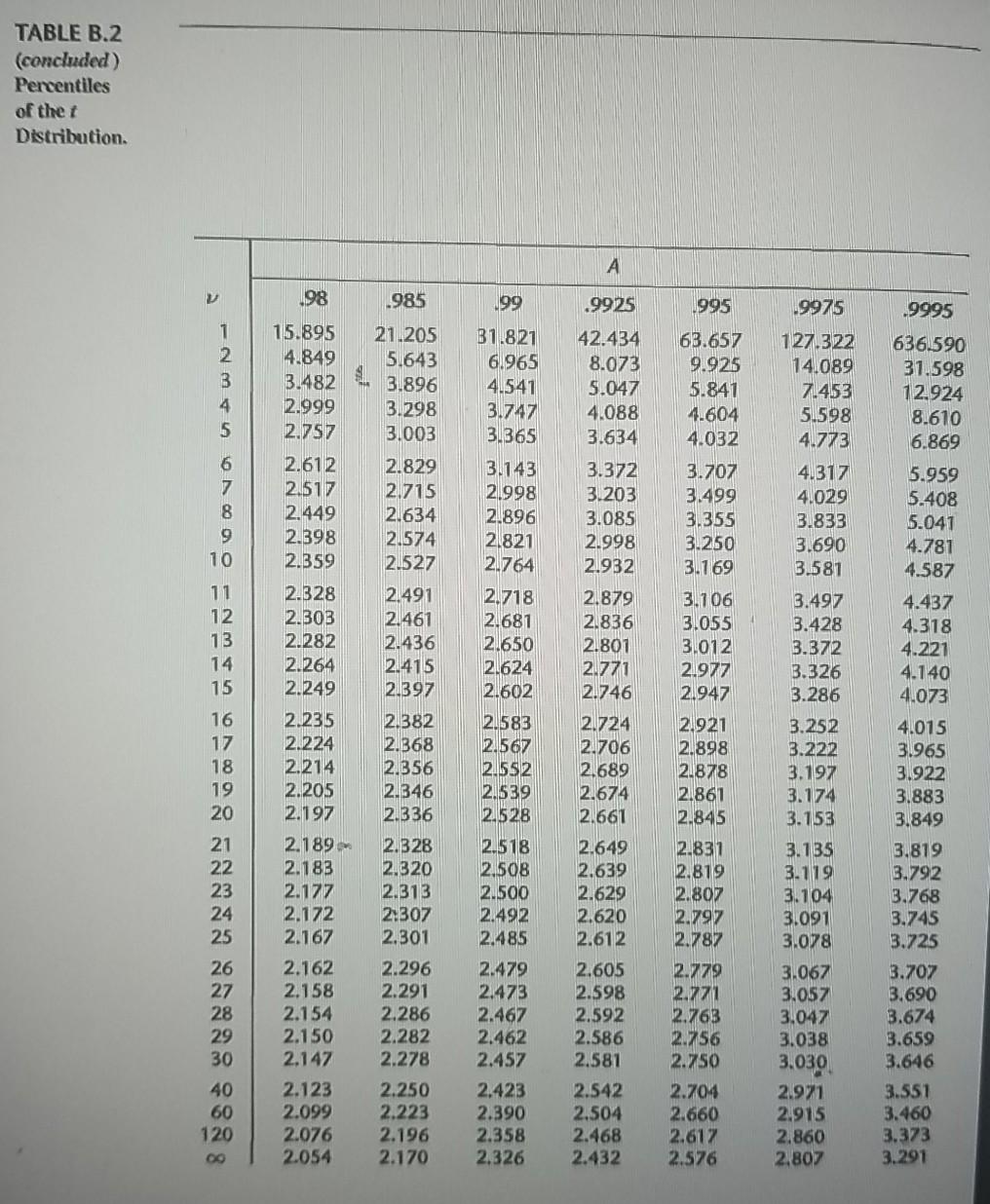

1. A consumer organization studied the effect of age of automobile owner on size of cash offer for a used car by utilizing 12 persons in each of three age groups (young, middle, elderly) who acted as the owner of a used car. A medium price, six-year-old car was selected for the experiment, and the owners solicited cash offers for this car from 36 dealers selected at random from the dealers in the region Randomization was used in assigning the dealers to the owners." The offers (in hundred dollars) follow. Assume that ANOVA model (16.2) is applicable. b) Identify a point estimate for the mean cash offer for young owners and calculate a 95% confidence interval for the mean cash offer for young owners. [To find the critical t-value, use the degrees of freedom (v) in Table B.2 (on pages 1317-1318) closest to your calculated degrees of freedom.] [5 points] Obs age TYPE_FREQ_smean 1 0 36 23.5556 7 1 2 3 4 5 2 1 1 6 12 21.5000 7 8 9 10 21 12 3 2 1 12 27.7500 1 2 3 Young Middle Elderly 23 28 23 25 27 20 21 27 25 22 29 21 21 26 22 22 29 23 20 27 21 23 30 20 19 28 19 22 27 20 19 26 22 21 29 21 4 3 1 12 21.4167 Source DF Sum of Squares Mean Square 2 316.7222222 158.3611111 Model Use the corresponding SAS output to answer each of the following questions a) What does the main effects plot of the estimated factor level means suggest regarding the effect of the owner's age on the mean cash offer? [3 points) Error 33 82.1666667 2.4898990 Corrected Total 35 398.8888889 20 c) Test whether or not Pa - M = Ha-Ha use a = 0.1. (To find the critical t-value, use the degrees of freedom () in Table B.2 (on pages 1317-1318) closest to your calculated degrees of freedom.] Obs age _TYPE_ FREQ_ smean 1 0 36 23.5556 Comparisons significant at the 0.1 level are Indicated by *** age Difference Simultaneous 90% Confidence Comparison Between Limits Means 2 1 1 12 21.5000 6.2500 4.8805 7.6195 - 3 2. 1 12 27.7500 2-3 6.3333 4.9639 7.7028 - 4 3 1 12 21.4167 1-2 -6.2500 -7.6195 -4.8805 - 1-3 0.0833 -1.2861 1.4528 3 - 2 -7.7028 4.9639 *** -6.3333 -0.0833 3-1 Source DF Sum of Squares Mean Square Model 2 316.7222222 158.3611111 Error 33 82.1666667 2.4898990 Corrected Total 35 398.8888889 -1.4528 1.2861 c.1) State the alternatives. e) Would the Bonferroni procedure have been more efficient to use in part (d) than the Tukey procedure? Explain. [2 points] [2 points] c.2) Find the test statistic. [3 points c.3) State the decision rule. [3 points) C.4) What is your conclusion based on the test? [2 points) d) Confidence intervals for all pairwise comparisons between the treatment means are provided using the Tukey procedure and a 90 percent family confidence coefficient. Interpret your results. Are your conclusions in accord with those in part (a)? [ points) The GLM Procedure ) To estimate the following comparisons with a 90 percent family confidence coefficient, what is the most efficient multiple comparison procedure? [1 point] D = us - D. = Hi- D = H2H L = Da - Di Tukey's Studentized Range (HSD) Test for offer Note. This test controls the Type I expedimentus error rate Alpha 0.1 Error Degrees of Freedom 33 Error Mean Square 2.489899 Critical Value of Studentized Range 3.00643 Minimum Significant Difference 1.3695 Appendix B Tables 1317 Entry is t(A; v) where P{t(v)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started